Tatton Teaser

Posted 6 March 2024

Is pharma the next AI?

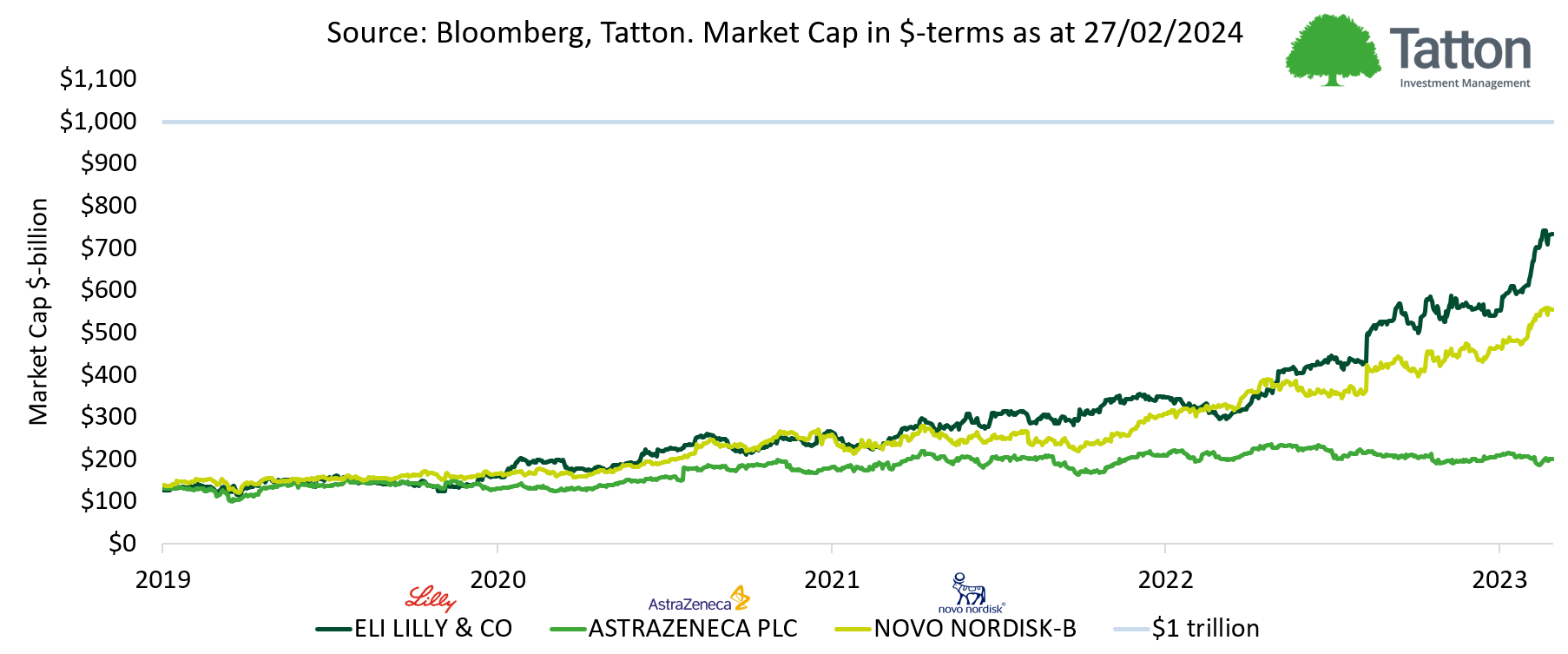

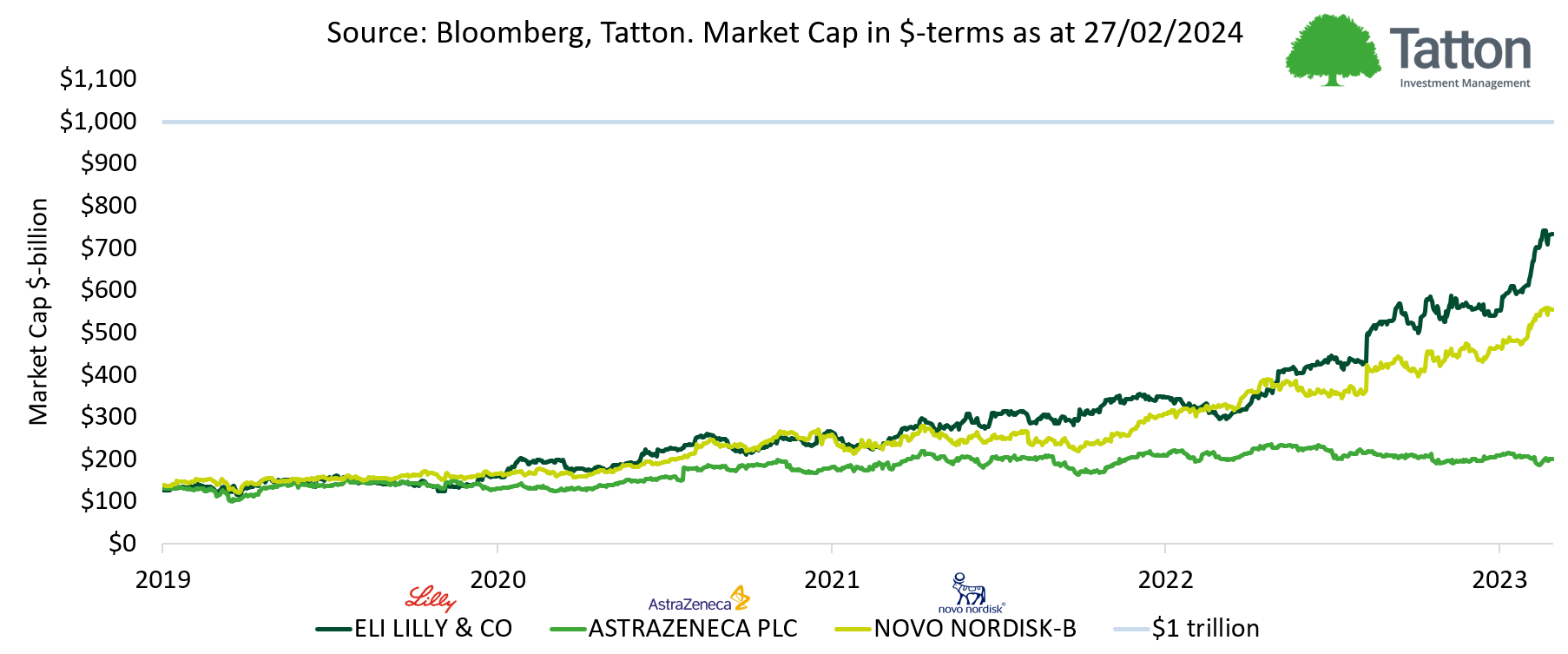

The stunning share price jumps of companies like Nvidia has led to questions of what’s next for AI investment. This is not a stock recommendation of any kind, but on the current path Eli Lilly could possibly be on track to become the first trillion-dollar pharmaceuticals stock.

Eli Lilly isn’t a tech stock, or an AI developer, but it does use AI and Big Data to develop medicine. AI allows can speed up the creation of drugs and reduce the time it takes to get new treatments to market. Creating medicines is high risk, expensive, and has a lengthy approval process. The University of Chicago estimates that 90% of all new drugs that enter clinical trials fail to ever make it to market.

Investors have taken note of the innovation applied to develop Elly Lilly’s newly approved weight loss obesity drug GLP-1. With insulin production now federally controlled in the US pharma responded by seeking margin in obesity treatment, instead of managing diabetes – and its working for Ely Lilly. Goldman Sachs estimates that if 60 million people in the US used GLP-1 medicines, GDP or economic output could increase by as much as 1% thanks to improved health outcomes. Further out, AI performing the repetitive trial and error thinking can help with exciting developments such as Tufts University’s Dr Michael Levin’s work that ultimately aims to regenerate vital organs or lost limbs – something completely revolutionary for human health.

The chart shows Eli Lilly’s market capitalisation from January 2020, compared to the UK’s largest stock, AstraZeneca and Denmark’s Novo Nordisk. The blue line shows the $1 trillion watermark. Of course, we cannot know if Eli Lilly will reach $1 trillion in market cap, but it shows that applying tech innovation does not need a tech company. AI is not sector specific but does give companies the ability to transform, regardless of what they actually ‘do’.

Thank you Samuel Leary for the analysis.