Tatton Teaser

Posted 17 April 2024

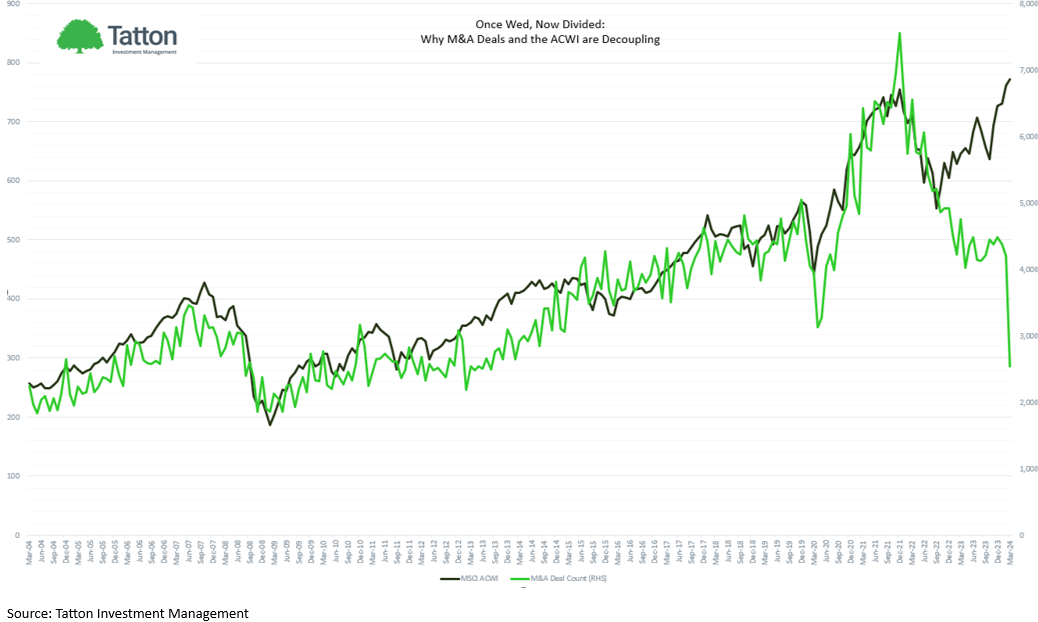

Once Wed, Now Divided: Why M&A Deals and the ACWI Are Decoupling

The relationship between the MSCI All Country World Index (ACWI) and Merger and Acquisition (M&A) activity is well known. A rising ACWI, reflecting a bullish stock market, often coincides with a surge in M&A deals To some surprise, however, over the last two years this correlation has broken.

Historically, a strong ACWI signalled a buoyant market environment, which makes M&A deals more attractive. With inflated stock prices, companies could use their shares as currency for acquisitions – a more enticing option than cash. Further, low-interest rates meant cheap borrowing for acquisitions, further fuelling dealmaking activity.

But, over the past two years, despite a healthy ACWI, M&A activity hasn’t followed suit.

Why? Interest rates, increased regulatory scrutiny to ensure competition, ‘true valuations’ and the geopolitical climate all combine to slow deal flow. The breakdown in the M&A-ACWI correlation highlights the evolving dynamics of the financial landscape. While the stock market may still be a good indicator of overall economic health, it no longer provides a foolproof signal for M&A activity.

This decoupling presents both challenges and opportunities. For companies, it may necessitate a more creative approach to deal structuring and demonstrating true value. For investors, it underscores the importance of in-depth research beyond just the headline index performance and a focus on the underlying fundamentals of potential acquisition targets. The future relationship between the ACWI and M&A activity remains to be seen, but one thing is certain: in an era of higher rates, scrutiny and security, the old rules no longer apply.

Thank you Anthony Graham for the analysis.