Tatton teaser: Portfolio Insurance

Posted 16 November 2022

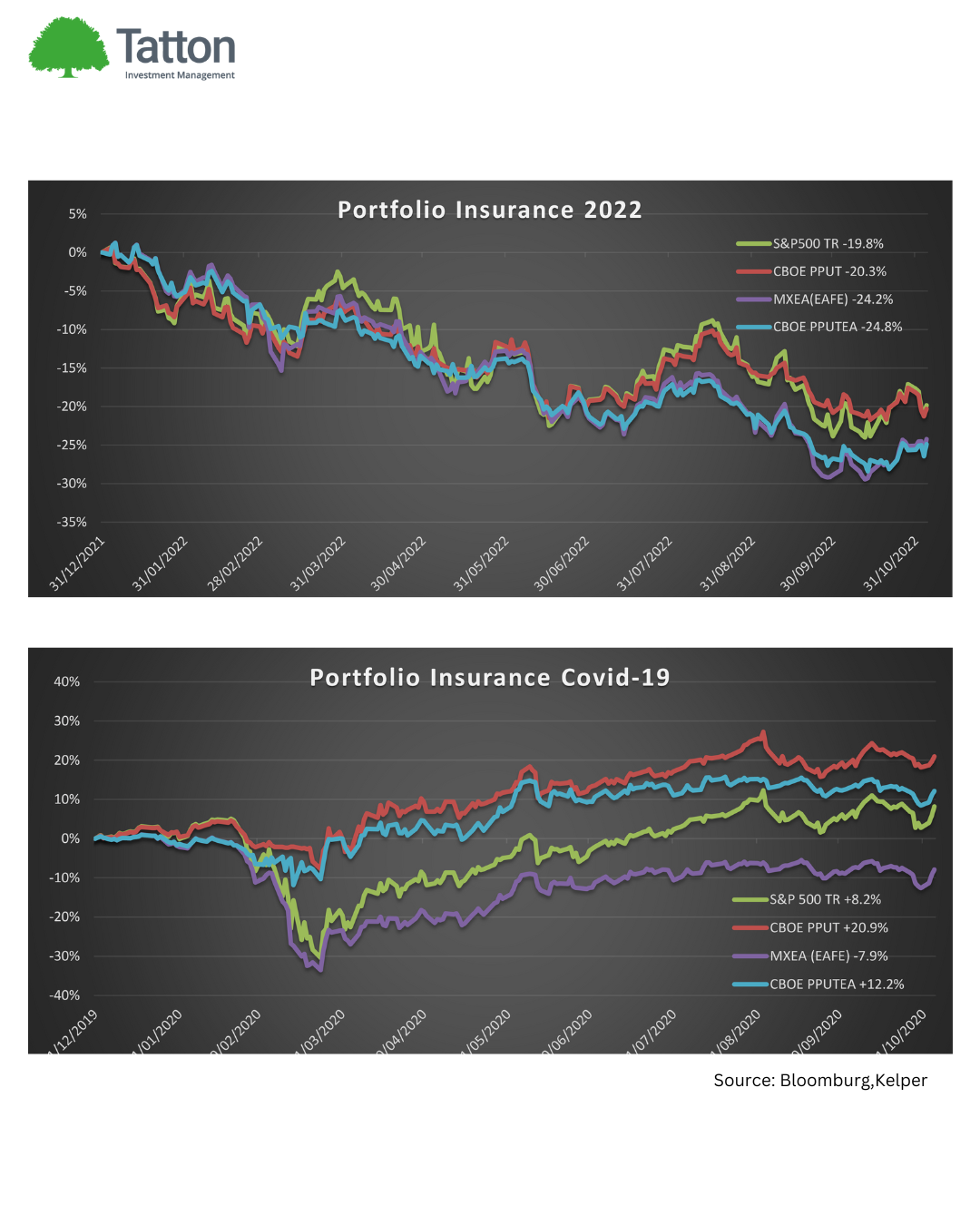

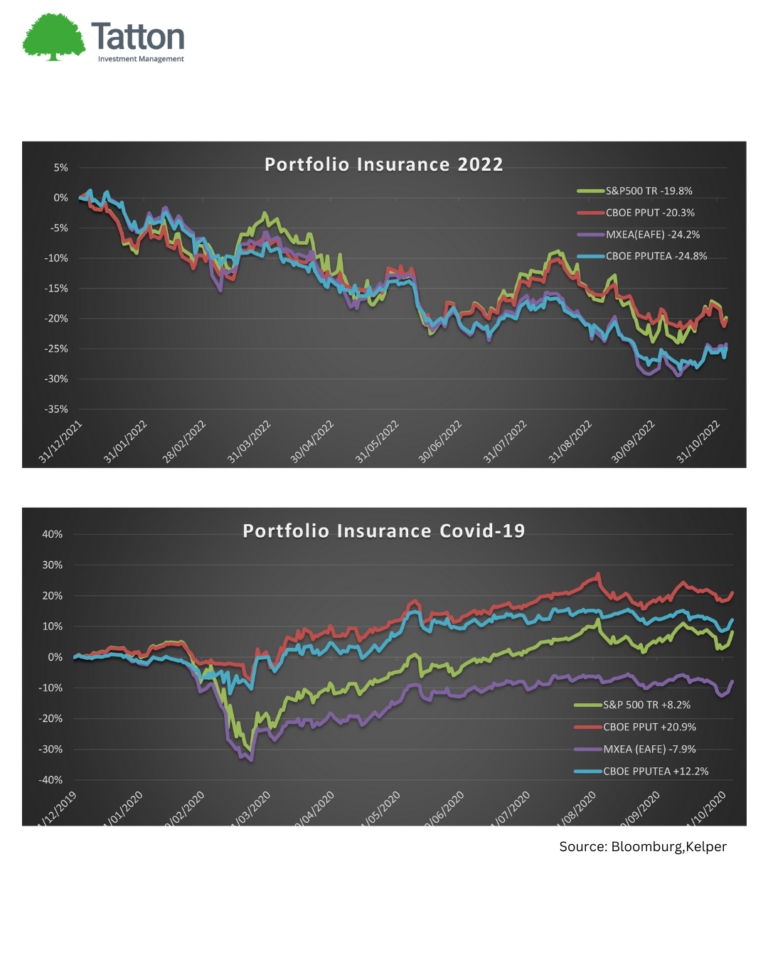

During stressful periods for markets investors commonly look for strategies to provide protection for portfolios outside of traditional asset classes. ‘Put options’ are often described as portfolio insurance for investors. For the price of an “insurance premium” they give you the right to sell an asset to the issuer of the option at a fixed price protecting your portfolio in the event of a market fall. However, 2022’s continual grind lower in equity markets has proved difficult for these strategies. The 2022 chart above shows the performance of the US market and the rest of the developed world (EAFE) over the year versus a corresponding simple put strategy that goes long the index and buys a 1 month 5% out of the money put option on the same index to act as a hedge and then rebalances each month when the put expires. Since the turn of the year this type of strategy has provided little protection for investors with the cost of the put premium eating into returns and meaning investors would have been better off simply holding the equity index.

For a strategy like this to add value there needs to be a period where realised volatility exceeds the expected volatility used to price the options, or a sharp fall in equity markets such the Covid-19 outbreak where it pays to buy insurance as seen in the second chart. Conversely managed futures strategies which are able to capitalise on market trends have had much more success in 2022 – with the AH Managed Futures Index returning 15.5% to the end of October – but struggled during Covid. As with all these strategies, hindsight is a wonderful thing and highlights the importance of taking a diversified approach to investing especially when looking for alternative sources of return.

(Sources: Bloomberg, Kepler)

Thanks to John Messer for the note.

Thank you James Saunders for this note.