The pre-Christmas ‘quiz’ that not many want to play

Posted 3 December 2021

As the end of the investing year draws nearer, markets remain on edge, questioning everything that it thought it knew the answers to only very recently. But this week, central bank and government policy, inflation pressures from supply chain issues, and the latest developments from the virus that refuses to be defeated, threatened to leave investors in a state of puzzlement.

Not surprisingly, the new Omicron COVID variant has dominated the news cycle and the financial press. Each time new information (or maybe, at this stage, rumour) hits the headlines, markets move sharply in either direction. However, taking a step back, we suspect these wild gyrations are less to do with the virus news itself, and more a case of the “straw that breaks the camel’s back”. While not so worrying in itself, the build-up of other risks means the new uncertainty presented by Omicron offers a convenient (and welcome) excuse for investors to crystalise the reasonable returns gained in 2021 so far. After another arduous year, the temptation to close up early, take the money and run is entirely understandable. We include a separate article this week discussing November’s capital market returns.

After some weeks of rising concerns about the economic outlook, conditions have started to improve again. While employment indicators have reaccelerated, (notwithstanding a slightly disappointing US figure on Friday), markets are signalling that concerns about the inflation outlook have lessened. Looking at the most recent regional Purchasing Manager Indices (PMIs) which capture the prevailing economic sentiment, JP Morgan research offered a good example of how the ever-changing impact of the various factors mentioned at the beginning are being interpreted:

“Activity data … are constructive. Alongside a reported further improvement in labour markets, country-level retail sales data (including Germany, France, and Spain) align with our call for a 0.2%m/m October spending gain in the region. This increase would leave Euro area retail sales 1.2%ar above the 3Q21 level. A key question, however, concerns the impact of higher energy prices on consumer spending. While natural gas prices have steadied out over November, the sharp gains since this summer are now visible in consumer prices. It is encouraging that consumer confidence remains elevated through November, but rising inflation expectations along with building COVID-19 concerns could pose a challenge to spending growth in the coming months.”

Despite expressing concerns about the inflation outlook, they (and we) are of the opinion that supply chain issues may be fading. Since October, ocean container shipping costs from Shanghai to Europe are down by more than 6%, and from Shanghai to US ports by over 20% (source: JP Morgan, WCI). The recent rise in the Baltic Dry freight shipping index is probably driven by an upswing in demand from China – containers are once again returning to China filled with goods, having often gone back empty in recent months. As a result, we do not expect any inflation follow-through from these rising shipping volumes – perhaps the opposite.

Rising worker power as a consequence of labour shortages would be one reason to expect inflation to become sustained rather than remain a temporary phenomenon tied to supply bottlenecks. However, rising wages create a different outcome to supply chain issues. Ultimately, relatively low-paid workers spend a lot more of their earnings than the highly-paid and the owners of capital. While there is good reason to expect a wage-price spiral of sorts, ultimately pricing power must mean that the workers benefit, and that real wages rise. That will get spent (especially given household balance sheets have improved during the past two years) so rising real wages translate into rising real economic activity.

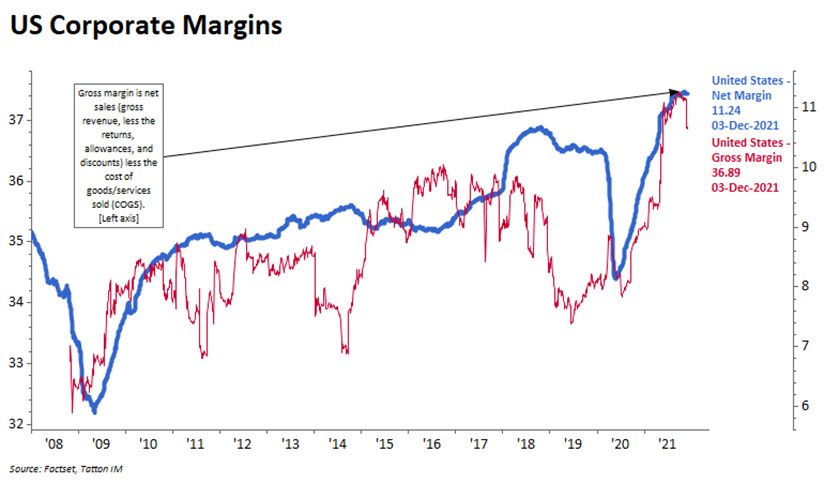

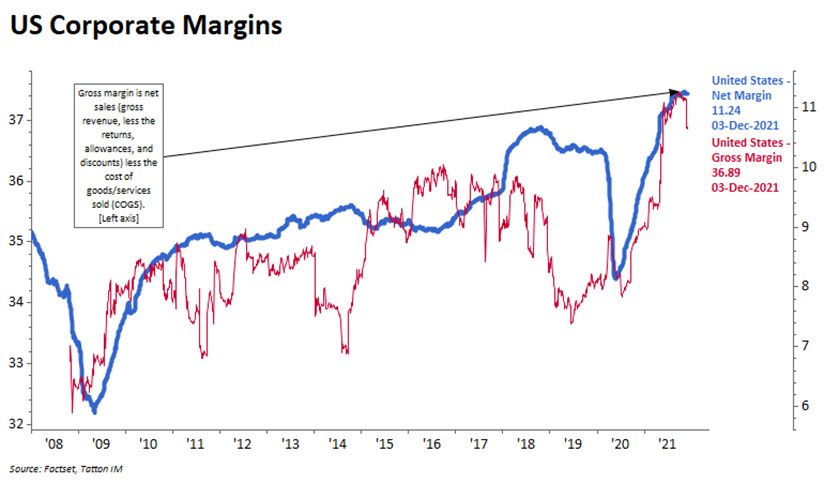

Sales volumes should therefore rise but, for businesses, rising input costs from higher labour costs suggests some pressure on margins which have been at historical highs. In the US, gross margins look as though they have started to come back a bit as the chart below shows (red line):

Still, the historical contrast with net margins (blue line) also shows that businesses can usually do a lot to stabilise the final net margin – so it probably will not feed through yet. Meanwhile, a rise in sales will continue to improve overall earnings (Note: the bump up in margins at the end of 2017 was due to Trump’s corporate tax cuts).

While the uncertainty caused by the Omicron variant may well disturb the otherwise positive economic backdrop for December and 2022, we note that most investors are not quite so perturbed after the experiences of the past two years. Vaccines are now more straightforward, timely adaptable than we could possibly have hoped this time last year. There is also the possibility that with the Omicron mutation the SARS-Cov2 virus is showing signs of running the course of previous viral pandemics: more infectious but at the same time less dangerous to public health. We shall see.

Elsewhere, the major news item that drove markets from our perspective had to do with the confirmation of Jerome Powell’s second term as Chairman of the US Federal Reserve (Fed). Perhaps his reappointment emboldened Powell to speak more forthrightly about inflation than he has in recent months. There is room for different interpretations over what this week’s remarks really meant, but most market participants took it to mean that the Fed is very likely to taper bond purchases more aggressively, starting in December. This would mean an earlier than anticipated draining of the ‘punchbowl’.

As a result, the market pricing of inflation expectations fell back as short-term yields rose. However, longer-dated nominal treasury bond yields fell, with inflation-adjusted (real) yields rising a little. Our best explanation of this is that investors now believe the Fed has moved into a phase of tightening near-term policy, which means the threat of unconstrained consumer price rises is much less.

However, for markets, it also means less ‘free money’ with which to buy risk assets. In that sense, Powell’s words are a double-edged sword. So, while risks for elevated equity valuations from rising yields – on the back of rising inflation expectations – have reduced, the cheap ‘fuel’ for economic activity is also less plentiful. The coincidence with the arrival of a new variant scare that may further hamper activity in the short term is unfortunate, but that even in light of this double whammy, markets only sold off lightly tells us the narrative of a sustained economic upswing into 2021 remains firmly embedded in medium-term investment outlooks.

However, for markets, it also means less free money with which to buy risk assets. In that sense, Powell’s words are a double-edged sword. So while investors may perceive that risks to equity prices from rising inflation expectations have reduced, the money ‘fuel’ for markets is also less plentiful. The timing of a Fed tapering announcement just as professional investors are thinking about booking profits on equities and corporate bonds isn’t great. The coincidence with the arrival of a new variant scare that may hamper activity in the short term could be a little unfortunate.

An acceleration of this week’s benign sell-off may or may not happen. It would be a brave investor who sold now, hoping to buy back when liquidity returns after the holidays, given that a sustained economic upswing into 2022 remains firmly embedded in medium term investment outlooks.