Climbing the wall of worry – again

Posted 13 August 2021

August continues to be what one would expect from the middle of the summer: quiet. Yet for investors, it is also pleasing that stock markets around the world are gradually nudging upwards, allowing them to remain relaxed wherever they have retreated to in these travel restricted times.

US stock markets have even been hitting highs again. Normally, this would feel like an exceptional time, but then sometimes our perceptions play tricks on us and perhaps it is not as exceptional as some media commentators make it sound.

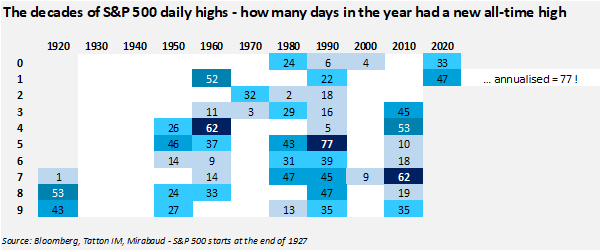

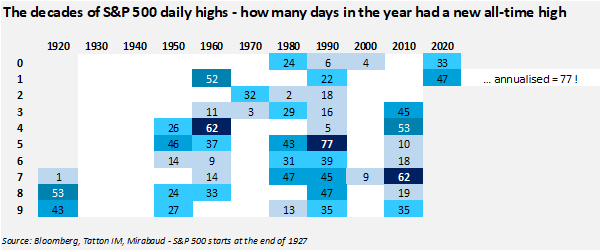

The table below shows the S&P 500 and how many days in a specific year it hit an all-time high. For 2021 the count is already at 47 and there have only been four years with new high days above 50: 1961, 1964, 1995 and 2017. The 1990s run lasted 11 years, ending with the dot-com period.

Should history repeat, or at least rhyme, and we are in the midst of the same, there is another three years to go.

Of course, such runs invariably come to an end, the great unknown, as always. As our regular readers know, we at Tatton prefer to look at the economic and corporate earnings fundamentals and view past precedence and graph patterns only as sentiment influencers of the speculative parts of the markets. The phrase “climbing the wall of worry” was used frequently several years ago, but it seems entirely apposite again now.

Just like at previous similar waypoints in the past, we are entering a period of transition in this cycle of global economic expansion. We have most likely come to the end of a short period of very rapid and exceptionally high rates of corporate earnings growth, as economic activity bounced back following the gradual lifting of pandemic restrictions. Growth is expected to continue, even if the sheer rate of growth will not be sustained at the high levels seen in the first half of the year. This should continue to provide a solid base for risk asset prices, so long as sudden moves in the bond markets do not upset the fine balance between sustained growth and the relative valuation metrics that bond yields so heavily influence.

In this regard, capital markets appear to also have been shifting gear. There seems to be an acceptance that central banks may be right in their view that the current elevated levels of price inflation will prove temporary (more on the underlying argument in a separate article this week). This is evidenced by the textbook insight of negatively correlated bond and equity markets being re-established.

Nevertheless, transition periods when fast economic acceleration gives way to a more moderate pace of growth have also historically been choppy for investors, as sentiment is more likely to gyrate between confidence and fear. This is a particular issue for the richly-priced US equity market – particularly its mega-cap growth stocks – which is particularly vulnerable to a meaningful rise in government bond yields.

So, if and when the global growth momentum moderates, there is a risk that investor sentiment sours temporarily – at least until the fragile equilibrium between corporate earnings yields and government bond yield levels reasserts itself.

The global political class appears also ready to reassert itself, having seemingly grasped the historic opportunity to reaccelerate the world’s economy back to a higher level of growth. There now seems the willpower to address the many areas of public underinvestment of the previous decade, be that basic infrastructure, education and professional training, or addressing the threats of man-made climate change.

In the European Union (EU) the fiscal investment programme under the ‘NextGenerationEU’ recovery plan is gaining momentum as money is raised in capital markets. While not amounting to multiple trillions like the proposals of the US administration of President Biden, it currently comes with a higher probability of being implemented.

Compared to the relative calm and quiet of European politics, in the US, legislators on Capitol Hill were working overtime to get their stimulus programme – or at least parts of it – on the way. We dedicate a separate article this week to the topic of Biden’s stimulus packages, and their potential impact over the coming months. Unfortunately, there are still considerable political hurdles to be overcome and plenty of drama potential ahead, which is likely to stimulate more market choppiness than economic activity.

When we all return from our (non-traditional) summer breaks this September, we will gradually find out where things stand. Perhaps the transition will be towards much slower mid-cycle growth, or even a growth blip, or perhaps collective political will combined with increasing business confidence can open up a much more enticing recovery path for the remainder of the year. Until then, the current calm in markets is both rational and welcome.