A clearly defined and robust investment process

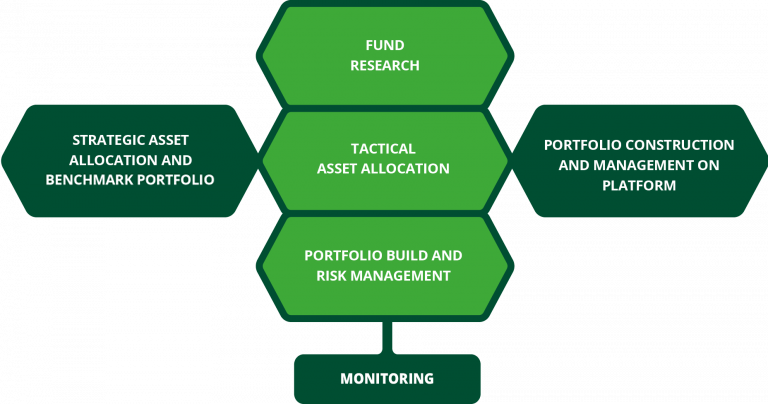

Our investment team follows a clearly defined and robust investment process that draws on its experience and expertise. Each investment decision is well-considered, leading to portfolios that contain a suitable blend of global assets, regions and strategies to help meet investors’ needs.

We are unconstrained investment managers, meaning that we are not limited by a particular style or provider when selecting investments. Our investment process identifies any opportunity based on the benefits it presents – we then select an investment that most closely matches it.

Our investment philosophy and process is founded on a principle of portfolio stewardship. Stewardship, to us, means keeping portfolios aligned to the desired long-term investment objectives in the face of a constantly changing world. As such, we offer clients a broad range of investment risk exposure and investment strategies, always guarding against the unintended risks that can arise when making such investments.

Our aim is to provide the widest choice of portfolio styles and risk profiles, so that clients and advisers can decide how best their individual needs and longer-term investment goals can be met. We are agnostic on the choice of platform or investment style, whether that be opting for portfolios with active or passive funds, an income focus, or any ethical restrictions.

We offer two asset allocation choices: Classic and Global

Tatton Classic

The Tatton Classic allocation invests a greater proportion of equities to the UK creating portfolios allocated towards more familiar companies and sectors rather than a fully global exposure.

Tatton Global

The Tatton Global allocation provides a broader exposure to the global economy and is not focused on one geographic region or country. This allocation provides a more cosmopolitan allocation to benefit from the growth potential of the global economy as a whole.