A Swiss-Army Knife To Cut Carbon Emissions?

Posted 29 June 2023

The hydrogen economy has emerged as a promising solution to address the challenges of climate change, energy security, and the transition to a sustainable energy future. Hydrogen’s versatility means it is often referred to as the Swiss-Army Knife of climate solutions, with multiple applications across various sectors including transportation, industry, and power generation. However, despite its immense potential, hydrogen faces several challenges which may limit its widespread use in energy transition.

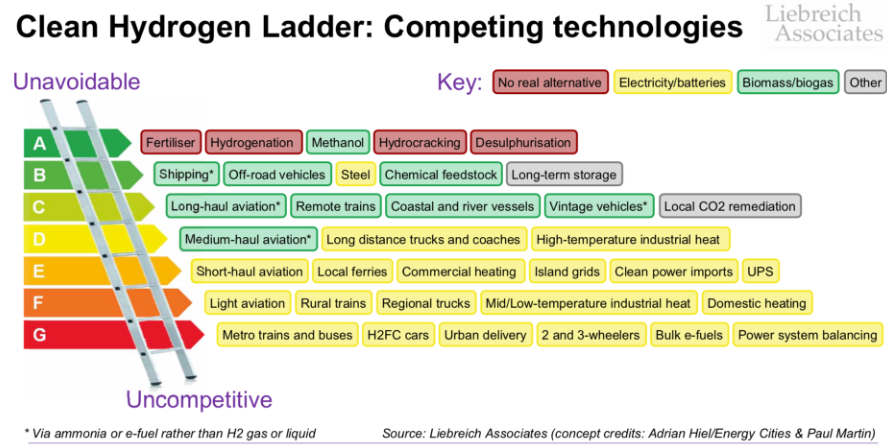

Firstly and most importantly, hydrogen’s current costs make it uncompetitive. Alternative existing green technologies such as batteries in areas such as urban delivery, regional transport or electrification in domestic and commercial heating are far cheaper so it is unlikely to make a meaningful contribution to these areas.

Secondly, although hydrogen is a clean fuel – producing only water vapour when combusted – traditional hydrogen production is not environmentally friendly. “Grey” hydrogen, which accounts for most of the hydrogen produced today, is made using fossil fuels and releases a lot of CO2. This accounts for roughly the same level of emissions as the UK and Indonesia combined, according to the International Energy Agency. “Green” hydrogen is produced by electrolysis of water using renewable energy and is clean, but it is much more expensive than grey hydrogen and relies on additional investment in renewables to provide this power. The good news is that these costs are expected to come down as production levels increase, McKinsey & Co believe that the cost of clean hydrogen will fall dramatically over the next decade with it becoming cheaper than grey hydrogen by the 2030s (especially when considering the cost of carbon credits). At about $2 per kg the molecule will become a viable alternative fuel.

Even with improvements in the above, there are some areas where hydrogen is unlikely to gain mass take-up. For example, the battle for the car is looking increasing to have been won by the battery producers. It is less efficient in energy terms to produce green hydrogen to power the fuel cells in cars than to remove a step from the process and use the green electricity to fill up the vehicles’ batteries.

The argument for a move to hydrogen is stronger in areas where fossil fuel use has been hard to replace. Longer-haul transport and shipping where a high energy fuel is required, and battery use would be inefficient are possible areas for hydrogen use. Steel production is another key area of growth for the hydrogen economy. Creating steel requires intense heat and releases a lot of CO2 accounting for 8% of global emissions, so decarbonisation of this production method would have a meaningful effect on emissions. As of 2022 countries around the world have announce 52 steel making projects using green hydrogen which could meet more than 5% of current steel production and this is expected to grow rapidly as the costs come down.

Expansion of the hydrogen economy is gaining momentum with c.$10 billion of new projects announced each month, indeed the war in Ukraine has made hydrogen use not just a climate change issue but an energy security issue as well. That being said, there is still a sizable funding gap to existing projects remains. Of the $700 billion of projects in the pipeline out to 2030, $460 billion of investment is yet to be found and it will require a big push from governments and business to get the price of hydrogen low enough to make it a viable resource. Policies such as the Inflation Reduction Act in the US and the Green Deal Industrial Plan in Europe should continue to increase the use of hydrogen and we would expect further incentives to be provided as countries look to create national champions and gain market share in emerging economy.

The challenges to the mass adoption of clean hydrogen remain, but the necessity of energy transition and the heightened awareness of energy security make its versatility as an energy source an incredibly attractive as a solution in the future and should fuel in the sector.

Thank you John Messer for this note and Liebreich Associates for the charts provided.