Bank stress testing – live

Posted 17 March 2023

Unease about the state of markets had been palpable since more or less the beginning of the year, as noted repeatedly on these pages over the past months. Following the run on Silicon Valley Bank (SVB) last week, financial system fear spread around western markets and the smell of bank stress last experienced during the 2008/2009 Global Financial Crisis (GFC) had some market veterans experiencing a bout of post-traumatic stress disorder (PTSD). However, it seems to us that banks have simply become the unfortunate focal point of market unease and are now experiencing a similar roller-coaster ride as felt by so many other sectors since the COVID pandemic disrupted every aspect of life.

Returning to the focus of this week, when interest rates and yields, (i.e., the cost of finance) rises so quickly – and after such a prolonged period of ultra-low levels – as it has over the past year, then something is inevitably likely to break at some point. Not that that’s what central banks intended, but using rate hikes as an emergency brake to slow down the economy inevitably carries the risk of collateral damage.

As it turns out, the stress originated in what had run ‘hottest’ during the recent boom – the tech sector, healthcare sector and crypto currencies. The failure of SVB, which kicked-off this week’s market stress and stock market downdraft, became the first sizeable victim of the yield rise-induced economic downturn, but it is its close affiliation with tech, healthcare and crypto that is notable. After seeing a near tripling of money deposited by start-up companies and their affiliates during the good times (namely the 2020/2021 tech and healthcare boom), those deposits were heavily drawn on recently when those same companies required funds to bridge the financial strains of these distinctively more challenging times.

But different to the reckless lending that led to the 2008/2009 crisis, SVB had stashed its client deposits away in what most investors until last year would have known as the lowest-risk investment available, a portfolio of government bonds. Just as private investors found out, when yields suddenly rise very significantly such holdings with historically low yield coupons can lose substantial value, if marked-to-market rather than held until maturity. When the drawing on their deposits accelerated because of the need to also wind-down its crypto bank specialist Silvergate Capital, SVB’s management’s decision to raise more liquidity by liquidating their government bond holdings at a loss and raising new equity was interpreted by their deposit holders as a sign of weakness, rather than determination to repair their mistake of misjudging possible yield rise scenarios. What ensued was a classic bank run as all trust was lost – a scenario that no bank can ultimately withstand.

The nervousness of market participants over recently elevated stock and bond valuations, therefore found its focal point and so the stock index of the aggregate global bank sector had a very bad week, taking away a substantial part of the sector’s rally of last year that had been fuelled by the better margin prospects for banks from higher rates.

Taking into account how much better capitalised banks are today when compared to the run up to the GFC, they seemed an unlikely target and victim this time, but it turns out the trust had never been fully rebuilt. Given SVB was an outlier with its losses from its long maturity government bonds wiping out its equity base, it was right that central banks stepped in to stop the self-enforcing avalanche of mistrust. That stock markets continued their highly volatile trading into the latter part of the week goes to show that once confidence is dented investor are more open to consider that there is more than a ‘steady as she goes’ scenario possible this year.

Diving into the wider repercussions and likely medium-term effects of this week’s banking crisis, with the effective demise of three US banks, we observe that the NASDAQ composite share index of US tech and growth companies traded within a whisker of the 20-day high at the opening of Friday’s US markets. Other markets have not been so buoyant, but it is fair to say that we close the week with a sense that the height of this crisis lies behind us. Tech indices do not tell the whole story. Companies that have fared well this week are those that benefit most from the fall in bond long-term yields, which corrected sharply last week. Large caps such as Amazon have done very well; at the end of Thursday’s trading it was up over 6% for March.

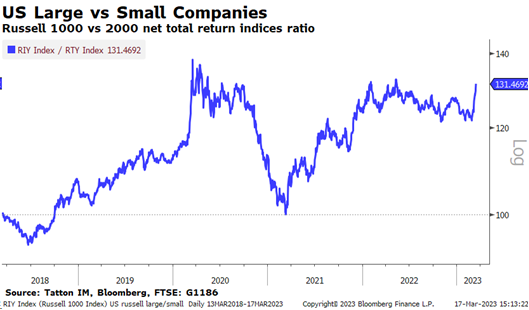

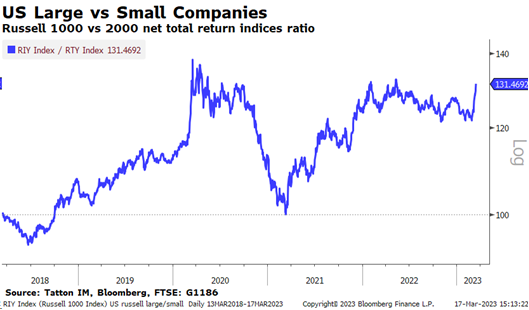

The chart below shows the large cap Russell 1000 index’s total return as a ratio of the smaller cap Russell 2000. While 2022 saw large caps lose out against smaller rivals by about 10%, that dynamic has reversed almost entirely in just over a week. In the general scheme of things, the move is not unparalleled, but it is still significant. The Russell 2000 has a lot of early-stage highly valued companies of the type that would have banked at SVB.

A similar situation has occurred in Europe, although large cap firms had a worse time in the period before the pandemic.

The lesson from the past few days is that the pain caused by the rises in rates is hitting small and micro-cap firms particularly hard, even if they are strictly speaking growth stocks whose valuations would otherwise benefit. There is other evidence, such as employment rates. According to US employment agency ADP, firms with 1-19 employees have been cutting jobs this year despite the generally improving employment situation. Firms of this size employ in aggregate almost the same number of people as firms with 250-500 employees. This means that both these groups are larger employers than either larger or other mid-size firms. In Europe and the UK, a similar situation persists.

The rescue of SVB depositors was welcome, of course, from a financial stability point of view, but it does not help at one level. SVB went to the wall because its depositors were having to take their reserves out in order to keep going. That situation is not likely to have improved, it is just they will not reach the end of their reserves right now because of a bank failure.

But we should be heartened that this week proved central banks are reactive to issues of financial instability. The centre of the storm moved to Europe and particularly Switzerland as Credit Suisse came under pressure. We touch on this in the article below. (The European Central Bank (ECB) still raised rates by 0.5% on Thursday as it had promised at its previous meeting, but President Christine Lagarde was notably reticent about offering any further indications of rate moves).

Credit Suisse has underlying issues of years past – under different management – that are completely different in nature to those of the US banks. The Greensill and Archegos debacles of early 2021 showed it had consistently displayed a conspicuous lack of risk control and oversight. But Credit Suisse is still a major counterparty with just about every major bank across the world (although less so than two years ago). Despite its problems differing from those of the US small banks, the problems end up creating the same reaction: depositors and clients look for new bankers which then multiplies the restrictions on the bank they leave with its ongoing business, unless some willing funder is found to replace the depositors. The swift actions of the Swiss National Bank (SNB) were welcome, particularly for the other counterparty banks.

Yet banks did not bounce noticeably, despite the early central bank support. We think this links back to the first point. Small firms are the mainstay of banks’ lending books, having lost larger firms that have shifted to raising their own debt in market-based borrowing or to private credit (fund) lenders. Banks, which up until the start of March were celebrating the improvement in the margin between taking deposits and lending (net interest margin) on the back of higher rates and yields, are suddenly faced with the flipside of the same rate rises, namely having to tighten lending to their already stressed borrowers – a recipe for an increase in non-performing loans.

To top it all off, the market is now pricing a strong likelihood that March will see an end to all the rate rises in the Western world, and that rates could be cut everywhere by year-end. Net interest margin will be on its way down again.

As mentioned, the ECB raised its deposit rate to 3.0%, in the first of the round of March central bank meetings. Next week, the Federal Reserve (Fed) and the Bank of England (BoE) meet. Despite the turmoil, markets on balance expect a 0.25% move from both. We have revised our views as well and see a 0.25% move in the US where data remains strong enough to justify it, but that the UK will not move. So, for the shorter term it appears that central banks’ objective to tighten financial condition to bring down inflation has suddenly been significantly accelerated through market action.

On the inflation side, this week’s Spring Budget in the UK surprised some with the forecast of a 2.9% year-on-year inflation rate before 2024. In fact, inflation is already running well below that level on an annualised monthly basis. The NHS pay award could not have been achieved without a general acceptance from the workforce that inflation was no longer out of control, and that will be a strong softening signal to the BoE Monetary Policy Committee’s concerns about potential wage-price spirals.

In conclusion to this thoroughly unpleasant week for investors, we would observe that the trend of overshoots that started with the onset of the COVID pandemic continues. It started with too severe restrictions of movement (only clear with the benefit of hindsight), carried on with too much fiscal support for what turned out to be more like a natural disaster economic impact rather than global depression and carried on into a tech and crypto sector boom and ‘Roaring Twenties’ talk, before inflation and energy prices completely overshot.

However, ever-new overshoots, as unnerving as they are, appear to gradually bring down the prospect of out-of-control inflation and thereby forever rising interest rates. This week’s events may have dented recent improvements in consumer and business sentiment, but they have also brought down the prospect for higher inflation and thereby central banks’ tightening action through ever-higher rates. The risk of recession has perhaps not significantly increased as softening sentiment and tighter lending standards seem to be balanced by lower yields and the prospect of an end to rate rises.