Debt ceiling angst or simply lack of good news

Posted 26 May 2023

Compared to last week, markets did not really get much ‘new’ news to digest, and yet this week brought a renewed bout of equity market volatility. Given bond yields experienced even larger moves (up), speculation has been blaming the latest market wobble on the unresolved US government debt ceiling negotiations. The deadline after which the US government runs out of money – and technically defaults on its financial obligations – is now likely only 5-10 business days away. Given US government bonds are deemed the bedrock of global financial markets, as the only financial instrument free of default risk, market nervousness ahead of such an impending – and portentous – deadline is wholly understandable.

To be sure, it is absolutely not the case that markets are no longer willing to lend to the US government or that there is an absence of a democratically-sanctioned budget, but rather that the US government’s financial framework has an oddity that does not permit it to raise debt beyond a certain limit regardless of whether that borrowing has already been signed-off by Congress. Without going into too much detail, this separate public spending hurdle follows a different set of legislative rules and is therefore harder to get through Congress than the budget, when the party of the governing president does not have a majority in both chambers of Congress. This is currently the case since the mid-term elections in autumn last year. As such, it offers the opposition party the opportunity to hold the government to ransom in order to push through fiscal and other political concessions they would otherwise not be able to achieve in the regular legislative process.

The looming risk of default of the safest borrower known to markets must surely seem hair-raising to anyone who hears about this possibility for the first time, and observers will wonder how capital markets could have been so relatively sanguine about the whole affair over the last few months of continued political haggling. The answer lies in the fact that this is not the first time this is happening – as the date of our opening cartoon relates and thereby perhaps adds to the humour of the donkey (Democrats) and the elephant (Republicans) willingly hitting their heads while the rest of the world despairs over such nonsense.

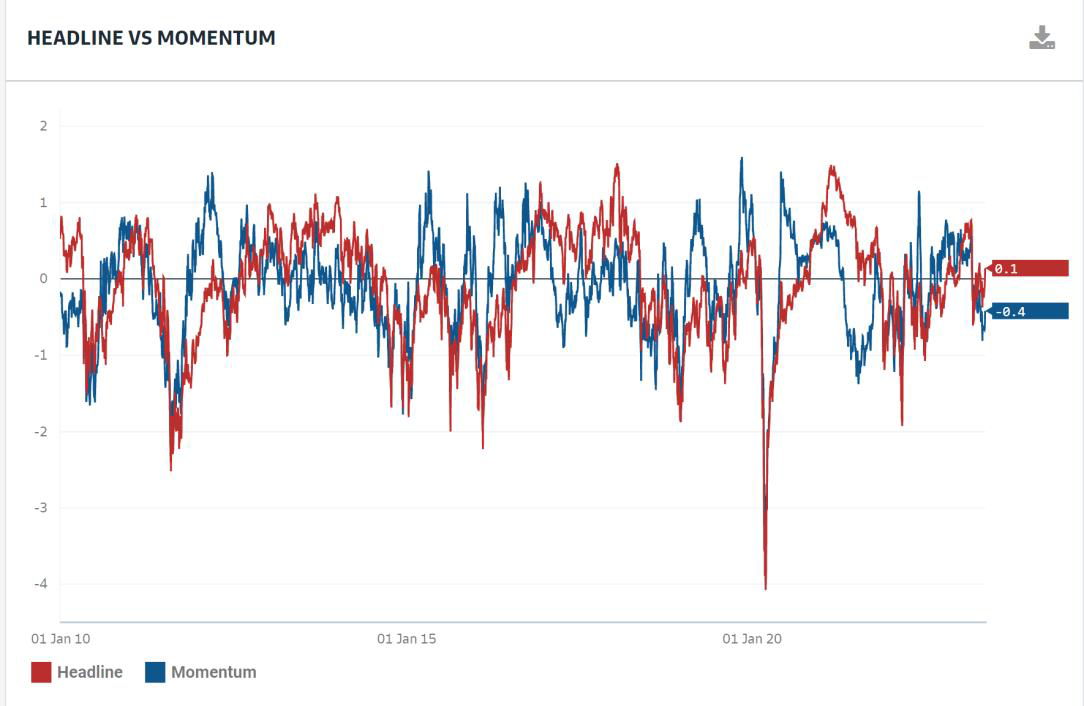

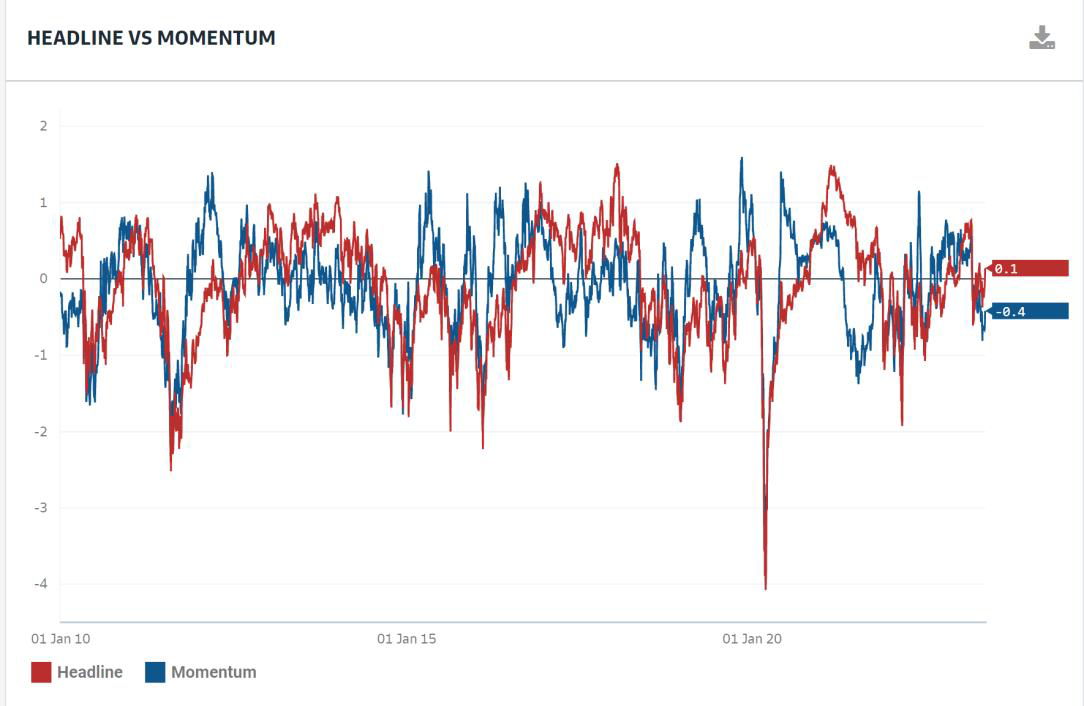

As the most recent and much renowned Goldman Sachs market risk appetite indicator below clearly indicates, risk appetite has been rising rather than crashing as it last did during the depths of the COVID market meltdown in 2020:

Source: Goldman Sachs Risk Appetite Indicator, 24 May 2023

Markets have taken solace from repeated pledges by Democrat president Joe Biden and the Republican Leader of the House Kevin McCarthy that they will not allow the US to go into default. Perhaps even more from the fact that in the aftermath of the 2011 episode there was a cross-party consensus that in the end the episode had benefitted no-one but had caused economic harm.

Despite all this, it is hard to deny the degree of causality between the market downdraft early this week and there now being only a very limited number of days left to resolve the debt ceiling deadline. At the time of writing, there are suggestions of meaningful progress towards resolution being made and stock markets around the world were bouncing.

So, another cliff-edge (most likely) circumnavigated, with calmer times returning as with previous episodes? The answer is yes, but only to an extent. This is because after the stock market bounce-back, the bigger market move of the week remains. Bond yields have moved higher again, in some instances, like the UK, reaching levels not seen since last autumn, after the Truss government’s ill-fated mini-budget. As we know by now, higher bond yields put downward pressure on equity valuations, unless they are caused by an improved growth outlook. This week’s step up in bond yields came at the same time as inflation reports (such as in the UK) showed that inflation – while trending downwards – is nevertheless proving more sticky and persistent as had been expected by central banks. At the same time, Germany was reported to have been in recession over the winter quarters and China’s COVID recovery has disappointed this far against the high expectations earlier in the year. Against this backdrop, expectations of central banks reversing their rate hike policy towards rate cuts has been further pushed out towards the end of this year and even the first quarter of next year, and expectations of resurging economic growth over the second half of this year have been dampened. This is likely to have been the cause of the bond yield increase this week, while a risk-off dynamics from debt ceiling angst should have pushed yields down with bonds seen as safe havens in times of stress.

From this angle, it is far more remarkable that risk asset markets took the developments of the week overall in their stride, whereas in the past most yield step-ups of this magnitude would have upset the market balance from the valuation side.

It is unsurprising then, that we currently observe more disagreement within the investment research community than usual. In fact, there are many strong arguments pointing towards an eventual downturn – even if that only takes place next year – and equally good reasonings why the global economy might just muddle its way through the downdraft forces of 2023, and keep going forward for longer than conventional economic theory would otherwise suggest.

For those who have already looked beyond the likely resolution of the debt ceiling cliff, the next market threat will likely be the impending liquidity drain caused by the US government which must replenish its empty coffers by issuing $1 trillion of new bonds into markets. But there may be some reassurance that most of the $2.4 trillion of cash currently deposited by US money market funds in the US Federal Reserve’s Reverse Repo facility is expected to be attracted by the higher rates the US government will have on offer then the US central bank. Perhaps this insight better explains some of upbeat market sentiment on Friday than the positive vibes from the debt ceiling negotiators.