Easter review and outlook

Posted 14 April 2022

The annual rate of inflation, as measured by the consumer price index (CPI) was reported at 7% in the UK, 8.5% in the US and even Germany recorded 7.3%. These are heights not seen for 40 years and were unsurprisingly front and centre of this week’s news flow. While equity market investments have historically demonstrated their inflation-hedging characteristics, the fact that investors appeared to shrug off these new peaks may well point to the belief that this is about as high as inflation is likely to get.

Even so, one would be brave to call this the summit. However, there were a few souls willing to say so and, at the margin, investors seem inclined to agree. We go into more detail on this in our article about US inflation, following the release of US inflation data this week.

In essence, markets have come to accept that the US Federal Reserve (Fed) is serious about preventing the price rises of the past quarters from becoming engrained and structural through a change of economic actors’ mindsets. More importantly – as we reported last week – markets appear to believe central bankers will be successful in their task.

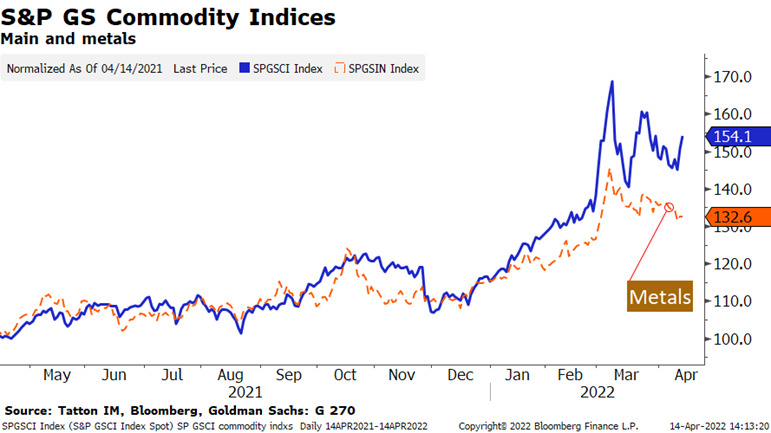

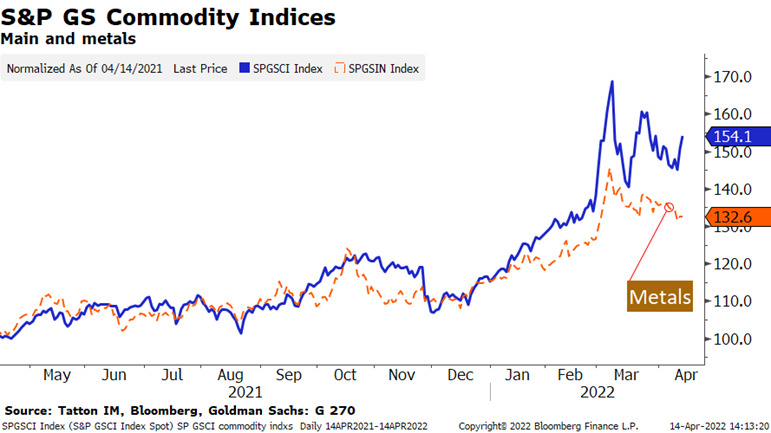

While monthly CPI data may already be turning, producer price index (PPI) data for March showed no such decline, which is perhaps no surprise given it tracks commodity prices more closely than CPI. The Goldman Sachs Metals index is showing it has passed a peak rate of growth although the energy-heavy main index is still not yet clearly down from the start of the highs (see chart below).

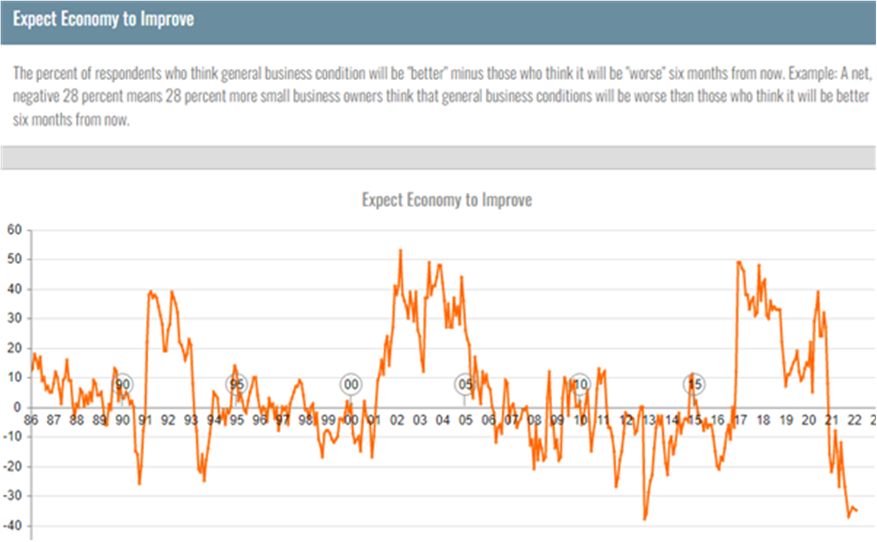

If CPI is slowing earlier than PPI, perhaps it suggests a cooling of the very consumer demand that was driving inflation in the first place. While the March reading for a leading US consumer sentiment index was better than expected, it is still only just off the five-year low. Business sentiment is also weaker, shown by the US National Federal of Independent Business (NFIB) survey:

Slightly at odds with this is that intentions to hire are still higher than they have been for the past three decades, which is notable given it is an important indicator of economic expansion.

Good employees are difficult to find and a shortish downturn in expectations tends to dissuade the employers to stop hiring, let alone fire them. On the side of the corporate economy, we have noticed that US equity analysts have started to downgrade sales growth expectations but margins, which were edging down a bit, are expected to stabilise.

The Q1 reporting season has started with mixed results. Some earnings announcements will inevitably beat expectations – as they are ‘engineered’ to always do – but Morgan Stanley tells us to treat Q2 guidance with a pinch of salt. Q2 will see slowish earnings growth but hopefully heading towards a second half (H2) that will show stronger real growth while being less inflationary.

Such a positive trajectory may need adults to continue to return to the workforce. They have been doing so but at a slower pace than usual after recessions, as they were so well (over-) supported by governments this time. This diversion from the historical norm is uncomfortable for investors and high equity valuations, particularly in the US NASDAQ, mean that recent early retirees with decent market-tied pension savings can afford to stay away from jobs for longer. In order to get them back, we need the NASDAQ to be weak – a bit of a Catch-22.

It will also require that commodity and energy prices do not reaccelerate, and that will depend on both Russia and China to a large extent. While all of this has resulted in whispers of recession doing the rounds, there is an equal possibility for a sharp rebound of stocks if one of the repressors reverses, such as:

- A path to peace opens up in Ukraine, in which case energy prices would probably fall by about $20 per barrel – or roughly 20%.

- China finds a way to reverse its extreme COVID lockdown policies (currently affecting some 40% of production), bringing goods production back online.

On the latter point, it is possible that China somehow engineers a way back to opening up which is not constantly interrupted by another outbreak. The decision to block the Pfizer/Moderna mRNA vaccines in order to promote China’s own healthcare technology winners assumed they had winners. They might be able to reverse this decision without loss of face.

As Rabobank tells us, the current situation would usually present a buying opportunity from a contrarian point of view. The China credit impulse – which measures changes in new public and private credit as a percentage of GDP – has continued to improve, which historically heralds an upbeat growth outlook. Without it its 5.5% GDP growth target for 2022 is becoming increasingly illusory, and boosting infrastructure is the only viable policy lever to mitigate the downturn.

Capital spending by the Chinese government will likely support related Chinese sectors and the overall commodity complex, but consumer demand and service sectors will be further suppressed.

Unfortunately, however, Xi and Putin, the self-styled strong men in charge of both these hugely influential countries seem unlikely to reverse their decisions. The more difficult the situation, the more likely they want to appear to be ‘STRONG’ – by sticking to their previous path. We cannot know the information they receive, nor pretend to understand their mindsets. Unfortunately, everybody’s best guess is that they will continue as they have done.

From our perspective, this means that while there is every opportunity for the economic outlook to brighten substantially in a very short period, the more likely outlook is that we will once again experience a muddling through. This should keep the global ‘growth-wagon’ largely on track, supporting further, if less vibrant, corporate earnings growth. The inherent slowdown in demand that comes with that compared to last year, should mean that central banks can succeed in bringing down inflation without having to deploy the harsh policy measures they are currently threatening, which should in turn relieve some of the valuation pressure that rising rates and yields have had on equity prices over the first quarter of 2022.

The Easter holidays should bring some sunshine and warmer temperatures, but whether we will see a similar warming in the global economic outlook still depends on so many ifs and buts, that until China’s and Russia’s paths become more positive, we should expect sideways trading of markets to continue.