Inflation, a common side effect of growth

Posted 26 April 2024

Intraday equity market volatility is back, as this roller coaster week showed. Still, we yet again seem to be ending flattish after a busy end to the week.

UK markets were strong, helped by the bid for Anglo-American from BHP. Anglo American’s share price rose to match the premium offered by BHP. Meanwhile, China is also managing to rise and, in Sterling-based terms, is now 15% above the lows of late January. The Hang Seng is even perkier, up 20%. The Japanese stock market has had a less happy time of late, falling over 7% from its peak on 22nd March, although it has still risen 1.5% since late January.

Part of this has been the different performance in their respective currencies. China’s renminbi remains only slightly weak but the yen has moved to the lows of 1990. This week, the Bank of Japan made no change to policy, ignoring the calls for some sort of intervention to halt the yen’s fall. The US dollar rose slightly against most currencies as well.

This week was much calmer in geopolitical terms, fewer high-profile tensions between Iran and Israel, especially after the passing of the Ukraine/Israel/Taiwan aid package by US congress. That helped risk assets to find buyers and equity markets generally stabilised. However, the concerns are still strong, now mostly centred around rising bond yields.

The US 10-year treasury bond yield, regarded as the global bond yield yardstick, had moved down below 4.6% briefly but ends the week a little higher at 4.65%. Other bond markets have also seen rises, partly spurred by weaker currencies but also by fears about global inflation.

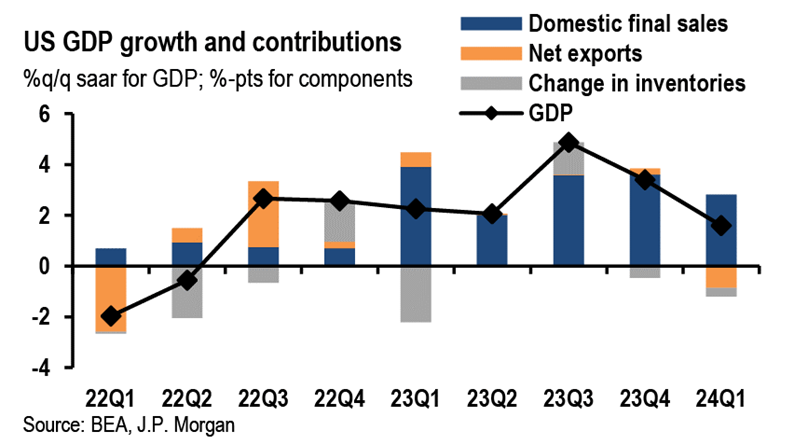

The week’s main economic event was in the US, with the release of the GDP data for the first quarter. According to the preliminary data, US overall real growth has slowed to an annualised rate of +1.6% for the quarter, undershooting economist expectations of above 2%.

The headline real growth number rather disguises the important point that US consumers and businesses have continued to increase their spending at a fair tack. Domestic final demand was buoyant and remains above a +3% annualised rate.

Instead of producing the goods for sale, some of the sales were filled out of inventories. Also, for the first time in two years, the US economy imported more from the rest of the world than it earned in exports. When final sales (driven by consumption) are strong, it usually drags in more imports than exports, but this had not been the case for two years. As the chart from JP Morgan Research shows below, net exports have been a positive, even when final sales growth moved into a very positive state. Now, it has moved into a more normal position but this only underlines the strength and health of final demand.

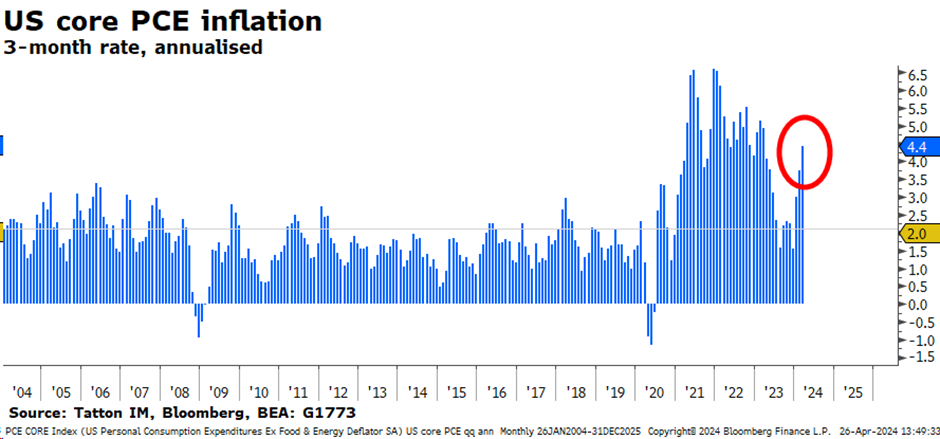

This means, however, that US consumption is strong enough to create a problem for the US central bank, the Fed. Inflation in the US has stopped falling, as evidenced by today’s (Friday 26th) release of the personal income and spending data. Core prices in this measure were the same as last month on a year-on-year basis. The inflation measure known as the core personal consumption expenditure deflator is +2.8% year-on-year (one of the key inflation measures the Fed considers) but this represents a rate well above 4% over the past three months, heading back into deeply uncomfortable territory for the Fed, and way above their 2% target (see chart below).

This also presents a problem for the rest of the world. JP Morgan Research reported on their aggregation of the March CPI data across the world, saying that the annualised three-month growth rate for global headline inflation and core inflation picked up to 3.7%.

This is the third consecutive firm monthly gain, with continued strength in services prices (+0.45%m/m). But there was some good news as well, with core goods prices showing a small decline.

However, the fact that prices have started move back up faster, even where growth has been less strong, creates difficulties for the recently dovish central banks such as the ECB and the Bank of England. The ECB is likely to stick to the plan of cutting rates in just over two months’ time, but the members are making hawkish noises much like those on the Federal Open Markets Committee. The implication is that there will be a move in June, but then a delay before the next one.

This would make the global rate cutting cycle very different to others. Usually rates move quite swiftly downwards, typically about 2-3% over the year before bottoming. At the moment, the extent of cuts is expected to be about 1% for a full year in Europe. In the US, rates are expected to go no lower than 4.5%, less than 1% from today’s levels.

Still, the major central banks have not returned to actively trying to discourage growth by raising rates (apart from the BoJ, and even they are being dovish). We have not got to the point where any policy maker is openly talking of raising rates. For that, we would need to see signs of rising prices coming through the supply chains.

The bid by mining giant BHP for Anglo-American is related to that inflation story. Copper prices have been moving up very sharply and we write below on the story. One aspect behind the rise is to do with AI. Artificial intelligence has been a market theme since ChatGPT burst into the mainstream nearly 18 months ago and has spurred huge gains in stocks associated with it.

This week, we saw Microsoft and Google (aka Alphabet, although almost everybody has given up calling them by that name) bring good profit news, ostensibly because of AI impacts. Google also announced a $70bn share buyback program (we write about the spread of those programs as well, below). However, Meta (Facebook) took a share price hit because of its ambitious AI-related investment plans. They are likely to be hugely expensive.

Mark Zuckerberg spoke in an interview saying the costs are high because of supply chain bottlenecks. The issue is not chips, as those supply chains are largely sorted out. He was talking about building power plants to supply a gigawatt. That’s about the size of an average US nuclear power plant or 5 gas-powered plants. The amount of electric transport (copper) cabling is mind-boggling.

Still, pricing power is always good news for some stocks, such as Anglo American. And rate risks to markets are being offset by continued positivity coming from the US earnings season, which is in full flood, with few nasty surprises so far. The next big thing comes next week, with the Federal Open Markets Committee meeting on Wednesday. There’s a miniscule chance of rate moves, or at least some more guidance on when to expect them and under what circumstances, so all ears will be on Jerome Powell’s press conference. The rest of us can brace for another volatile week in markets.

Strangely, many of the conditions now causing volatility were present in the first quarter. Back then, yields were rising and markets were expecting a global inflation rebound, but investors took it in their stride. Now that inflation has actually returned, markets realise they might have been overexcited, and price rises might be more serious and long-lasting than assumed. This means growth expectations will take longer to turn into actual profits, while the other headwinds that existed before are still annoyingly persistent (Geopolitics, financial pressures from elevated rates and yields, China’s demand deterioration).

That being said, the medium-term case for global growth getting back on track – the ‘back to mid-cycle’ outlook we wrote about before – is still unscathed. Constructive corporate earnings reports now being released show as much.

It may just be that markets got a little bit ahead of themselves – as they do – and are now experiencing a consolidation phase. It might look bad now, but it should recalibrate expectations to more realistic timeframes. Keep calm and carry on.