Fear of missing out

Posted 12 August 2022

Investors are feeling FOMO: the “fear of missing out” once again. This week was a continuation of the trend from the start of July – which has seen a significant boost to both bond and equity markets. Curiously, the good feeling among investors seems unaffected by the bad news all around. Inflation is roaring ahead and consumers are struggling to keep up, central banks are intent on crushing price pressures with aggressive monetary policy, and talk of a global recession abounds. The growth slowdown is already being felt by companies. This year’s second quarter earnings showed a downgrade in forward-looking estimates for the next 12 months. And yet, stock markets continue to rally.

Naturally, falling earnings and rising stock prices mean equity valuations – on a price-to-earnings ratio – have climbed higher. This is a reflection of increased risk appetite. On our model, equity valuations have two major components, both of which are to do with borrowing and the cost of finance: real (inflation-adjusted) yields and corporate credit spreads (the difference between government and corporate bond yields). We have written before about the move down in credit spreads, and how it shows increased confidence in company prospects. This is essentially a sign that markets do not expect an imminent recession – for the US at least (still the world’s leading economy) – despite media headlines to the contrary.

Equally important has been the fall in real yields. At the start of August, inflation-adjusted yields on 10-year US Treasuries once again sank to almost zero, and they are still well below their mid-June peak. This is largely down to shifting impressions of US Federal Reserve (Fed) policy. But it also shows investors are confident in the stability of financial assets, and in the Fed’s ability to promote a healthy US economy.

The key question is whether the macroeconomic backdrop has improved enough to justify this view. Markets are certainly betting it has, but we are not as convinced. As we have written before, such optimism can cause an underappreciation of risks – of which there are still many. Since the onset of the pandemic, the global economy has fluctuated between too hot and too cold. This has led to intense supply-side problems, and spots of severe economic weakness.

We should note that this is very different to what we saw before the pandemic. Over the last 30 years – and especially since the Global Financial Crisis (GFC) – the global economy has been in a near-perpetual state of oversupply. There were many reasons for this (China’s ascendency and supercharged output chief among them), but the result was that economic management – by governments or central banks – was largely about encouraging demand.

Due to the coronavirus hangover, undersupply is the big issue of the day. Policymakers’ demand-side techniques are ill-equipped to deal with such supply issues, and large fluctuations have ensued. We can see this in the recent movements in metals prices, which have quickly turned from weakness to strength. Similarly, oil, which was falling back towards the $90 per barrel threshold, has now broken back above $100.

In the past, when faced with looming recessions central banks would try to stimulate demand until supply overhangs receded. But now the inflation genie is out of the bottle such growth-oriented policies are a huge risk for price stability. This is a nightmare for investors, who at times seem not to know how to react. Every time inflation pressures fall back slightly, the prevailing mood in markets seems to be “thank god that’s over!”.

The pandemic presented unique threats to global supply chains. But it also revealed that the wider trend of global undersupply had perhaps come to a natural end. China and other emerging markets have long pursued policies to boost domestic demand and become less export-dependent. Even before coronavirus gripped the world, such policies looked to have succeeded. At the same time, western labour markets severely tightened, due to historic underinvestment in education and harsher stances on immigration.

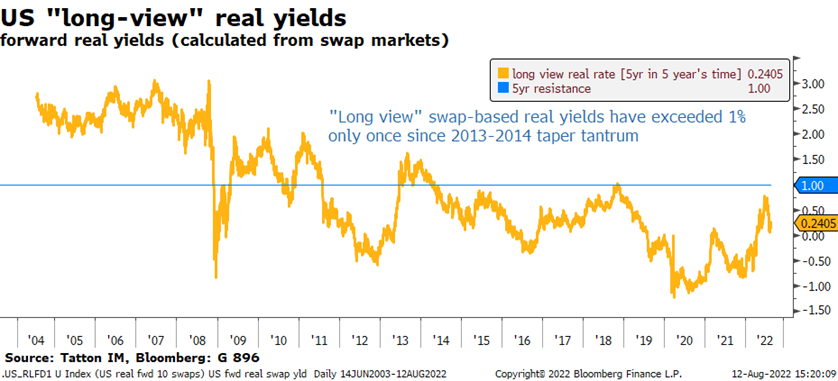

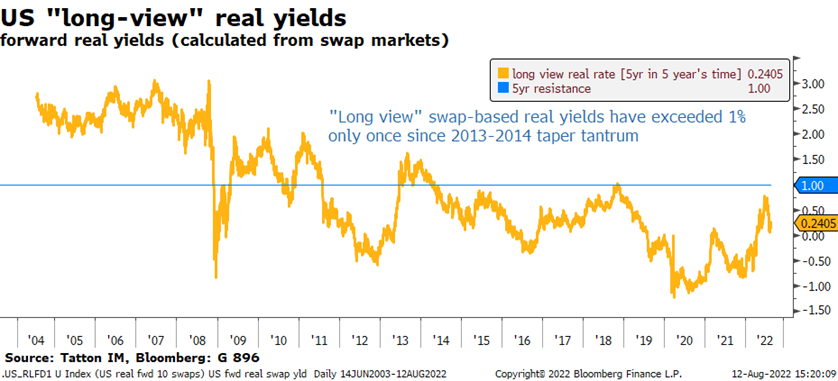

In such an environment, we would expect the ‘natural’ real yield to be closer to 1%, above the post-GFC norm but still below the historical average. Current US “long view/natural” real yields have fallen to around 0.25%, and therefore have ample room to rise as the chart below shows. Unless energy and labour market problems dissipate, a return to the zero real yields of the post GFC-era seems unlikely.

We believe this is important for equity valuations. It means that stock market strength will have to come from improvement in earnings, rather than just improving sentiment and lower yields. And with the economic problems facing us in the short term, that might be hard to come by. The passage of new fiscal policies for more sustainable infrastructure in the US gives credence to the view that the world’s largest economy might avoid recession altogether – or at least that any downturn will be brief and shallow. But while this is a positive for growth, it is likely to put even more upward pressure on longer-term real yields.

We have never agreed with the doomsayers, and we still do not think that a global recession is inevitable (though recessions in the UK and Europe are all but certain). At the same time though, we are slightly uncomfortable with the level of optimism implied by current equity values. The jury is still out for the short-term – and the long-term picture is likely to be very different.

The summer lull has probably helped prop up market sentiment somewhat. With many away on holiday, it is much easier for traders to convince themselves that everything is rosy. This happens to coincide with a two-month break in Fed meetings too, with the next one scheduled for the end of September. When that does come around, we should expect the Fed to have a renewed zeal for taming prices, which could provide a wake-up call for markets. We should enjoy the sunshine while it lasts, but future market improvements will need to be based on more than just the summer breeze.