A bumpy upwards path ahead

Posted 12 January 2024

Every hangover comes to an end and the equity market’s malaise lasted no longer than usual. After refusing to get out of bed last week, this week the markets decided to go to work. Europe recovered last week’s losses while US indices moved ahead smartly. However, softness in global banks hit the FTSE 100 as did a continued pullback in energy and materials sectors (that is, the more commodity-related companies).

The standout performer was Japan, where investors appear convinced that a corner has been turned. As widely reported in the financial media, the Nikkei 225 reached – and exceeded – the high of 1990 even if its actual all-time high of 38,916 was reached at close on 29 December 1989, the height of the infamous Japanese stock market bubble. That’s another 10% away from today’s level, but investors have got the bit between their teeth and so now such a move looks entirely attainable.

Interestingly, it appears to be driven by domestic as well as international investors in this phase. The good performance of previous months was accompanied by small bouts of yen appreciation, but January’s move has occurred while the yen has eased against the US dollar. Japanese investors have not been happy supporters of their own domestic companies in recent years (with good reason) but they may be changing their view. A bout of self-confidence may have positive impacts for Japanese stocks.

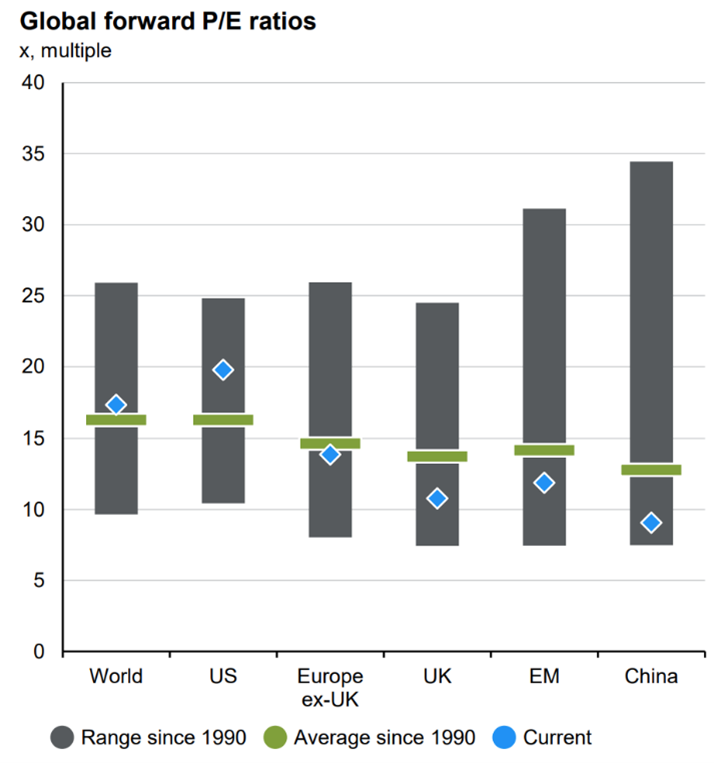

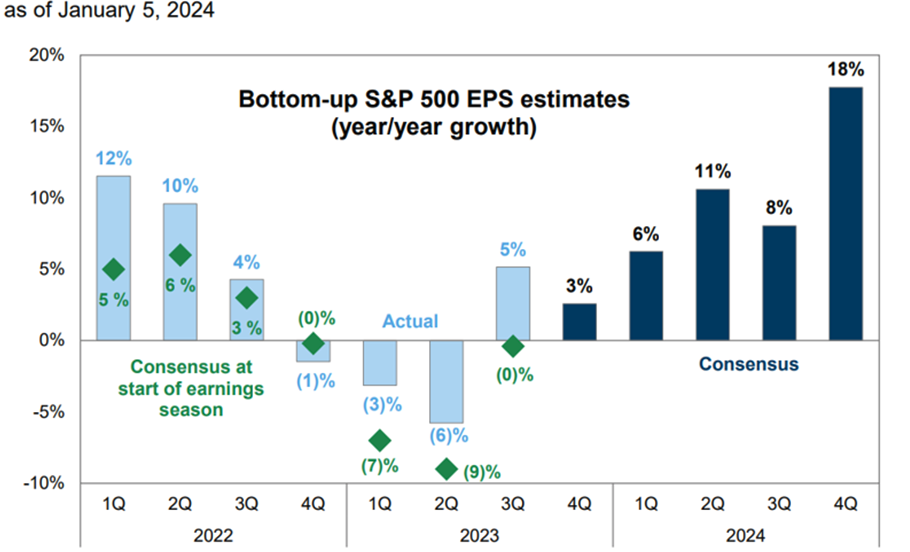

The December rally in equities and bonds was, from our observations, driven by the remarkable shift in investor sentiment – we reported at the time – which unleashed flows of idle liquidity more than any fundamental change in the macro-economic landscape (yet). And of course, December is a quiet month for earnings reports so there was little change in underlying earnings. Across the world, valuations (such as price-to-earnings ratios, even when using analyst expectations which include next year’s anticipated growth) are slightly expensive within the historical ranges, and they are expensive in the US (note the blue diamond above the green bar for World and US).

Source: JPM IM, Guide to markets, 31 Dec 2023.

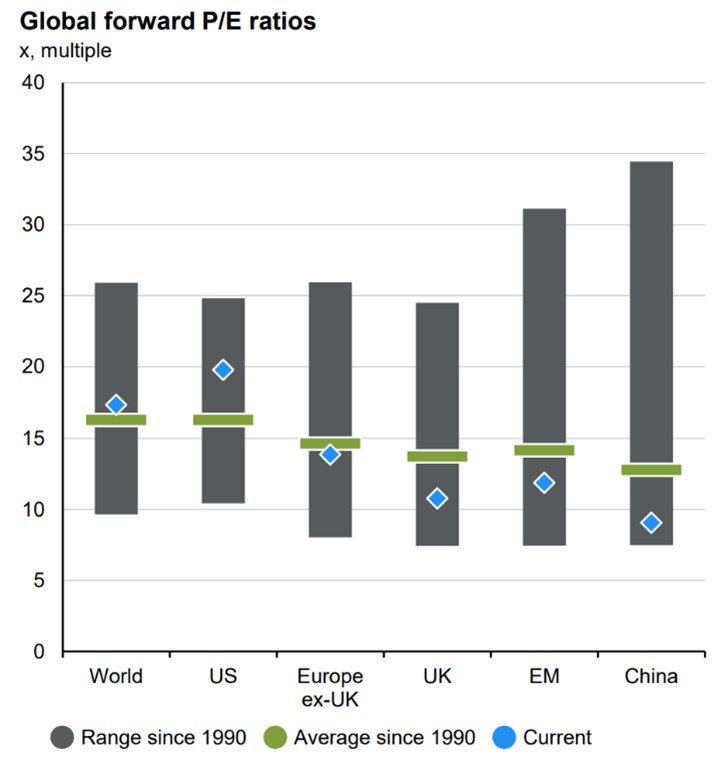

Against this backdrop, as we enter earnings season, companies will need to report lots of surprisingly positive Q4 earnings and solid outlooks in order for equity prices to rise substantially from here. Yet, that’s perfectly possible. Investors know that analysts can easily prove not to be optimistic enough.

Source: Goldman Sachs Global Investment Research

The biggest issue is that company share prices do not go up just because the current share owners want it. Even with good news, there has to be somebody else to bid to buy the shares. A company may reveal higher earnings than expected, but the prospective new owner has to be convinced that either that against these news the current valuation is now cheap or that the positive earnings indicate a faster growth in future earnings.

When positioning becomes extended, it can mean there will be less additional interest and so fewer prospective owners willing to bid prices higher. On a historic comparison basis, this seems to be the case with Goldman Sachs noting that US equity futures’ outstanding investor exposure now stands near record highs of almost $160 billion and that momentum funds are positioned towards 2023 highs. Furthermore, their GS Sentiment Indicator, which tracks position across more than 80% of the US equity market owned by institutional, retail and foreign investors, is likewise indicating high levels of investment noting at very extended levels versus its long running average (in math terms by +1.2 standard deviations). JP Morgan (JPM) noted that many risk appetite measures are back at bullish late-July levels. Bank of America’s Bull & Bear Indicator ticked up to 5.3 from 5.0, the highest since November 2021.

Meanwhile, although issuance of new corporate bonds slowed a little last week, corporate bonds as an asset class overall appeared to get a big infusion of investor capital. On the back of the strong demand, alongside equities, corporate bond yields fell somewhat, compressing spreads (the premium corporate borrowers have to offer above the government) in the US corporate market to levels which have marked a low over the past 25 years. One can conclude from this that fears about a near-term recession have not just ebbed, they have effectively disappeared.

Against this backdrop of positivity, the risk for asset prices is unlikely to be about current earnings or their future growth. Indeed, valuations in equities and spreads in bonds tend to be quite stable over any medium-term period. However, in recent times, equities and corporate bonds have performed less well when government bond yields have risen – and this is where the risk lies for the coming weeks.

As laid out at the beginning, the last quarter’s fall in government bond yields was largely the driver of valuation rises, but now yields appear to have bottomed. The inflation picture has stopped improving for now, with this week’s data from the US and the Eurozone being somewhat higher than anticipated. We cover some aspects of the story in an article below.

Geopolitical risks also continue to bubble. This weekend we have the Taiwanese elections and the incumbent governing Democratic Progressive Party – with William Lai (Lai Ching-te) as their candidate for Prime Minister – is thought to be the most likely winner. The FT reported that “Joe Biden plans to send a high-level delegation of former top officials to Taipei after the election in Taiwan on Saturday, a move that could complicate efforts by the US and China to stabilise their strained relationship”. We don’t think it is in anybody’s near-term interest to provoke action, but next week may see rather unsubtle posturing, which might present some risks.

China’s markets are most at risk due to the poor domestic investor sentiment there and they have as a result already been poor performers. Recent news flow has made little impact on domestic equity markets, so we don’t view predicting any link between event and share price outcome as a worthwhile activity. However, at least one large investor introduced a note of positivity, putting on a very large call option trade this week. This gives them substantial medium-term exposure to potential China share price rises. That’s an interesting move, given the proximity to the election.

The next (scheduled) globally important election will be the biggest ever seen. In June, India goes to the polls to elect its members of parliament and Prime Minister. We have dedicated a separate article this week to write about Modi’s second term and some implications for the further modernisation upside that investors are currently contemplating.

The last few months tell us of rising investor confidence. Household/consumer and business confidence is showing early signs of turning upwards, and this positive combination augurs well for risk assets. The key question though, is whether positive growth will be gentle enough to keep prices stable and allow central banks to cut interest rates before the summer as markets have thus far anticipated. The next round of central bank meetings begins with the European Central Bank on Thursday 25 January, with the Fed and Bank of England meetings scheduled for the following week. Given how much market fortunes have been tied to interest rate and yield levels over the past two years, yet again it is the central banks, and not so much the underlying economy, that will determine the direction of market travel over the coming quarter.

Central bank watchers will be in heavy demand over the next two weeks.