A small predicament

Posted 5 May 2023

The week’s investor focus has been dominated by May’s central bank rate decisions, with the weaker spots in US (regional bank) markets continuing to rumble just beneath the surface. Australia’s Reserve Bank made the start on Tuesday, surprising most commentators by raising its cash target policy rate again, up 0.25% to 3.85%. It had been expected to hold steady. This proved the only surprise policy move; both the US and Eurozone central banks also raised rates by 0.25% to 5.25% and 3.25% respectively but this was in line with expectations. In the UK, we await the Bank of England (BoE) decision next week, with its Monetary Policy Committee (MPC) also expected to raise rates by 0.25% to bring the UK’s base rate to 4.5%.

Both Jerome Powell at the US Federal Reserve (Fed) and Christine Lagarde at the European Central Bank (ECB) managed the neat trick of sounding hawkishly dovish. That balance has helped to maintain a sense of calm and, together with a mildly cautious positioning among the institutional investor base, this meant a steadying of markets. Economic sentiment data and corporate earnings news flow have been positive enough to offset fears that financial conditions (the ability to secure finance at a reasonable rate) are getting too tight for comfort.

Indeed, the US economic data on the jobs market keeps sending positive signals. The first week of the month brings the overall US employment data in the form of new jobs created (aka non-farm payroll) which downright refuses to show weakness. Revisions for previous months were negative but not massively. Cyclical sectors did show some job losses, but these were made up for by gains in sectors which have had difficulties in recruiting in past years – health and education particularly. That means the resilience is there and gaps opening on the cyclical side are being filled by other sectors and those hiring sectors are not especially rate-sensitive.

And, for us, rate sensitivity is what it’s all about. Households are currently not sensitive to short-term rates, given the pandemic payments meant short-term borrowing got paid down, while long-term mortgages were refinanced at very low rates (more so in the US than elsewhere). Jobs being still plentiful, consumption remains at healthy levels although no longer buoyed by the ‘excess’ savings from the pandemic payments.

This is how far this week’s good news story extends, because rate sensitivity is much more apparent in the world of small businesses, in real estate, and among private equity – all areas that matter greatly in the overall economy. JP Morgan’s buyout/rescue of First Republic Bank helped sentiment at the start of the week but this was short-lived. With PacWest and Western Alliance coming under pressure next, the woes of US regional banks continued up until a Friday bounce (although they are small in comparison to Silicon Valley Bank and First Republic).

Perhaps more important, but maybe less remarked on, the major listed private equity firms are doing less well. Carlyle gave investors a real surprise, with first quarter distributable revenue (aka profits) missing estimates by 10%. As can happen when a new chief executive arrives, it did feel like a bit of a “kitchen-sink” job, with Harvey Schwartz telling his troops he intends to instil discipline.

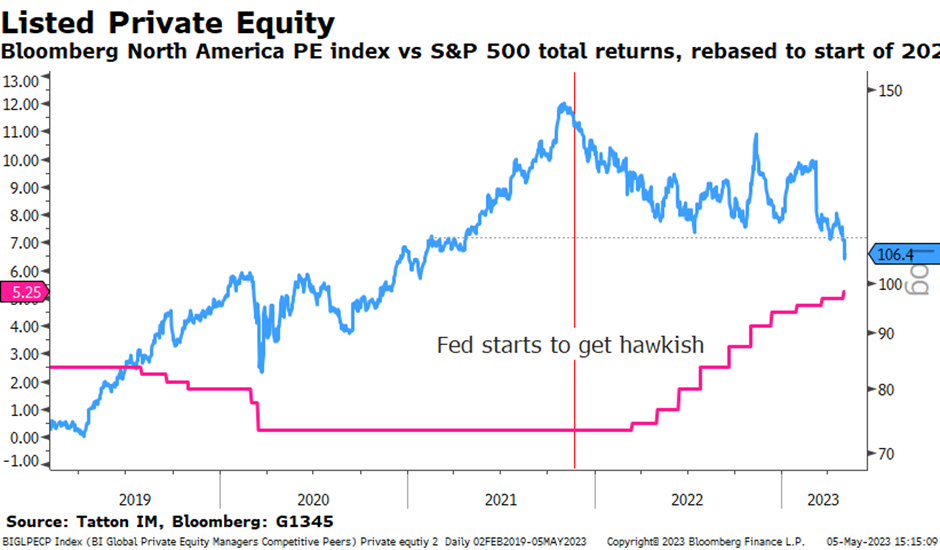

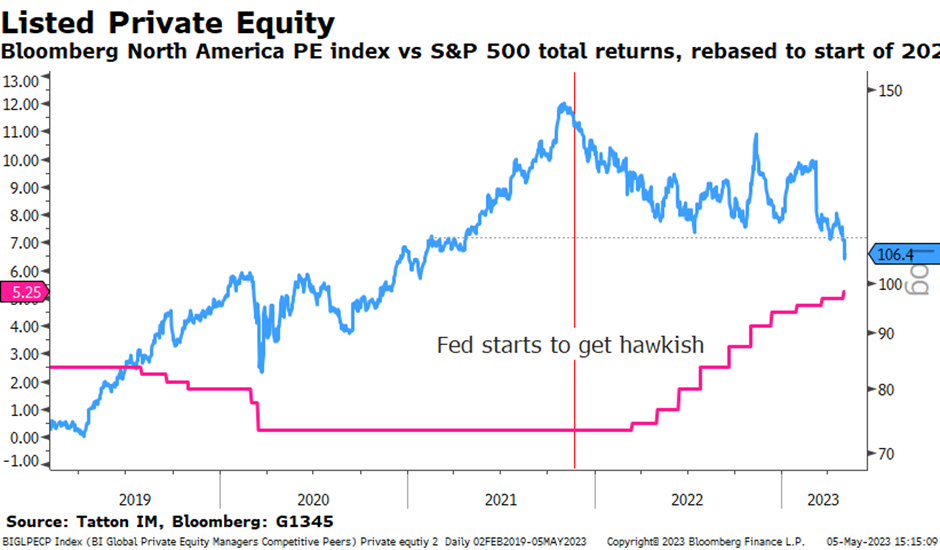

Private equity (i.e., not stock market listed) has been massively aided by a long period of cheap debt which has given their early-stage high growth-potential (and therefore mostly tech) firms time to blossom. The speed of rate rises has abruptly curtailed this environment. The graph below shows the Bloomberg North America Listed Private Equity index relative to the S&P 500 (with 100 being the start of the pandemic period) with the US rates development at the bottom:

The relative gains from 2020/2021 have been lost, because the problem for these groups is that the era of cheap money is over. Investors can earn a reasonable 5% in US dollars and 4% on sterling without trying. It may have been reasonable when cash returned nothing, but why would you now tie up your money in the illiquid and opaque funds created by the private equity industry?

Despite what central bankers told us this week about not being done quite yet, markets expect that short-term rates will be on hold now for a time. There is much debate about when they will be forced to lower them again. However, for those under mounting pressure from the increased cost of finance, their deteriorating environment will not improve until short-term rates have come back down. Our best guess is that the rate (in US terms) is around 3.5%, which is near the recent historical averages of outstanding bond financing.

Economic sentiment and jobs data tells us that consumers are still ok and the earnings reports tell us large firms are also ok. This more visible evidence is not sending the monetary policy setters a signal to ease. However, the rate-sensitive small and mid-sized firms are not easily visible in any data. The quarterly US bank lending survey published on Monday will surely show another worsening of credit conditions. Indeed, the ECB’s version published this week showed credit conditions worsening markedly, despite the help coming from falls in energy prices.

Risk assets have done reasonably well in recent weeks, as global growth indicators improved through the first quarter. Recently these growth indicators have become more mixed again but, in the most important area of jobs, they remain buoyant. That means the central banks will be reluctant to ease off and supply the rate cuts which are already discounted in the bond markets. Small and mid-sized firms may be able to catch occasional small breaths but have been squeezed for a long period now and are running out of oxygen. The most timely signal to cut rates comes when, for those firms, it’s already too late – default and bankruptcy indicators lag until the moment they pick up but then they come in a rush. Time is getting shorter. If central banks wait for a clear decline in inflation, it will probably be too late for quite a lot of small firms.