Markets caught between hoping and dreading

Posted 14 January 2022

London was a tale of two cities this week: Panic in Whitehall but calm in the City. The scandals seem to keep coming for Boris Johnson, with several Tory MPs openly calling for his resignation. Betting markets now have the Prime Minister odds-on to resign this year, and discussion is rife about the government’s future. But capital markets took no notice. Indeed, UK assets outperformed on the week, with both the FTSE 100 and the value of sterling finishing higher.

UK markets have been on a good run for over a month now, while the odds of a prime ministerial change have climbed the whole time. This does not suggest investors want Johnson out, but it does suggest they are indifferent on the matter. What markets are happy about is the latest COVID numbers, as well as the government’s response. Officials have been lax in their response to the omicron variant (compared to previous waves and other countries at least) and it now seems case numbers are falling, without tighter restrictions ever being imposed. Perhaps markets sense a change of Prime Minister would have little effect on this policy, so positivity has been unaffected by Downing Street drama. With cases falling and high levels of immunity, Britain’s economy could do well this year – and currency markets seem to agree.

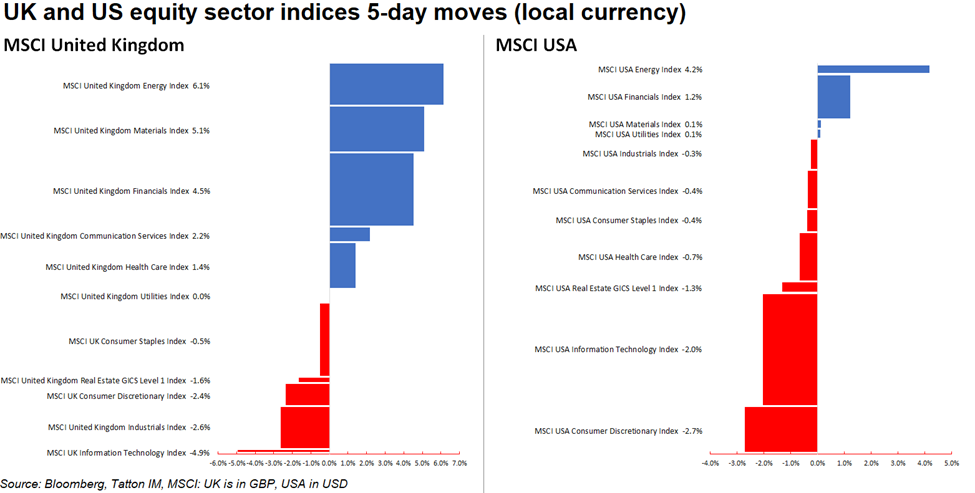

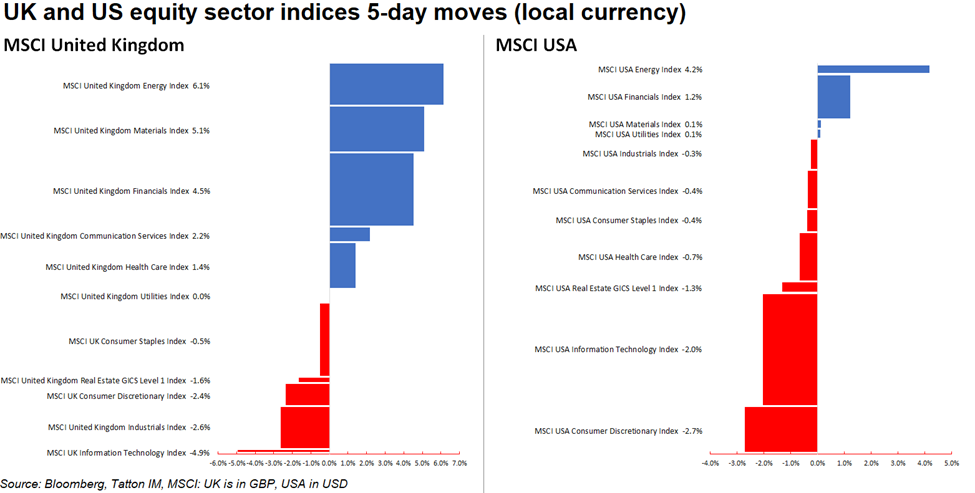

The UK’s outperformance – which is still ongoing at the time of writing – has also been helped by a rapid sectoral shift. This change in industry fortunes has been a feature of markets around the world this week. The chart below shows the broad sectors of the UK on the left and the US on the right, with the bars’ width showing their index weight.

We should point out that short-term index comparisons can be misleading, given trading times differ across the world. Nevertheless, broadly one can see that energy, materials and financials outperformed other sectors in both the US and UK, while IT and consumer discretionary underperformed (apologies for the small font of this chart!). This goes some way to explaining why UK equities as a whole outperformed the US – as America’s stock market has a large technology component (and Amazon being part of consumer discretionaries).

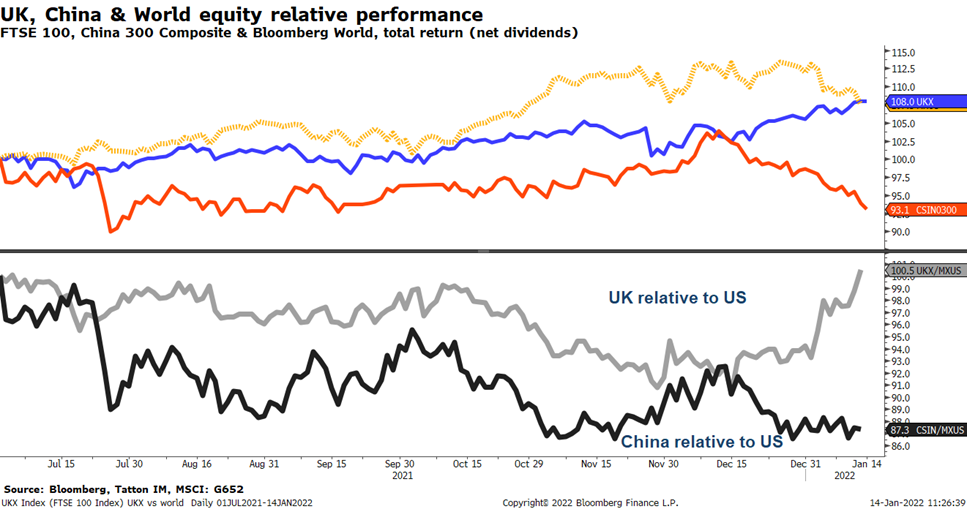

As we mentioned, currency values also had a big impact – with sterling gaining on the dollar. But even against other major currencies, the dollar also fell throughout the week, which added to the regional performance difference. The chart below shows the relative index performances (in sterling terms) over the last six months – with China’s stock market added in for comparison. A lot has happened in that time, but we believe that the spread of omicron has been at the heart of these moves.

The rapid transmission of omicron – and particularly its ability to infect vaccinated people – was a big concern for markets in December. But as we wrote back then, this variant could end up being a boon for the global economy if proven less deadly and offering greater immune protection once those infected have recovered (regardless of whether they were vaccinated or not). This is not to downplay the threat it poses to clinically vulnerable and/or the unvaccinated, but only to say it could change the pandemic from a global emergency to a long-term endemic illness, more like the flu.

It is still early days, but data from the UK and other heavily affected areas backs up this hypothesis. Moreover, Downing Street’s unwillingness to impose heavier restrictions has meant economic activity has stayed reasonably strong – meaning the recovery in growth can continue through this year. Things could be very different in other regions – particularly those with low vaccination rates and high levels of obesity and clinical illness – but it is a positive signal for global growth.

It suggests the global growth cycle – which has stalled and spluttered through numerous COVID waves – might finally become sustainable. Investors seem to agree, as the aforementioned equity market shift shows. Unfortunately, the last couple of days have seen a slight reversal. Long-term bond yields tailed off toward the end of the week, while global equities struggled to find support.

Much of this is down to disappointing economic data. US retail sales in December were well below expectations, as sales value declined 1.9% (seasonally adjusted) and an even worse 2.5% month-on-month after stripping out fuel and car purchases. When you also consider inflation is at its highest in decades, it will mean a fall in real disposable incomes and suppressed demand.

For equities, that has seen investors swing from anticipating sustained global growth to factoring in markedly slower earnings growth as consumer demand subsides. The flipside of this is that the problem looks like more US-based than global. In that case, we would expect US equities – particularly the mega-cap tech names – to fare less well than over the last two years. For now, UK and European equity performance backs this up – with this side of the Atlantic likely to exit the omicron slowdown earlier and experience another year of a marked activity upswing in the spring.

As the chart earlier showed, China has also underperformed. Much of this is to do with policy, as Beijing’s crackdowns have made many headlines. The Chinese government still appears to be pursuing a zero-COVID policy, and with omicron proving incredibly infectious, this means harsh lockdowns are happening while economic activity is still suppressed.

The State Council cabinet met earlier this week and acknowledged the slowdown, promising to increase the spending of money already raised last year, and to raise more debt (in local government bonds) to spend quickly. But China’s banks are reluctant to purchase more of this debt, despite ‘strong’ encouragement from local authorities. Last year, banks thought they had financed well-supported local government ‘financing vehicles’, only to find they had been duped by corrupt officials, with credit officers then blamed for not doing their job. They are (understandably) anxious about doing so again.

Plus, after Beijing’s crackdown on Evergrande and other large companies, credit demand has slowed more than the authorities intended. The Chinese government will do what it can to stimulate more activity, but this will be hard to do while maintaining lockdown policies. Overall, it means China’s weak period could continue. That is a concern for the global economy. Supply chain problems were extremely damaging last year, pushing up inflation to uncomfortable levels. We expect many of these short-term problems to drop away this year, but if Chinese production slows dramatically, it will only add to the supply side pressure. That is one of the biggest threats to the positive cyclical view. For now, we do not expect it to overwhelm market positivity – but we will need to stay wary.

The ups and downs of this week’s stock market action is a fair reflection of the competing economic dynamics still at play, and discussed at length here before. Threats from rising yields and inflation pressures on one side, and support from a sustained economic recovery on the other. This could well bring about an overdue market rotation and the chance to turn a page – moving away from the darlings of the pandemic and into the cyclical recovery plays that have been shunned but will see demand increase when COVID no longer dominates our lives. For now, we cannot be certain which way 2022 is going to tilt, but the latest market signal – together with the rapid reduction of infection numbers in London – means a more pleasing springtime is looking more probable.