Markets give thanks

Posted 25 November 2022

The last week of November is generally a quiet one for markets. Many professional investors head back to family homes in the days before Thanksgiving, and will have already closed down their risk positions for the year. Few like to be exposed to markets when there are lower trading volumes in December, and this may be one of the reasons why US equity markets tend to enjoy a seasonal boost in the last quarter.

This year’s Thanksgiving lead up has been a good one, and not just for equities. Government and corporate bonds have all recently gone up in price. This suggests the professionals had been more pessimistic about the growth/inflation dynamic than appears warranted now and as result they have rapidly reversed their risk underweight positions.

We track several indicators of how the markets are thinking about the global and regional economies’ medium-term future, and it is reasonably clear to us that the recent declines in both actual inflation data and the continued falls in the raw material cost inputs has changed the investor perceptions of medium-term risks. The release of the minutes from the Federal Open Markets Committee’s (FOMC, US central bank rate setters) 2nd November meeting provided documented evidence that the voting members now see a case for a tempering of hawkishness (raising rates ever further) over coming meetings.

That increase in visibility is good for markets. Interest rate markets responded, but neither by lowering the estimation of the short-term rate peak, nor when they anticipate this to occur. The US Fed funds rate is still seen as hitting 5% early in the second quarter of 2023, with cuts being priced in for some point in Q3 or Q4.

What has changed more markedly is the ‘terminal rate’, the medium-to-long-term rate markets foresee as being the end point for rates in this new cycle. One way to measure this is by comparing five-year and ten-year US Treasury bonds. Here is the chart of how this ‘terminal rate’ has moved over the past ten years:

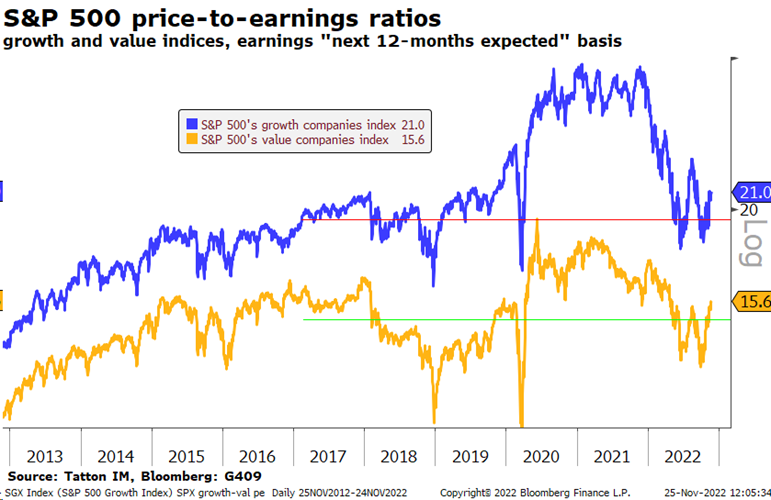

If one thinks that the US and the world is returning to the same situation as in the years before the pandemic, there is some room for this yield to continue to fall, given in 2017-2018 it was around 3%. That asset-price ‘Goldilocks’ era back then had low inflation and low growth, a regime where certainty of long-term cashflows was valuable. This year, equity valuations have swung down dramatically from the extremes of the pandemic period as yields rose. It is not impossible that they may return to those heights, but few of us would want a return of that situation. But unlike bonds, which still have a bit to go to match 2017-2018, the price-to-earnings valuations of stock markets (based on aggregated analysts’ company projections for the next twelve months) never went below the 2017-2018 levels, and have now started to move up again as this chart indicates:

The Q3 earnings results season was hard for tech companies especially. Despite the usual near-term manipulation by companies in order to ‘beat’ expectations, analysts now see growth companies’ earnings some 9% below the peak level they foresaw back in June.

So, given stock markets have risen regardless, equity investors appear to be more positive about the future than bond investors. They expect earnings growth to either rebound next year or for the following years to be more profitable than usual.

The problem with this view is that should growth rebound in the nearer-term, it will be difficult for the Fed to give us much dovishness. As a result, yields would probably rise – not fall further – and that would undermine valuations from the other end of the valuation equation. Earnings might go up but rising yields would put the PE multiple of their price over earnings under pressure to fall.

Still, market sentiment does seem to have improved a lot from a month ago. Despite the potential for shock from the crypto-currency market, US retail investors appear to be heading back into the equity market. Indeed, perhaps they have given up on the promise of fanciful riches from speculation in new currencies, and would rather invest in the more certain profits of companies. And after the summer, when savings were being drawn down to pay for sky-high prices on goods and services, it seems people have got some spare cash to put into markets. November retail volume flows have been the best in two years for small and mid-caps, according to JP Morgan’s flow data. Total retail market volume was back at 20% of overall order flow, the best since the heady days of late 2020.

For us, one of the most interesting dynamics in capital markets this year has been the decline in corporate high-yield bond issuance. At one stage this year, the amount of US bonds outstanding within the high-yield US Bloomberg bond index was declining at a 20% year-on-year rate. Even now the index is shrinking at a 10% rate. Maybe companies are generating enough cash flow to pay down debt without having to raise finance. More likely, they are awaiting a better opportunity to issue debt, when investors are more optimistic and willing to buy at a yield expense less than the levels seen a couple of months ago. The index yield peaked just shy of 10% at the end of September. An opportunity to issue more may be around the corner, as we are now down 1.5%, at 8.5%.

The balance sheet management of larger companies has improved dramatically in this century, but as every mortgage holder knows, there is no avoiding the need to refinance when debt reaches maturity: delays in issuance can therefore only go on for so long. We expect to see pre-Christmas issuance pick up, but many will try to wait into 2023. Investors, with enhanced appetite for high yielding bonds, may be happy to pick up new supply and their demand may keep corporate bond yields contained. It will be very interesting to see how their appetites continue into the new year, when issuance picks up beyond the point of demand saturation – the recent suppression of yields because of the mismatch of supply and demand may well come to an end.

We now turn to another remarkable return dynamic of 2022: the impact of currencies/FX movements. Looking at the market data table at the bottom of this edition of the Tatton Weekly, the FTSE 100 is up on the week, and as we write this paragraph, by about +1.2%. The best performing equity index in the table is the S&P 500, at +1.6%. And yet, when you look at your portfolio, the HSBC S&P 500 tracker fund shows no change. How on earth has a tracker underperformed by 1.6% in a week? The answer is that the fund is denominated in £-sterling and the US dollar has gone down versus sterling by about -1.5% since last Friday’s close.

In fact, for much of this year, and contrary to what we experience now, while stock markets have been weak, sterling’s value has also fallen. Even though US equities were down from the start of the year, UK-based investors were cushioned by the rising value of the dollar. Indeed, towards the end of August, the combination of currency and stock markets meant that while the S&P 500 was down 9.2%, in sterling terms it appeared to have risen by 1.7%! The dubious benefit of a weak currency is that overseas equity assets go up even when they are not going up, or even slightly down.

The reverse has been happening since a new Prime Minister became certain. From the lows of the end of September, sterling has rallied some 10%, as has the S&P 500. So, since 30th September, the GBP-denominated HSBC S&P 500 Tracker Fund has risen only by about 1% (as of Thursday close).

Currency volatility can sometimes be an issue for investors and overseas assets are often thought of as raising risks. However, as has happened this year, overseas assets can also reduce the risks and volatility of a portfolio. More importantly, the biggest benefit comes from the much greater diversification of global companies.

Having said all of that, the UK FTSE 100 is on course to being one of the best performing major markets for 2022 in sterling terms. It is currently eclipsed only by the Indian stock market, which is about 2.5% ahead in net total return terms according to Bloomberg indices. Given the current turmoil and economic pessimism, who would have thought the UK stock market would do so well?

A last word on China, which we talked about last week in a hopeful manner. While moving away from its ‘zero-Covid’ policy was inevitable, the transition was never likely to be smooth. Chinese authorities’ relentless past messaging about the dangers of the virus spreading may have been useful in gaining acceptance of the stringent lockdowns, but now those fears are a big impediment to opening up. It is going to be challenging, for sure, and our experience has been that some aspects (like the rise in long-term mental illness) will be uncovered at levels which were never expected. Nevertheless, there is no real alternative and so we expect China to gradually open up, even if that is interspersed by many renewed regional short-term lockdowns.