A double edged sword

Posted 4 March 2022

During the course of this week, the impacts of the war on global financial assets changed in nature. Last week, we wrote that minor sanctions were a help for asset prices even if the sanctions did not match the level of outrage. Starting Sunday, the European Union (EU), US and UK imposed new sanctions almost every day. Perhaps inevitably, this has resulted in equity market weakness.

There are separate aspects of the week’s market moves. One is centred around liquidity and the risk of contagion across the financial system. In a separate article below, we write about how Russian equities and bonds have not only seen their values plummet, the inability to trade them at any price has then impacted broader emerging market mutual funds and exchange-traded funds (ETFs).

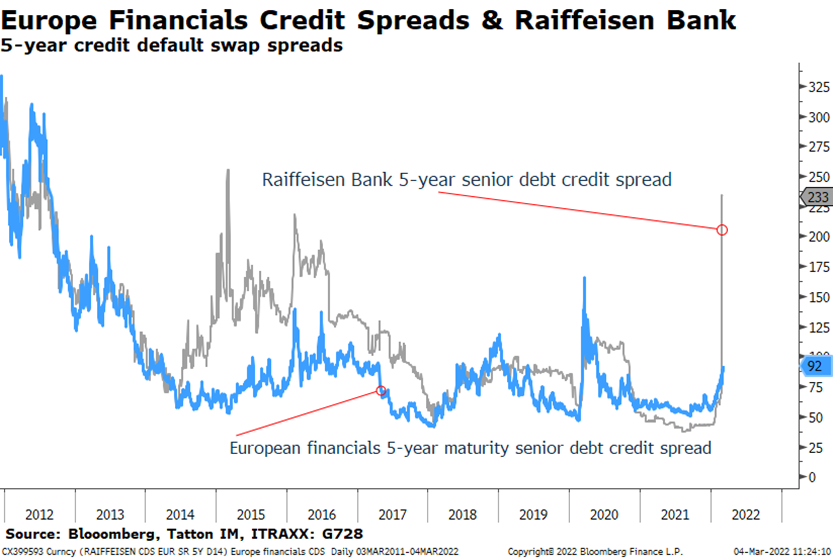

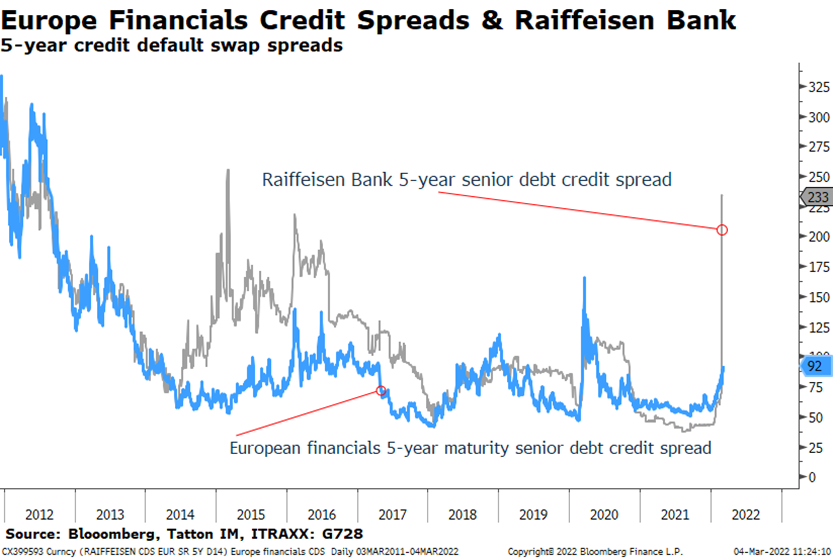

Often, as in the global financial crisis of 2008-2009, markets worry about the banking system. As the blue line in the chart below shows, currently European financial credit spreads do not show exceptional levels of stress. That’s potentially quite comforting. However, direct sanctions on Russian banks have created problems for financial institutions that share larger lending and trading flows with them. For example, Raiffeisen Bank of Austria saw its share price dive again this week after Europe’s weekend sanction announcements.

Over two weeks, Raiffeisen’s share price has halved, with the collapse in its value being more than all of the Russian-based assets and businesses it had under management. However, its fall in creditworthiness accounts for the rest – other banks are much less willing to transact with it, so its ongoing going costs rise dramatically.

In our opinion, one difficult aspect has been the interplay between sanctions on Russian banks and energy and commodity markets. For example, European utility companies are not barred from buying Russian oil and gas. However, they have difficulty in paying for it in the normal way. Rebuilding these payment channels will take time. If businesses are still able to buy Russian energy, then authorities must ensure financial channels are open to make those energy purchases. Moreover, companies will need reasonable reassurance that energy sourcing sanctions won’t be put in place later, and that they will be protected from other reputational risks.

The confluence of issues has led to another surge in global oil and European gas prices. In past weeks of rising spot prices, the prices of log-dated contracts didn’t rise as quickly. It has therefore been interesting how futures markets have seen longer-dated contracts moving up sharply, perhaps indicating a more extended surge in costs.

And therein lies the other aspect prompting equity market weakness combined with bond market strength. Government bond yields across the developed world have dropped sharply. This is almost certainly because investors have substantially downgraded real growth estimates amid greater inflation pressures for this year. The epicentre has been Europe, but the rise in energy costs has meant the US is also affected.

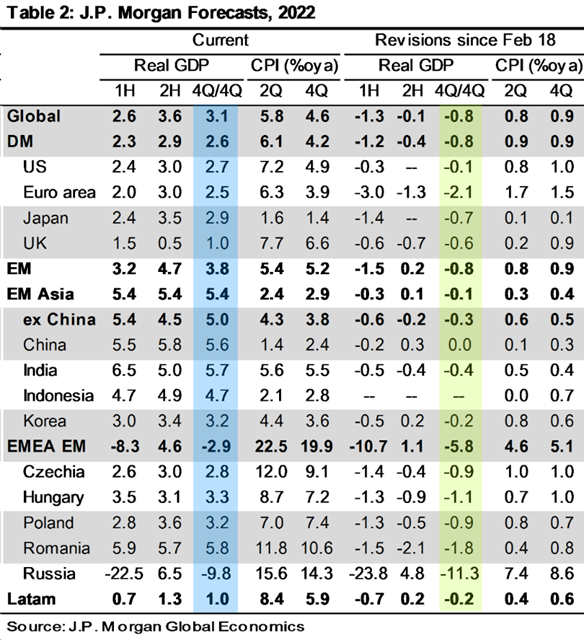

Bruce Kasman, JP Morgan’s chief economist gave us his team’s thoughts on Thursday evening. They have revised global growth for 2022 lower by 0.8%, down to 3.1%. Here is the table of their new estimates and the extent of the revisions:

Russia is expected to contract almost 10% (in rouble terms). Europe’s growth is now expected to be +2.5%, down from +4.6% previously. The main hit will be for this first quarter.

US growth stays almost unaltered (+2.7%, from +2.8% previously) while China remains at +5.6%. The stability of their stock markets in recent days suggests that investors are broadly in line with these estimates.

Bond markets are telling us a similar story. In particular, the yields on inflation-linked bonds have headed down sharply as increased demand for safe haven assets saw bond prices soar. US ten-year ‘real’ yields are back down to -1.0%, where they were last year. Fixed coupon yields have fallen back to 1.75%. German inflation-linked bonds are at -2.6%, substantially below last year’s low of -2.1%. Fixed coupon yields moved back into negative territory, at -0.16%.

These bond moves also may be telling us that central banks could look through the current input cost-push inflation and keep monetary policy accommodative for the time being, thereby allowing elevated levels of inflation persist for longer. In his three-hour testimony to Congress, US Federal Reserve (Fed) chair Jay Powell said interest rates will still almost certainly go up 0.25% on 16 March, less than the 0.5% almost universally expected two weeks ago. Even today’s startlingly strong US employment numbers (non-farm payroll data) (which suggested the US economy added 678,000 jobs in February) failed to push up fixed coupon yields.

JP Morgan’s economists suggested their growth forecasts are probably still too high. A lot depends on the passage of energy prices so, with European natural gas prices pushing up to new highs again on Friday afternoon, equity markets remain vulnerable.

So, is there any hope? We believe there is. As JP Morgan suggests in its forecasts, the damage is to Europe growth estimates. While there will be a big hit from energy costs, a lot of nominal spending will be unaffected. Impetus from the EU’s Next Generation Fund will continue through this year and next, come what may. And, the massive increase in defence spending by the German government will also come through quickly. A lot of this will be spent among European defence manufacturers (the UK should also benefit). Defence spending has a large ‘multiplier’ effect – the spending being recycled round the economy. Looking out beyond 2022, growth could be shifted up to a higher, not lower, level over the next few years.

Over the short term, as has been the case for the past weeks, much depends on energy costs and how long they remain elevated. While the de-coupling of bond yields to oil prices is heartening, it would be good to see the Brent crude spot price fall back from today’s $120 per barrel to a more manageable level well below $100.

Ultimately, when risks are obvious and emotions are running at a high level, markets will overshoot the downside at some point. Of course, it’s difficult to know when that is. Meanwhile, the strategy of remaining calm and waiting for the market to cool off has usually proved beneficial, and we think it probably still is.