Reading the runes of this week’s market bounce

Posted 7 October 2022

Market volatility has been in the air all year and given the macroeconomic backdrop this is not at all surprising. A weakening global economy marred by war and labour market-driven supply squeezes, while simultaneously trying to cope with aggressive central bank rate hiking to prevent inflation turning permanent, all makes for the distinct whiff of recession. But volatile markets do not always swipe down, as the beginning of this week showed, nor do they stay volatile forever. Monday and Tuesday saw a formidable ‘relief’ rally in global equities. Indeed, on Tuesday, US stocks recorded their biggest daily gain since 2020, leaving the S&P 500 up 5% by midweek.

The rally did not extend greatly, and the relief felt slight. Stocks slid back toward the end of the week, but not by the same margin. And neither did they collapse after – on the face of it – very disappointing news of OPEC+ oil supply cuts. Indeed, the week has felt like a microcosm of how the year has gone so far: down-trending capital markets, ricocheting between yield rise-driven recession fear and bear market rallies when hope takes hold that inflation is turning over.

As a result, bond yields have been rising steadily, driving down bond and equity valuations throughout this year. That means the expected rate of return for being invested in them has risen – good news in some sense. However, the volatility in the process – read increased uncertainty – makes the higher expected return seem less attractive in the near term. But when markets appear to calm down, when the volatility decreases, those higher expected returns begin to look more attractive.

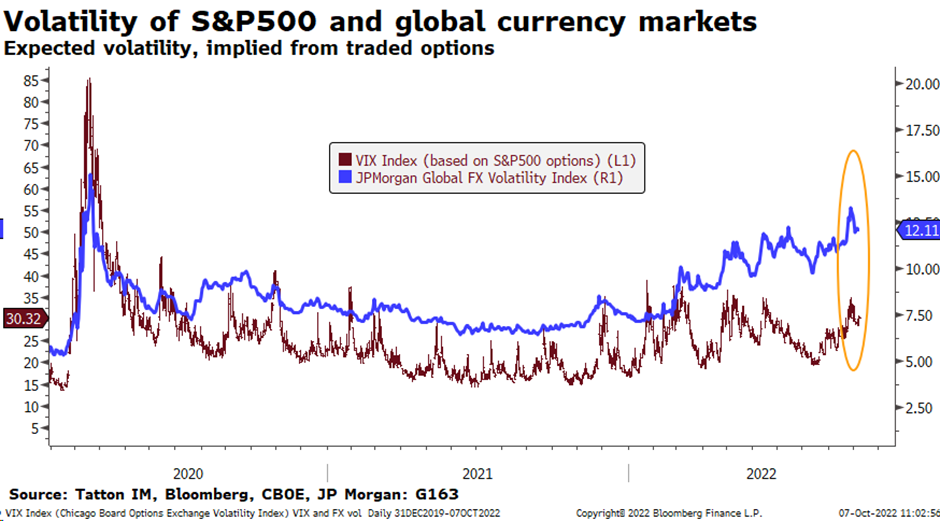

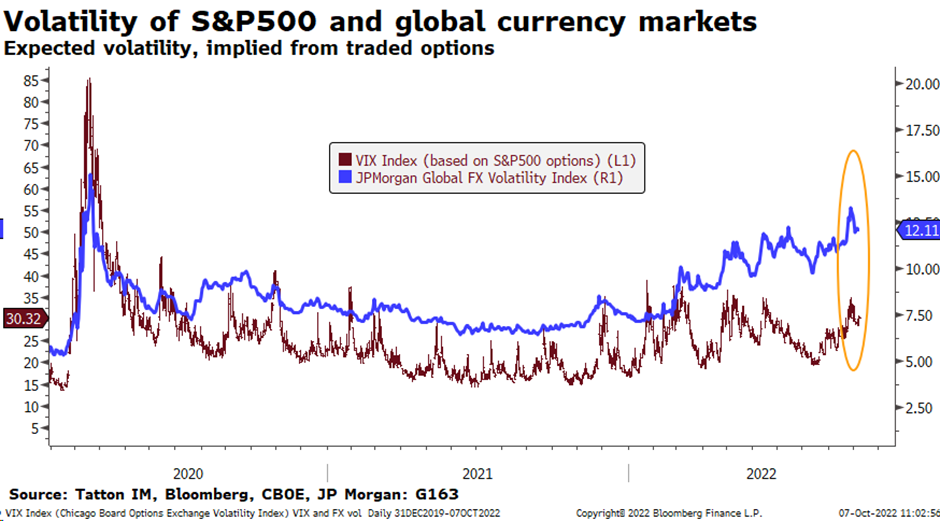

This week’s toning down of actual and expected volatility has therefore helped sentiment, even if it is definitely too early to call it a trend. The chart below shows the track of equity (brown) and currency volatility (blue):

the chart illustrates, currency volatility has coincided with the year’s downtrend and so the US dollar’s partial retreat against most currencies this week was another driver of marginally improved investor risk appetite. Why? Because the exceptional economic strength of the US – and its relative insulation from the rest of the world’s travails – has been a driver of dollar strength and, historically, a strong dollar has coincided with weaker global trade.

There is much debate about whether a strong dollar causes weaker global growth, or is merely a sign of weak growth beyond the shores of the US economy. But there is no doubt that, while the rest of the world languishes, a US central bank (Federal Reserve/Fed) purely focused on domestic inflation pressures does not help the global economy. Indeed, Janet Yellen, US Treasury Secretary (and former Fed Chair) sounded a warning bell on Thursday, speaking at a central banker symposium:

“Policymakers in the major economies must continue implementing policies to rein in high inflation while remaining attentive to global repercussions [our emphasis]. Clear and open communications, coupled with cooperation among the major economies to address spillovers, remain essential.”

She may have been addressing the audience of central bankers, but everyone knows she was really addressing the Fed. So, as we wrote last week, a bit less of “I’m alright Jack” from the US is likely to help global capital markets, and Yellen’s influential comments suggest the US is not totally unaware of its impact on global financial conditions.

Back to this week’s market action, Monday and Tuesday’s market optimism came from bad economic news of weak US employment data, which might seem perverse. Job openings in the world’s largest economy fell by more than one million in August, the largest fall since the start of the pandemic. But, with the Fed still intent on crushing inflationary pressure by cooling wages, bad news is good news as far as investors are concerned. The hope is that rising unemployment will give the Fed license to ease its grip, bringing the fabled ‘peak interest rates’ forward and setting the stage for looser financial conditions next year as the Fed pivots away from raising rates further. The JOLTS (Job Openings and Labour Turnover Survey) data thereby jolted markets upwards.

Up stepped the world’s oil barons to dash such hopes. On Wednesday, OPEC+ agreed to cut production targets by 2 million barrels per day from November. As well as reducing crude supply, and thereby squeezing fuel prices even higher, the apparent unity shown by de facto leaders Russia (the ‘+’ in OPEC+) and Saudi Arabia puts the latter on a political collision course with the US.

As we write in a separate article this week, the apparent ‘betrayal’ probably has more to do with oil producers’ inability to even meet existing targets and weak demand, than Russia’s desire to exert influence, or the Saudis’ willingness to help it. Reduced oil supply is an unwelcome headwind nonetheless, and one that is likely to hurt the US economy more than others – given its sensitivity to gasoline prices. Traders seemed to agree, punishing American stocks more than British or European counterparts.

On this side of the Atlantic, natural gas is a much bigger concern than oil. Europe’s energy crisis is probably the major global economic concern as we head into a harsh winter. Interestingly, gas prices have actually been on a steady downfall recently – which has gone entirely unremarked by European equity markets. At the same time, governments across Europe have unveiled enormous spending plans to protect businesses and consumers against the worst energy price spikes.

Germany’s massive €200 billion support programme announced last week is the headline act in this line-up. Despite being debt-funded and amounting to a substantial loosening of fiscal policy, bond markets have not punished German bunds for the apparent laxity with public money. This is in sharp contrast to the UK’s experience over the last couple of weeks.

As for the UK market itself, this week offered some respite – though not much. Gilt yields dropped back below 4% (they had touched 5% before the Bank of England (BoE) intervention the previous week) in tandem with the early equity rally. Sterling also recovered, reaching the $1.14 level it held before Chancellor Kwasi Kwarteng’s not-so-mini-budget two weeks ago. Midweek jitters reversed these trends though, with yields rising and sterling falling into the weekend. Thankfully, these falls were not as severe as the chaos wrought in the last fortnight.

Interventions from the government and (especially) the BoE have stopped the bleeding, although it would be a stretch to say UK assets are in good health. Britain’s current account deficit (money flowing in minus money flowing out) makes our economy and financial system largely dependent on the will of foreign capital. In that respect, it is at least heartening to see – as the bond and currency recovery showed – that overseas investors have not yet lost all trust.

Liz Truss’s fledgling government has actually had a better week, at least in the eyes of some investors, if not among her own Tory MPs. The near-chaos at the Conservative conference – replete with rebellions, U-turns and accusations of a “coup” – passed by with the Prime Minister finishing with an appeal to optimism, albeit with little in her speech to tell us why. Yet, the conference drama coincided with the rebound in gilts and sterling, suggesting markets are not too concerned with the situation.

Perhaps this could be down to Conservative MPs’ successful lobbying on the 45% top rate of tax. The government appears to have little ability to force an unpopular radical agenda in the face of opposition from its parliamentary party. Truss’ backtracking came quickly after repeated insistence she was not for turning. Markets might be inclined to think that this government is paralysed from making any sweeping changes – and markets tend to prefer the absence of surprises.

However, many UK exporting companies will be cheering at signs of rapprochement with Europe. The Times trailed a series of bilateral compromises over the Northern Ireland Protocol, including an extremely important acceptance of (some) jurisdiction for the European Court of Justice. And then, in Prague, a genuine warming of relations with French President Emmanuel Macron (perhaps the most influential of European leaders) sharply improved the sense that we may be moving beyond break-up to make-up.

It will still take time, but this raises the prospect of some freeing-up of access to Europe’s markets. It also may speed up stalled trade negotiations with the US. Given the strength of the dollar, making UK goods and services highly price competitive, improved access to US markets is vital.

Betting markets still imply a 50/50 chance of Truss leaving office before 2024 and the next General Election. Nevertheless, it will be difficult for the Conservatives to row back from a more pro-Europe stance if a warmer relationship brings economic benefits.

Day-to-day politics does not usually have much impact on asset prices, but last week’s chaos showed when it does, it can be to devastating effect. If the new government is as market-oriented as it claims, and is prepared to be responsive to the warnings it sends, then investors will give a little cheer.