Hot now, colder later

Posted 19 August 2022

Will a new PM be good news for investors?

Here at Tatton, we rarely talk about UK politics in our deliberations on markets. That’s not because we’re not interested. Rather, it is because domestic politics have less of an effect on the broader global assets that we invest in on your behalf.

Yes, the FTSE 100 is an important component of those investments. However, many of the large-cap companies comprising the main UK index are global in nature. The vagaries of UK domestic demand are important, but not as important as the US, mainland Europe and China. Likewise, while the bonds in which we invest are hedged to Sterling so as to take out much of the currency volatility, most of the interest rates and credit risks are broadly global in nature. The most identifiable UK-based risk in

Tatton’s portfolios revolves around Sterling. Even here, because the global equities we hold do not usually have any currency hedging, the performance of our portfolios tends to look better when Sterling is weaker.

But we do watch the UK economy closely, and of course we want our nation to do well, in absolute terms and in relation to other nations. It’s almost certain that Liz Truss will win the Conservative Party leadership ballot and become the UK’s next Prime Minister on Monday 5 September. According to Betfair Exchange, Rishi Sunak has only a 5% chance of victory. With most Conservative Party members having already cast their votes, it will take a cataclysm to derail Liz Truss’s leadership bid.

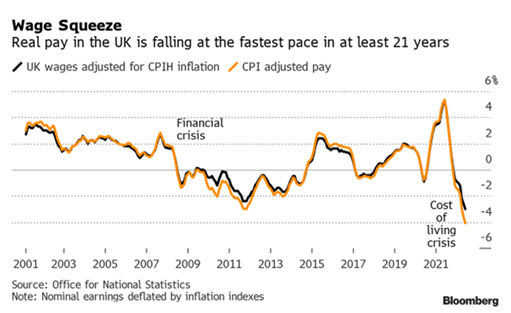

She will face a very difficult start. There is little doubt that the UK economy is in poor shape. The most obvious expression of this is consumer confidence, and the GfK Consumer Confidence Barometer is currently at -44, a move of three Standard Deviations. One reason is surely the reduction in the purchasing power of UK disposable incomes. Earlier this week, every news and media outlet ran the story that average real disposable income has fallen at its fastest rate in the 21st century. Below is Bloomberg’s chart drawn from data from the Office for National Statistics, which shows wages adjusted for current inflation:

Consumers are reining-in effective spending. That is likely to worsen as the weather cools and the next massive change in energy prices is due. Without government action, UK household energy bills are set to rise about 80% in October, when the regulator Ofgem next lifts the limit on how much energy suppliers can charge. Consultancy company Auxilione notes that the window is closing for Ofgem to calculate what the cap will be. Average bills will likely near £3,600 a year when the new level for the three-month period beginning in October is announced next week, up from the £1,971 cap, which came into effect in April.

One can make a case that it’s not all bad. When looking at current nominal wages, the recent growth path is rising at about an 8% annualised rate according to our calculations. The unemployment rate is around 3.8% and jobs are plentiful. People may feel hard done by, battling to get their wages up to damper the higher costs of living, but their employers still need the workers.

However, while jobs are being created, the pace of job creation has slowed and consumers have already started to reduce spending in volume terms. That’s evident in declining real GDP terms as well as in the retail spending data. However, for the Bank of England’s Monetary Policy Committee (MPC), it is highly likely that the rise in wage growth accompanying the rise in consumer prices will force their hand. Another rate rise of at least 0.5% in September is as certain as Liz Truss’s victory.

The market currently prices a rise in base rates to over 3.75% by March. The Bank of England will have its remit examined immediately by the new Truss regime, and this might be a source of worry for the currency market.

While we think it unlikely that the government would try to change the Bank of England’s independence directly, currency traders may worry about greater political influence exerted on its decisions and analysis. Sterling has weakened both against a strong US Dollar and even a weak Euro, and fears of spiralling currency-induced inflation would be unhelpful.

At least we are not alone, the rest of Europe has similar concerns over inflation and energy. They too have faced a nasty lack of rainfall, but the Rhine river levels have started to rise after rain fell this week. Although natural gas and electricity prices continue to rise, oil prices have fallen substantially over the past few weeks.

Below, we write about China, which is also facing growth issues. As we write, Prime Minister Li has announced more support for Chinese companies, which will help support global growth levels.

Moreover, US growth remains strong, almost uncomfortably so. Investors are moving back to expecting more rate rises from the US Federal Reserve (Fed) but that is in response to solid signs of economic resilience, something which is welcome for a softer Europe and UK. Despite Europe and the UK’s issues, the profit outlook for our global companies has remained positive, especially in Sterling and Euro terms. As we mentioned towards the start, globally-oriented portfolios can hold up reasonably well even if the outlook domestically is gloomy.

The new Prime Minister will have a job on her (or possibly his) hands. We wish them well.