The world beyond the UK

Posted 21 October 2022

Given the volatility in UK politics over the week, broader capital markets felt like a sea of calm in comparison. As far as the outcomes from the political side are concerned, markets had already priced in the upside on sterling, based on the belief unfunded tax cuts were no longer on the agenda, but not another leadership hiatus or even the possibility of an early general election. This perhaps explains that after initial cheers, sterling settled at where it had been against the US dollar before Liz Truss tended her resignation.

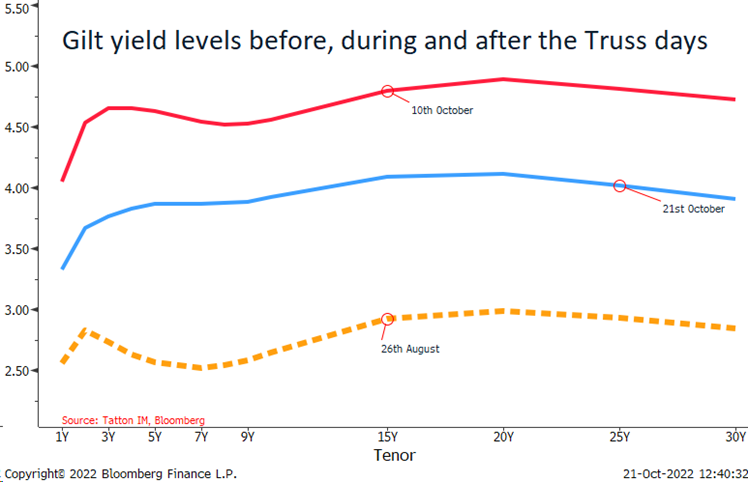

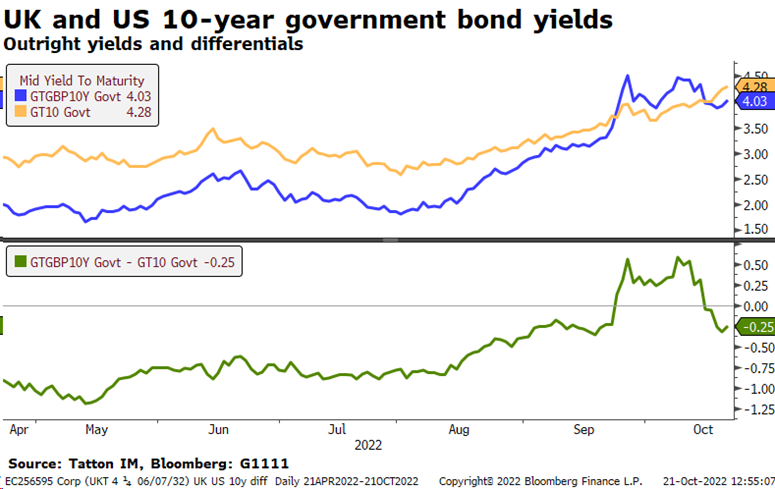

On the other hand, the UK Government bond (Gilt) market was cheered by the successful revolt against fiscal largesse. Yields are not yet back to August levels, but then neither are US yields, despite the US not experiencing any fiscal policy upheaval. Indeed, US yields have again risen while the Gilt market has experienced a significant bounce in prices which, as we explain in much more detail in a separate bond primer article this week, means that Gilt yields have corrected downwards.

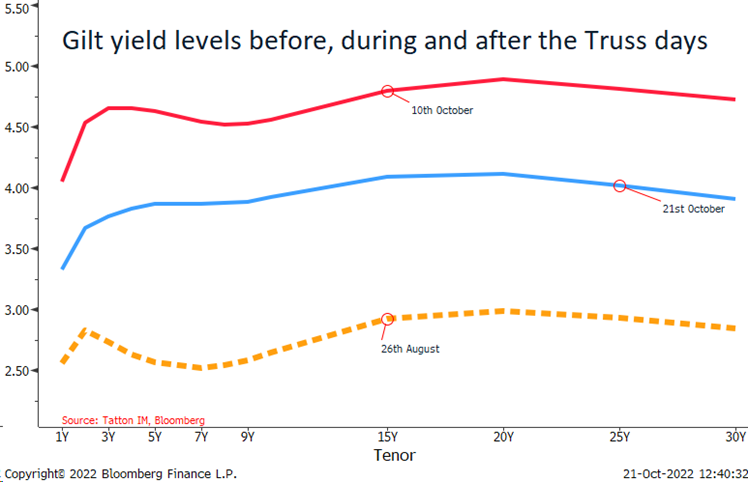

The chart below illustrates the wild and outsized movements in Gilt yields that the very short but also very turbulent, reign of the Truss government bestowed on the UK. The three lines show the different yield levels over different maturity bands in years (Tenor) on 26 August (dashed yellow, before ‘Trussonomics’), 10 October (red line, the highs of the Trussonomics implosion) and 21 October in blue, after the hapless Prime Minister had resigned.

However, as we said above and have written on these pages before, Truss’ ill-advised fiscal policy unhelpfully boosted an uptrend in bond yields that had been well underway since the beginning of the year. As the comparison of 10-year yield levels between the US and UK in the upper panel of our second chart (below) shows, the uptrend had accelerated since Spring, but the gap of lower UK yields versus the US closed rapidly as the Conservative Party’s leadership campaign progressed over the summer. It then jumped markedly after the former Chancellor’s announcement of unfunded and unassessed tax cuts. How yields and yield differences will fare from here will (hopefully) now only partially depend on the further political developments in the UK, but much more on where the rate of inflation is heading and with it, economic activity levels. On the much-discussed and lamented loss of trust of international capital markets in the reliability of the UK and its institutions, the past week has demonstrated that while the UK is most certainly not immune from political mistakes, the system deals swiftly and reliably with failure.

Regarding price pressures on consumers, this week offered another little-noticed story in Europe, although this one is undoubtedly good news. Gas and electricity prices for near-term delivery (over the winter) have come down, as gas storage reserves have filled to higher levels and earlier than anticipated, while industrial demand has fallen much more quickly than thought possible.

At the same time, however, longer out prices are still elevated, which keeps the pressure on to find longer-term solutions to the Russian gas deficit. Finding new sources of gas and redistribution is now the priority. Back to the near-term, reports that at least 35 liquefied natural gas (LNG) tankers are waiting to unload into Spain and the UK is another factor driving prices lower. While these loads are waiting because of a lack of regasification berths, they are also not yet needed, partly because gas use has been lower than expected, with unseasonably warm weather helping the deliberate cuts in consumption, but even more so in the UK because of the lack of storage facilities in comparison to the European Union (EU) market.

There was further good news on the electricity front as Germany’s Chancellor Scholz spoke a ‘Machtwort’ (meaning word of authority) and more or less forced his coalition partners to agree a temporary extension of the life of the three remaining German nuclear reactors over the winter.

This altogether lower temperature from the demand and the supply side in pan-European energy markets has led to a sense that the probability and extent of downside scenarios have lessened. This in turn is taking fiscal support pressure off politicians, and leaves markets anticipating less bad times ahead. Despite government-imposed price caps, there had been heightened fear of bankruptcies – which remains elevated, but the immediate danger is clearly receding as we note from falling European high yield credit rates for those firms with the lowest credit ratings.

Increasingly, scenario assessments like last week’s from Bloomberg’s energy analysts are circulating that are raising the possibility that Europe could find itself with a gas surplus should the coming winter prove warmer than usual. This would certainly be very good news for hard-pressed consumers, even though the boost to demand from the release of energy earmarked savings could fan broader inflation once again and force the interest rate setting bodies in the European Central Bank (ECB) and Bank of England (BoE) to follow their US colleagues from the Federal Reserve (Fed) in their push for rates that markets anticipate nearing 5% at the end of the first quarter of next year.

Still on consumer price pressures, back in the UK, the fall-back in bond yield levels has led to expectations that mortgage rates will start to come down as early as next week. This should be a relief to some, even if it does not yet mean the period of yield rises has come to an end – just the excessive and UK-specific part of it.

UK inflation (as measured by the Consumer Prices Index) was interesting this week, with food and insurance leading the core (non-energy prices) back up to 10.1%. Both may be seeing lagged impacts from previous energy price rises – but also the shortage of available labour. Our food has become much more energy-intensive in recent years. Indeed, the lagged impacts of energy are still evident across the board. Overall, and compared to previous weeks, the market has been cheered by a lessening of the sense of crisis around Europe and the UK, even if the backward-looking economic data reports still look concerning.

On a global perspective, US interest rates continue to be the main focus. In the US, much less pronounced energy price rises have allowed the domestic economy to continue to motor on, while an even more pronounced shortage of skilled and unskilled labour has raised fears that the initial price shock from the supply side-driven goods shortage is steadily creeping into wages – thereby creating the dreaded wage-price spiral dynamic. Therefore, there was some relief this week when the ‘Fed Beige Book’ on the state of the US economy reported a widespread drop-off in demand and reductions in freight rates.

While we know that the eyes of US rate-setters are trained on any signs of an easing of tight labour market conditions, a balance between nominal economic growth (before subtracting the rate of inflation as applies in the calculation of national GDP growth rates) and interest rates has historically been observed during periods of price stability. The heart of the question is whether the nominal current activity growth is in line with rates.

As mentioned before, this week markets have moved to anticipate a US interest rate peak of 5%. At the moment that is still just below the current run rate of US nominal growth. We calculate this as 5.1% if we apply the JPMorgan Nowcast, which has US real (after inflation) growth running at less than 0.5% at the moment and add US core CPI, which stands at an annualised 4.6%. That gives a current run rate nominal growth estimate of 5.1%.

When nominal growth slips below the Fed Funds (interest) rate, it offers a decent signal of a rate peak. These occurred in July 2006, June 2000 and January 1995. We are still some way off that in time terms, although the US growth trend appears to have finally reversed – the peak in Fed interest rates is seen by the market as being after March 2023. It may be a false signal as inflation and/or growth may not continue downwards as it currently seems. However, the balance of probability says the pressure on rates to go further is becoming more limited.

We believe US bond yields are not likely to move much higher because of the weakening nominal growth. That may not signal good news for the global economy in terms of aggregate demand, but we may be near the end of declines in asset valuations, and near a bottom for bonds.

Once inflation declines – and a softer US jobs market releases the pressure on US central bank rate-setters to keep raising rates towards 5%, this would afford bond yields some respite. Markets will certainly be happier should bond yields stop being one-way traffic – as the calmer markets of the past two weeks have shown. We are not quite there yet, but we are increasingly seeing signs that the peak in inflation, interest rate expectations and yields is getting closer, and with it a turn in market fortunes.