Big weeks ahead for financial policy makers

Posted 3 September 2021

Politics and policy sit at the head of the table

This week has felt a bit like the whole month of August. Equity markets (North America and Europe) were in the green over the past few days, and then on Friday expressed their disappointment over the weak US jobs report. Market participants discovered yet again their taste for cash-rich mega-caps in the US, especially after last week’s Jackson Hole symposium. US Federal Reserve (Fed) Chair Jerome Powell made clear that tapering would happen in the foreseeable future, but was not hawkish in terms of timetable or pace. As we explained last week, much more depends on how the Fed chooses to scale back its security purchases, and less on the precise start date. Friday’s US jobs report revealed the US economy created just 235,000 jobs in August, a steep decline on the 1.1 million created in July, and short of economist expectations by over half a million. The numbers appear to confirm that the US economy is still in a repair phase, which speaks in favor of a softer stimulus withdrawal. And, while Fed liquidity is important, the focus will firmly remain on fiscal support packages going forward.

Eurozone yields picked up as hawkish European Central Bank (ECB) members positioned themselves for their policy meeting next week. Their debate will focus on tapering the ECB’s own Pandemic Emergency Purchase Programme (PEPP). We note that the PEPP is currently limited to EUR 1.85 trillion, so is not as open-ended as the Fed’s initiative.

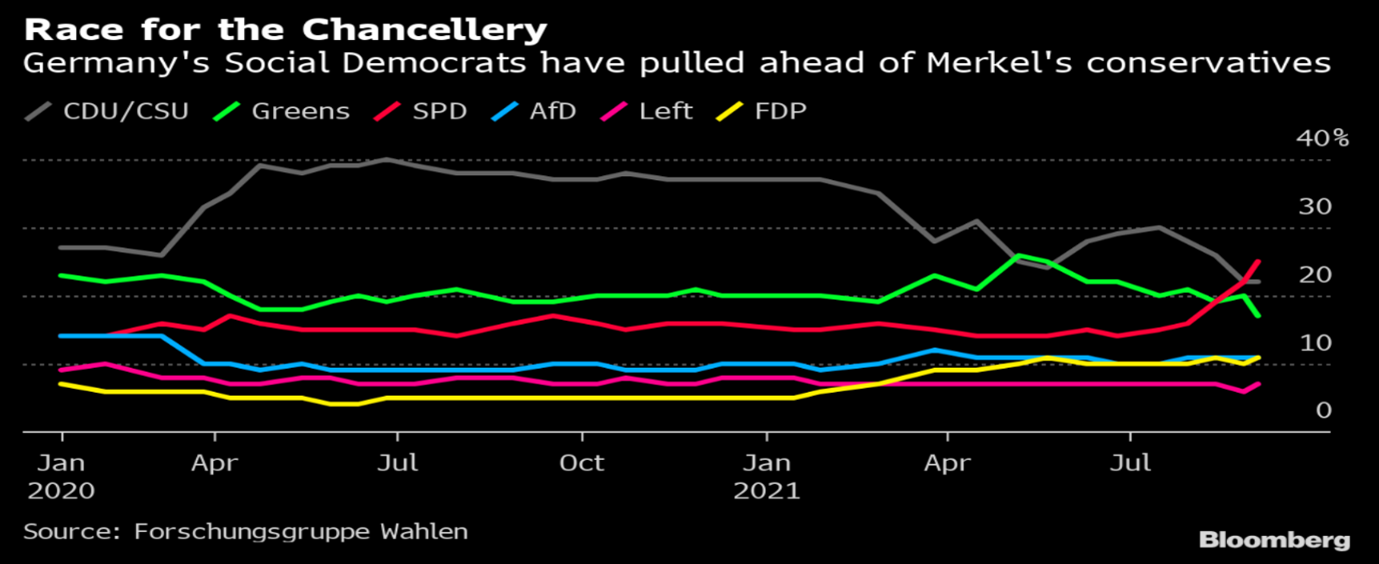

Europe, of course, has another significant event to look forward to. In three weeks, Germans will go to the polls, and the outcome of this year’s federal elections could not be more open. For the past 16 years under Chancellor Angela Merkel, the biggest question facing the German electorate was which party would become the coalition junior partner. This time it looks like three parties will form the next government, with several combinations available.

The Social Democratic Party of Germany (SPD) has staged a rather phenomenal comeback, thanks to its leader Olaf Scholz, who enjoys the highest approval rating of all the candidates.

Several three-party coalitions are possible and, according to current polls, the options revolve around the SPD or Merkel’s party, the Christian Democratic Union (CDU). The accepted wisdom is that the Green Party is likely to be part of the coalition, especially if the SPD refuses to team up with the CDU again. This means smaller parties may play the role of kingmakers, particularly the Liberal Free Democratic Party, which famously pulled out of coalition negotiations four years ago, or the socialist Die Linke (‘The Left’) party. The likely coalition options are as follows:

• SPD + FDP + Greens

• SPD + Die Linke + Greens

• CDU + FDP + Greens

• SPD + CDU + FDP

Negotiations are likely to be drawn out well beyond the results day, but much of the pre-election sabre rattling should give way to pragmatism. Still, there are a few key themes, the first being the debt brake that ensures public finances stability. The Greens would reform to include an exemption for structural investment needs. The FDP is less enthusiastic, and would not want to see higher taxes. Also, while the SPD could be seen as left-leaning, it’s worth keeping in mind that Olaf Scholz belongs to the conservative wing of the party and maybe less in favour of full-swing Keynesian spending policies. Die Linke’s main theme is that it wants to dissolve NATO, a rather sensitive topic in Germany.

What’s the most likely post-election market impact? There may be a knee-jerk short-term reaction that then gives way to ‘business as usual’ as coalition negotiations kick-off. But as was clear with the Brexit result and the Trump tax cuts, policies do make an impact as they slowly feed into the economy.

Fixed income markets will be most sensitive to German spending programmes and their bearing on the deficit. The German equity market depends much less on domestic consumption; hence the focus will be on corporate friendliness designed to ensure that exports can thrive. Traditional measures would be taxes and regulation, although the climate change debate means that a push towards an innovative policy framework with clear guidelines is increasingly important. The jury is out on which coalition combination will be most apt to respond to the challenge. But we do know that the Dax30 will expand its membership to ten more entrants in September – we discuss the changes in a separate article.

China’s regulatory drive has been relentless in recent months, and the crackdown continued this week. Authorities summoned the most prominent members of ride-hailing platforms – such as Didi and Meituan – and warned them that unfair customer and employee practices needed improvement. The overall stock market impact was muted though, most likely as price-earnings ratios are already relatively depressed, and markets are starting to get used to the meaning of China’s “common prosperity” drive.

But arguably the most surprising political development of the week was that Japan’s Prime Minister Yoshihide Suga resigned over the government’s COVID handling. Two former foreign ministers are in the race to replace him. Equity markets viewed this as a positive, calculating that it would increase the chances of additional fiscal stimulus. This may just bring us back to our opening thoughts – just as peak growth momentum wanes, policy stimulus is getting withdrawn, even if it is from exceptional levels. The business cycle will surely continue, but the transition phase can be tricky, especially for markets with elevated valuations.