Tatton teaser: Liquidity Shocks and Stocks

Posted 3 November 2022

The UK has a new government, and thanks to the speed of events, the recent turmoil in the UK gilts market may start to feel like an episode of the distant past. At the same time, it remains a vivid example of Central Banks having to step in quickly as liquidity recedes.

The BoE intervened directly with gilt purchases; whilst officially labelled as financial market intervention, observers were quick to wonder whether quantitative easing (QE) had started again. Though officially, for monetary policy purposes, the BoE was embarking on quantitative tightening (QT), which is net selling of gilts. So some confusion emerged.

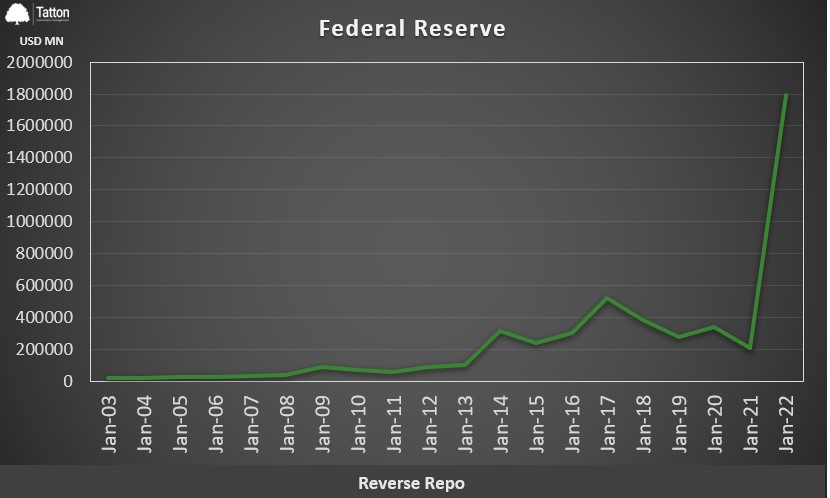

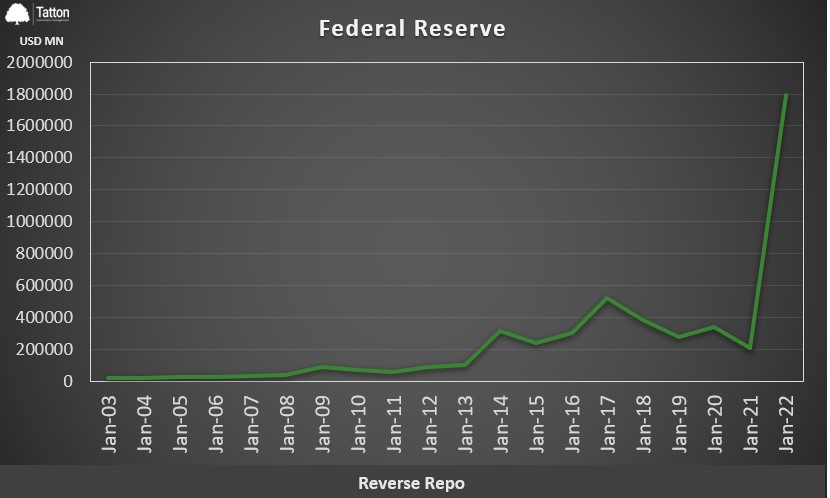

What other options exist for Central Banks to react to market dislocation? The world’s key Central Bank, the Fed, has built up an intriguing balance sheet position. Money market funds park around USD 2.5trn with the Fed, which signals a drain from financial markets. In case liquidity is needed, the Fed could release this buffer back into markets, for example by lowering the reverse repo rate. The rate at which money market funds are remunerated sits currently at a comfortable 3.05%. There will always be a question whether this liquidity will be passed on to exactly where it’s needed, but it’s a first valve which could be used.

Source: Tatton

Thank you Astrid Schilo for this note.