Taper Tantrum 2.0 fears rattle markets

Posted 28 January 2022

The unnerving start to the year escalated this week, with many lay observers attributing market volatility to the rising possibility of war between Russia and Ukraine. But as outlined in the video market update we posted on Tuesday, while political tensions are not helping markets (nor energy prices), the heart of the market rout lays with the re-emerging determination of central banks to fight inflation through monetary tightening. Markets are concerned central bankers, namely the US Federal Reserve (Fed) have veered from downplaying the inflation threat to overreacting, particularly now, when the economic temperature is coming back down on its own (more about this later).

Readers may feel reminded of the market dynamics of the 2013 ‘Taper Tantrum’, when equity markets sold off markedly after the Fed announced its intentions to wind-down its quantitative easing (QE) policy by reducing the pace of US Treasury purchases – indicating the beginning of a monetary tightening cycle. Back then, the news caused a ‘tantum’ from bondholders, pushing up bond yields significantly, while equity markets recovered relatively quickly. If history repeats itself, it would therefore seem that the current bout of market volatility is nothing overtly unusual at this stage of the economic cycle, and unlikely to herald a poor year for investors after two surprisingly strong ones.

While this is broadly true and our central case, circumstances are, of course, never quite the same. We are in near-uncharted territory (a post-pandemic recovery period), while it is also worth noting central banks have not entered a tightening cycle with the expressed intention of bringing down inflation since the 1990s. (more recent tightening has been aimed at preventing inflation from reaching the levels they are already at today, and about central banks raising rates to re-establish rate cutting potential to fight later downturns).

Markets are, therefore, excused for being both jittery but uncertain over the most likely direction of travel, as this week’s wild swings evidenced. This drab and second COVID-restrained January certainly does focus minds on the negatives. Retail investors are understandably worried about preserving the gains made over the past two years, even if they never really quite understood the reasons behind those gains, given the global economy – and their life in general – never lived up to a similar level of positivity.

That there were almost as many buyers as sellers of risk assets this week points to certain cohorts of investors being willing to identify positives further ahead, and also willing to assume the Fed will resist being too single-minded in its inflation fight to inadvertently choke off the nascent recovery. We remain in pandemic times, but we are quite evidently approaching the point of exit. Those who disagree, will nevertheless have to admit that even at the height of the pandemic, springtime has always brought relief and a significant rebound of economic activity.

So, together with Tatton’s Chief Economist Jim Kean, we wanted to share our thoughts and observations on the many moving parts that will appear to confuse, unnerve, but also present opportunities for the investment community as we look beyond the dark days of January 2022.

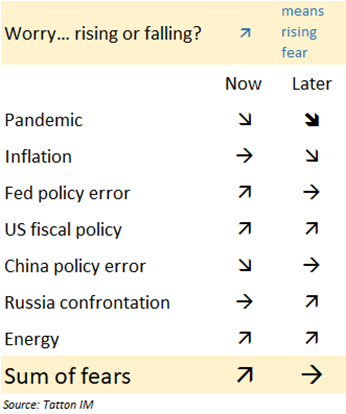

As discussed, this week has seen the current major worries become more prominent in investors’ perception, with negative impacts – real or potential – dominating. We list some of them below (in no particular order), and with a rough assessment of the direction of travel. The assessment of ‘Now’ is where we are at the end of this week, relative to recent past. It is not meant to tell us whether markets will go up or down, nor does it give each of the worries their own weightings. Rather, it places the different parameters driving investor concern into a loose context and helps gauge overall risk appetite.

The number of items on the ‘worry list’ have not increased this week, which is a mild positive. If the list grows, one would expect that in itself would hurt risk appetite.

The start of the week was dominated by heightened tensions with Russia over the Ukraine. After the removal of diplomatic support staff and families from Kyiv, the temperature appears to have cooled a smidgeon. Nobody thinks we are out of the woods, though. The experts of the Scowcroft Institute (based in the US, the experts being past senior soldiers) were somewhat pessimistic given the continued build-up of Russian forces in Belarus (which is much closer to Kyiv than Russia). They did say that the Russians would gain most advantage by moving swiftly. Moving heavy forces across March’s thawing ground would be difficult, so the risk is likely to lessen with time.

Still, it is difficult for Europe and the US to give Putin what he wants while maintaining public support. This political dynamic feeds into energy prices, especially Europe’s natural gas prices. Interestingly, these remained stable this week. However, oil prices peaked on Wednesday. Supplies from oil refineries are being hampered by outages and market conditions, and with relatively low stockpiles around the world, there is only a limited cushion to absorb market shocks.

Overall oil production has been ramping up slower than expected in both OPEC+ countries and in the US, despite the longer-term oil price hitting over $60 per barrel. The climate change barriers to investment in high carbon emission fuel is being blamed. The argument goes thus; if the timescale for productive life is halved, the crude price needs to be double the previous level for the investment to make sense. And, as we head towards the 2050 climate change ‘deadline for humanity’, things will get worse before sustainable sources are viable.

This only highlights the climate change conundrum. Meanwhile, global oil prices could also be affected by US President Joe Biden’s slump in the opinion polls. Republicans still appear likely to win back control of both the Senate and Congress, and are on course for the Presidency in 2024, even if the smart money is on Florida Governor Ron DeSantis, not Donald Trump. Biden wants to get his environmental measures through in a bill which may arrive in April, but which may prove too difficult to pass. In a more Republican-dominated environment, we might well find US shale and other oil producers are happier to invest.

We look at two of the other factors on the risk list in this week’s other articles. Both the US and China are areas where investors worry about policy-induced risks. This week, the respective authorities gave us much to consider. The Federal Open Market Committee (FOMC) left rates unchanged, but reiterated messaging from December that it sees little reason not to tighten monetary conditions substantially from March. Following Fed Chair Jerome Powell’s press conference, equities wobbled but did not fall through the week’s lows.

Trading volumes in risk assets have risen amid a week of relative consolidation. At the risk of rationalising what is difficult to prove, it looks like ownership is passing from retail investors to institutional investors, with the retail investor favourites remaining under pressure. This might be said to include cryptocurrencies, with Bitcoin (once again) having more than halved in value over the last two months.

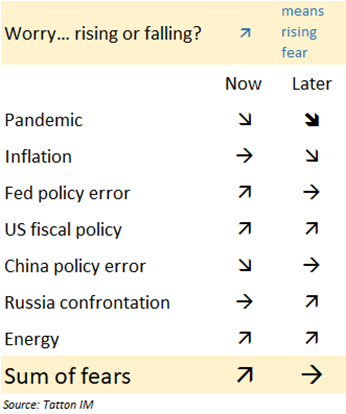

Meanwhile, stocks displaying ‘value’ characteristics have continued to outperform, as the chart below shows. One might associate this with a market that is positive on economic growth. In the US, it may be a near-term signal of the opposite should retail investors find their

spending power curtailed by declines in their portfolios of short-term investments.

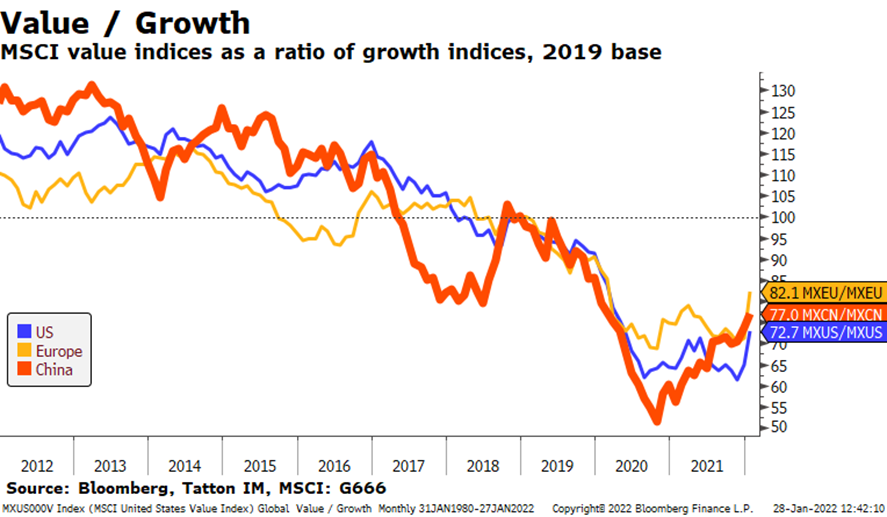

That’s corroborated, to some degree, by the other growth signal many market observers watch: the steepness of yield curves. A steepening yield curve is usually associated with a rising likelihood of growth. That’s being indicated in Europe and China, but the US is showing the opposite in the chart below.

We write about China in our third article. This week has seen a significant step-up in policy actions, all focused on addressing the extreme compression of assets linked to Chinese property developers (with Evergrande at the forefront). Interest rates have been cut, developers have been underpinned, and state-governed investment institutions have bought stocks. This marks a very significant shift in both the extent and urgency of action. Although China’s domestic equity indices fell on Friday, they have been better behaved than the US indices recently, and that may well continue.

It felt risky out there this week, but returning to our table of risk earlier, perhaps the risks are not worsening. This does not mean an end to the current market volatility, but it tells us that beyond all the identified risks there are also solid opportunities likely to underpin and advance markets further down the road.