Tatton teaser: Changing Habits for Changing Budgets

Posted 1 December 2022

Readers will not be wanting for coverage of the UK inflation picture, with large rises in energy and food costs being front and centre for most of 2022. We’ve seen a bit less coverage of how exactly consumers are trying to mitigate these, an economics article from an unlikely source, ASDA has shed a bit of light on this. Combining their own data with work done on their behalf by the CEBR.

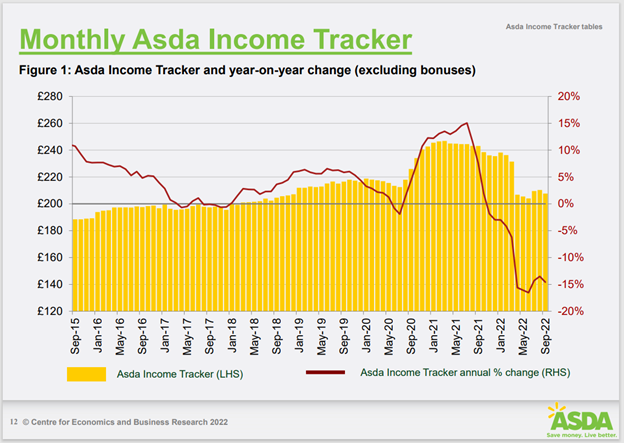

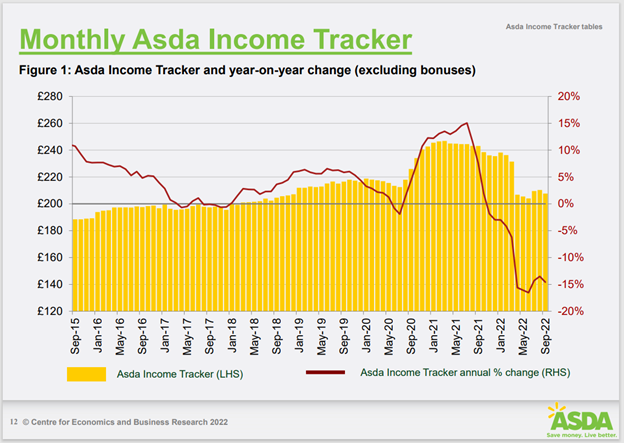

Source: PowerPoint Presentation (asda.com) retrieved 11th November 2022.

As we can see, the “Income Tracker” has dropped from £240 to £208, this is a measure of discretionary household weekly income. Designed to show what is left from income after taxes, groceries, electricity, gas, transport, and housing, this is down around 15% from a year ago.

ASDA also provide some commentary on what this has meant in their stores (Customers rush to buy energy-saving products as discretionary income continues to fall (asda.com)), with huge numbers of consumers buying air fryers (up 320% YoY) to save on cooking costs, as well as heated airers (up 90% YoY), to help cut down on the use of dryers. Unsurprising perhaps, but evidence that these changes in energy costs have been so severe that people are making significant changes both to purchasing, and given the specific items, how they go about their daily lives. Headline statistics are interesting but it’s also useful to have confirmation these numbers are making changes on the ground.

Thank you James Saunders for this note.