Are central banks transforming from hawks into doves?

Posted 3 February 2023

The week has been like the other four weeks of 2023: dominated by central bank action, inflation, and despondency over the UK economy. Meanwhile, stock and bond markets stayed buoyant. The monthly US jobs report could have upended the week but so far, after a brief market wobble, much of the week’s gains have been retained (we write before the close of trading). Indeed, the FTSE 100 may even close at a historic high today.

The US employment report was probably not known to the Federal Open Market Committee (FOMC) when its members slowed the pace of rate rises earlier this week. January’s wage growth showed some slowing to an annualised level of below 4% and more people came back into the workforce which backs the idea of inflation pressures calming down. However, the unemployment rate dropped again to 3.4%, having been expected to rise by most economists. The payroll rose by an almost unbelievable 517,000 while the previous data was revised up.

Such a report would almost certainly have caused a big sell-off in bonds and equities if market conditions were akin to those of the Autumn. The very steady reaction so far suggests that investors are still looking to deploy uninvested cash.

On Wednesday, the US Federal Reserve (Fed) raised rates by 0.25% to a midpoint of 4.625%. On Thursday, the Bank of England (BoE) raised the base rate to 4.0%, and the European Central Bank (ECB) effectively raised its short-term rate by 1.0% to 3.0% (0.5% now and the second 0.5% in March). However, you could be forgiven for thinking they had all announced rate cuts, given the very positive reactions of both bond and equity markets.

Investors have reason to hope monetary policy tightening impacts an economy more quickly than previously thought, as we discuss in one of the two articles below. Given that an end to the current tightening was signalled quite strongly by all three central banks, investors have an increasing belief that monetary policy-driven constraints on profitability are coming to end in the nearer-term.

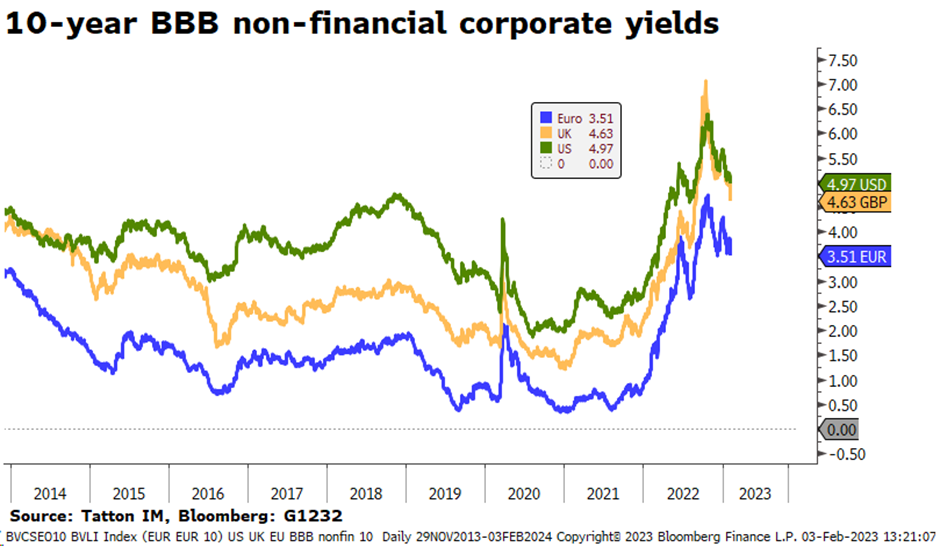

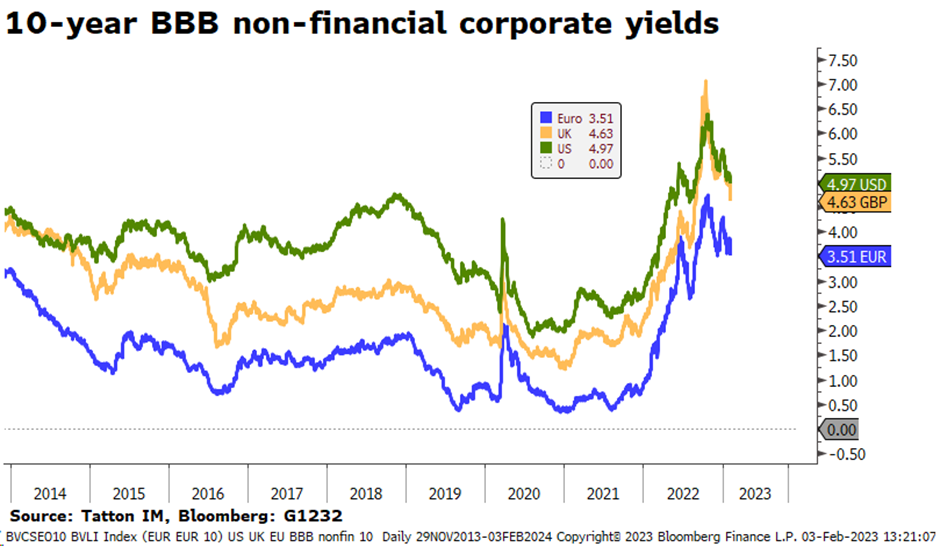

As ever, though, we suspect one shouldn’t get carried away by waves of positivity. Interest costs are still higher than before, and still have a bit further to go. Better news is that government bond yields have dropped sharply, and corporate bond yields have subsided even more, well below the nastiness of the October peak.

Nevertheless, non-financial investment grade 10-year bond yields are above the average levels for the previous ten years, even if we take out the pandemic period drop. US yields are about 1.0% higher whereas for both UK and Europe, corporate yields are still about 2.0% above the 10-year average.

The benefit of the recent fall in energy prices has fed through, but there is still a relative worsening of the terms of financing for Europe and the UK. For all areas, financing costs have risen and are unlikely to return to the pre-pandemic situation. Central banks are now more reluctant to use the extraordinary measures deployed then, given the inflation instability it seems to have brought about.

Bond markets have already built in that rates will be cut before the end of the year. Equity markets have either built in even more optimism, hoping either that economic growth will pass through into corporate profit growth or that central banks will be more aggressive than priced in cutting rates.

This optimism is quite extreme in historical terms when looking at the US equity and bond markets, according to Morgan Stanley’s research (and also according to our own work). Currently earnings yields are about the same as corporate bond yields. Morgan Stanley confirms that this situation has occurred three other times in the past 45 years: the 1987 crash, the 2000 dotcom peak and the 2008-2009 Global Financial Crisis. In order to invest in equities at these points, one should be expecting significant medium-term profit growth. In the 1987 and 2008 situations, it was possible to expect a market and economic rebound. In the 2000 case, the growth expectation was pure optimism.

There are good reasons to think that economic growth may rebound from here, but it feels less plausible that profit growth will be exceptional.

We had two reports on the UK economy this week, one from the International Monetary Fund (IMF) and the other from the BoE accompanying its rate decision. The IMF report was depressing reading but was very much in line with the gloomy BoE report published in Autumn. As is often the case, the IMF report felt out of date.

In contrast, at least for the nearer-term outlook, the improving inflation picture allowed the BoE to revise its growth projections up Autumn’s report. However, it was more downbeat about the longer-term picture because of ongoing supply-side issues, mostly from skilled labour shortages. Potential (non-inflationary) real growth was revised down to 0.7% for 2024 and 2025.

For us, this suggests that the pound may find it tough staying strong. After the report was published, sterling dropped to $1.22 and weakened to below $1.21 on Friday. For UK investors, this highlights the importance of holding overseas assets in a long term investment portfolio.