Signs of ‘peak inflation’ emboldens markets

Posted 11 November 2022

There were three big market-moving stories this week: the US midterm elections, the latest crash in the surreal world of crypto currencies, and the release of US inflation data for October. By Friday, it was the lower-than-expected inflation data that dominated in terms of market activity.

Thursday’s report from the Bureau of Labor Statistics revealed annual consumer price index (CPI) inflation slowed to 7.7% in October, below the 8% expected by most economists, and the lowest level since January.

And so, for the first time this year it appeared that, for the US at least, rising inflation may be behind it. While it is still too early to assume the US Federal Reserve (Fed) will pivot away from its monetary tightening policy, the market euphoria following the data release was quite something. Not since the market confusion in the early days of the COVID pandemic have we witnessed so much movement in both equity and bond markets. Observers could have got the impression that all 2022 dominating market trends had reversed: the tech-led Nasdaq gained 7.5% and US Treasuries rallied as yields of 5 year to maturity bonds fell 0.3%. While we may not have reached the actual turning point in terms of turning market and economic tides, perhaps this week’s activity confirms our suspicion that there is a widespread belief amongst market participants that current economic downturn is more likely to be shorter and shallower than some scaremongers (including the Governor of the Bank of England) would like to suggest.

What has led to the slight decline in US consumer price inflation is a reversal of what started this inflationary episode more than a year ago, the changing prices of goods (rather than services). Supply chain disruptions have largely disappeared as time has allowed production processes to realign themselves. Freight prices have normalised, and China has once again become an exporter of disinflation – as producer price inflation there has fallen back to where it was one year ago. This, together with a 10% depreciation in the Yuan/Renminbi has resulted in a sharp turn in external cost-push pressures for western consumers.

This is good news indeed for shoppers, especially with Christmas approaching, but is clearly no longer the primary focus of central banks, which as we laid out here before, are much more concerned about second order inflationary pressures, namely tight labour markets leading to a transmission of the initial price shock into more structural inflationary behaviour patterns. On top of that, central bankers are keen to curtail broader demand through the wealth effect, which means not letting higher asset markets have consumers feel wealthier and therefore drive spending on large ticket items like cars and housing.

Expectations that Fed Chair Jerome Powell will get more dovish are therefore premature until labour markets ease. Moreover, should the Fed raise rates at its December meeting by less than the a 0.75% jumbo raise as in their last two meetings, Fed members may as well tell markets that they are indeed pivoting. So, it is likely and even probable that external cost pressures in the overall inflation dynamics will be easing over the coming weeks and months (goods prices in the US and energy prices in Europe), but that is not yet sufficient to realistically expect central banks to take their foot off the monetary brakes.

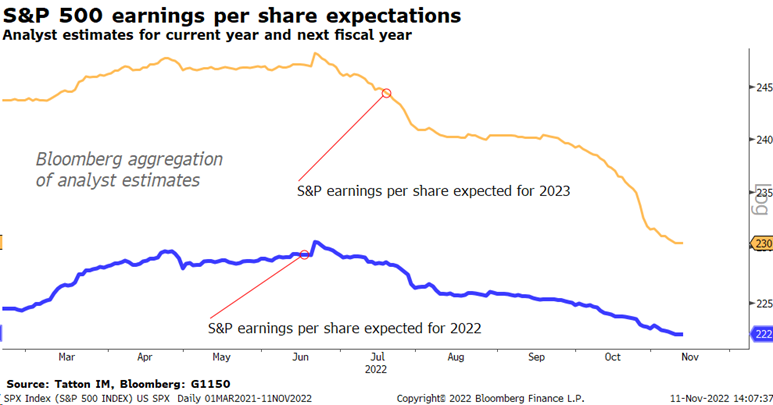

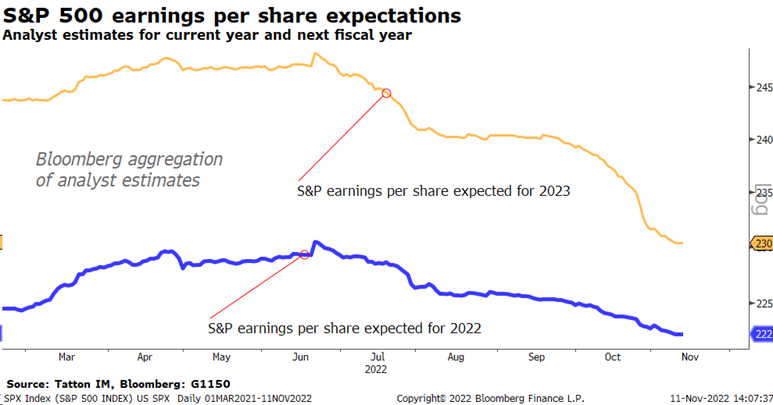

Anyway, the role of bond yields in the valuation of equities is only one side of the coin. The other – and over the medium term more profound side – is the development of corporate earnings, which have held up remarkably well over the course of 2022 thus far. Unfortunately, the flip side of falling inflation in goods and lower producer price inflation is that it tells us companies are now struggling to maintain their profit margins, which dovetails with company analysts’ expectations of declining corporate profits. So, the underlying profit cycle is still not conducive, and US expected earnings for 2023 continue to fall (as the chart below illustrates) while the pace of downgrades has accelerated.

The market may believe the Fed will pivot but, if it does not, firms will get doubly squeezed – on their margins and the cost of finance.

This late stage of the cycle can be harsh and a liquidity squeeze creates casualties. This is where the second big market news item comes in – turmoil in the crypto markets. This week FTX the second-largest crypto exchange, became a casualty of both crypto’s defining feature (it’s lack of regulation) and the less forgiving market environment after it become known that those involved in the company may have been less than truthful about their need for and access to (real) US dollar cash. It also turns out that diehard cryptocurrency traders still prefer the stability of the money created by their arch-enemies, the central banks.

For us, what is most interesting about this episode is that it had no discernible impact on general credit spreads – the proverbial canary in the coalmine of capital markets during economic downturns. Some talk of FTX as a “mini-Lehman”, but (as of yet) nobody is reporting large exposures. This may change given that FTX’s related hedge fund, Alameda Research, is likely to impact its prime brokers and some other hedge funds.

Instead, credit spreads have fallen a great deal, and more so in the derivatives known as credit default swaps. Fearful investors have been buying equity put options as insurance against further falls in equity markets and they have also been hedging both equity and credit risk using credit default swaps. These volatile market moves are perhaps a signal of uncertainty and changing fundamentals, but strongly rising markets have also put these fearful investors into a tight liquidity position as they were faced with margin calls on their ‘insurance contracts’ and so the market volatility is probably also a signal that liquidity remains tight.

The US midterm elections were the third big news item of the week, but ultimately had a far smaller impact that had been expected, largely due to the surprisingly strong showing from the Democrats. We have dedicated a separate article to what the midterm results may tell us.

Readers will wonder why the negative Q3 UK GDP reading of negative 0.2% is not featuring as 4th in our list of events of the week. The answer is that was along expectations, perhaps a smidgeon better than feared and therefore not particularly market moving. Also, when nominal growth is running at annualised 10% due to inflation all that such a very small real growth figure can tell us over and beyond statistical noise, is that the UK economy has likely stalled – which is hardly a surprise to any observer.

As we head towards the close of the year, when asset managers have a tendency to shut down exposures, this week’s positive upturn certainly felt encouraging. However, investors should not expect 2022’s market pressures to end here. The Fed’s December meeting may well cause yet another turn in market sentiment and the underlying corporate profit development, coupled with thinning seasonal liquidity from institutional investors, leaves us bracing for more potential volatility before the year ends.

The outlook for asset markets over the medium term (into 2023) is improving. But 2023 is still some way off.