Immaculate disinflation sentiment cheers investors

Posted 9 June 2023

Another positive week in global stock markets, which seems unremarkable given it has been fairly good since the beginning of May. However, looking more closely – as we do – two market dynamics tell us more market participants are warming up to the narrative that bringing inflation under control while still achieving a soft landing for the global economy may be what 2023 brings. First, stock market gains over the past two weeks have been spreading to the mid and small cap market segments, rather than coming from just a handful of mega-cap stocks. Second, falling inflation expectations mean recent yield rises in the UK have bumped up real yields, which can be interpreted as a sign of rising confidence.

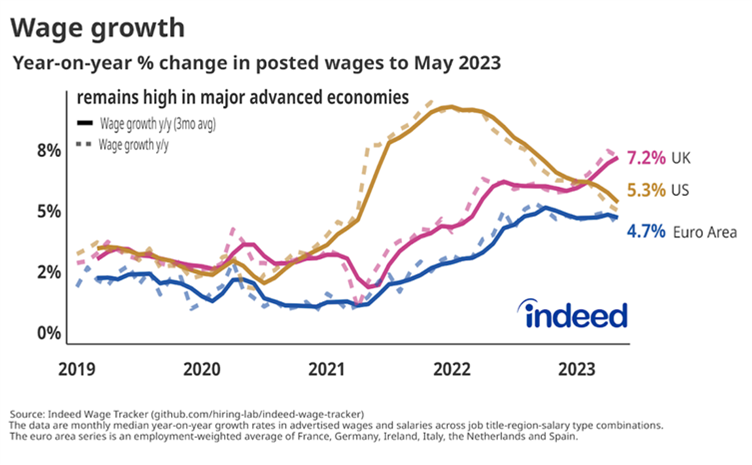

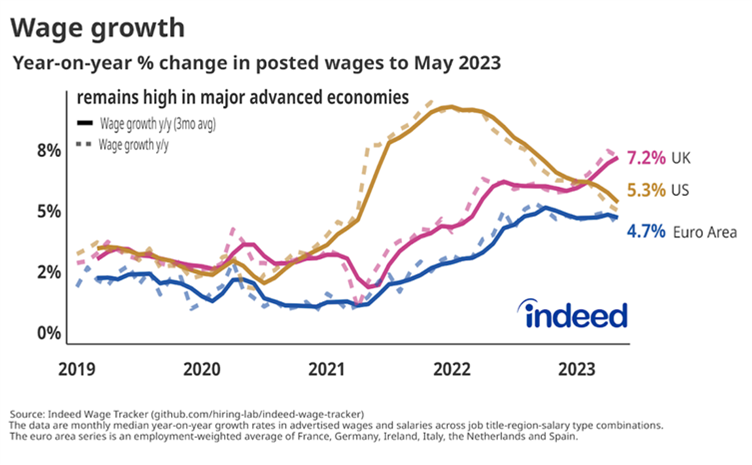

This may all seem somewhat implausible against the ongoing data flow which suggests second-round effects would keep inflation persistently sticky. UK wage growth, according to online recruitment agency Indeed, has moved up to 7.2% year-on-year, roughly tracking core consumer price inflation (after the more volatile food and energy components are stripped out). Taken at face value, this would make the Bank of England very worried, and likely cause them to continue raising rates which would be perilous for the medium-term prospects of the UK economy.

So, the conclusion that the recent rise in yields for gilts and other sterling-denominated bonds back to last Autumn’s levels (as we reported last week) may be due to worsening inflation expectations seems reasonable. Except that index-linked gilt yields rose almost as much up until the start of June. Indeed, it has been the rise in UK long-term real yields which has been moving other markets.

While fixed interest bond investors have been hurt by falling UK bond prices (which fall when yields rise), the rise in real yields could be signalling that global investors see better prospects for the UK economy and its companies over the medium-to-long-term. This view is supported by the other market dynamic of the smaller-cap and UK-centric FTSE 250 outperforming the more globally-influenced FTSE 100 since the end of April, while sterling’s trade-weighted index continues its rise which began after the trough of last year’s Truss-Kwarteng mini-budget debacle.

So, although yields are almost as uncomfortably high as those dark October days, this time the markets do not seem to point to the UK as an inflation-ridden basket-case. While the voting intention surveys tell us Keir Starmer could outshine Tony Blair’s 1997 General Election victory, the political focus on competence and detail (from both sides of the political divide) is perhaps improving perceptions of the UK. Sunak’s constant efforts to improve (trade) relations with our US and European allies may not win an election, but it is nonetheless valuable for our collective future and positively noted amongst investors.

Beyond the UK, the same could until recently not be said about US mid and small caps as they were languishing amid the artificial intelligence (AI) ChatGPT craze and a rush for defensive mega-caps. Interestingly, June has so far seen something of a reversal here too, with the Russell 2000 mostly small cap index rising about 8%, versus 4% for the mega tech-heavy NASDAQ 100. Europe also saw a similar move. Stocks of companies in cyclical sectors have generally done better, all of which suggests investors are gaining confidence that the headwinds to growth are turning towards tailwinds, which should prevent a recession. There are good reasons to think this might be the case. Globally, inflation driving excess demand and constrained supply capacity are no longer apparent.

Perhaps this is most evident in the oil market, where the Saudi commitment last week to cut production had no discernible effect on oil prices – perhaps because the cut may have been merely to offset an unseen increase in production from Russia. Backing this view up, this week saw trade and price data from China which indicated a sharp fall in energy costs but apparently an increase in volumes.

That same May data showed a further fall in overall producer prices (now running at -4.6% year-on-year versus April’s -3.6%). Other Chinese data hints that domestic services demand is holding up but global goods demand is hitting manufacturing exporters.

The overall situation has been enough to induce another policy move by the Chinese authorities, this time to ask banks to reduce interest payments to depositors (to which the banks are most happy to oblige) and to indicate a round of equity market support. There is plenty of liquidity in China, but depressed investor confidence has made valuations there very cheap, so we may be in for a sharp bounce in Chinese equities should the authorities succeed.

Further China policy easing will be another tailwind, and not just for China. However, until the developed world inflation picture really improves, it is hard to share the recent market optimism as central banks will feel obliged to keep adding to the headwinds through further rate rises. This week, the central banks of both Canada and Australia surprised markets by raising rates another 0.25%. Canada’s pause since March proved to be just that, rather than the beginning of a reversal, while Australia hiked its rates again amid high wage pressure and labour shortages.

Next week it could be the turn of the US Federal Reserve (Fed). Its Federal Open Market Committee will meet on Wednesday, and this time they are also due to provide us with another ‘dots plot’ survey, which indicates officials’ expectation for setting rates over the coming quarters. Markets have come to expect another rate rise, if not next week, then in July.

For what it’s worth, we are not so sure. The Indeed jobs data mentioned also has more timely weekly jobs posting numbers, helpfully split into 47 different business sectors. In the last two weeks, the vast majority have shown a decline, and at a quickening pace. As noted last week, May’s payroll survey showed a sharp jump in the number of people employed but was quite downbeat in other areas, and the unemployment rate rose to 3.7%.

Another factor that may stay the Fed’s hand is the resumption of US Treasury financing after the debt ceiling resolution. It may seem arcane but the central bank’s current account must be replenished – by issuing large amounts of short-term government debt at competitive rates – and that could drag money away from those rather stressed US regional banks. After March’s unnerving (and economy damaging) episode, another rate rise now risks worsening the situation and causing a second round of bank failures.

We wrote last week that optimists had gained the upper hand over the pessimists and this week’s market gains tell a similar story. It seems that while markets are never without their worries even the pessimists may find it difficult to be apocalyptic when the sun shines.