Tatton Teaser

Posted 29 January 2024

What hasn’t already been said about the M7 or Magnificent-7 that would be new news? Apple, Amazon, Nvidia, Tesla, Microsoft, Meta & Google saw a collective total return jump of USD 107% in 2023 according to Bloomberg. The prospects of faster profits growth from optimism around Artificial Intelligence appeared to boost investor interest and a lower discount rate, from falling bond yields, towards the end of last year likely helped too.

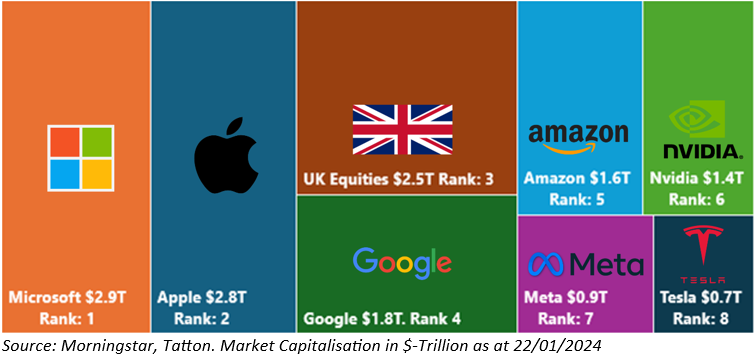

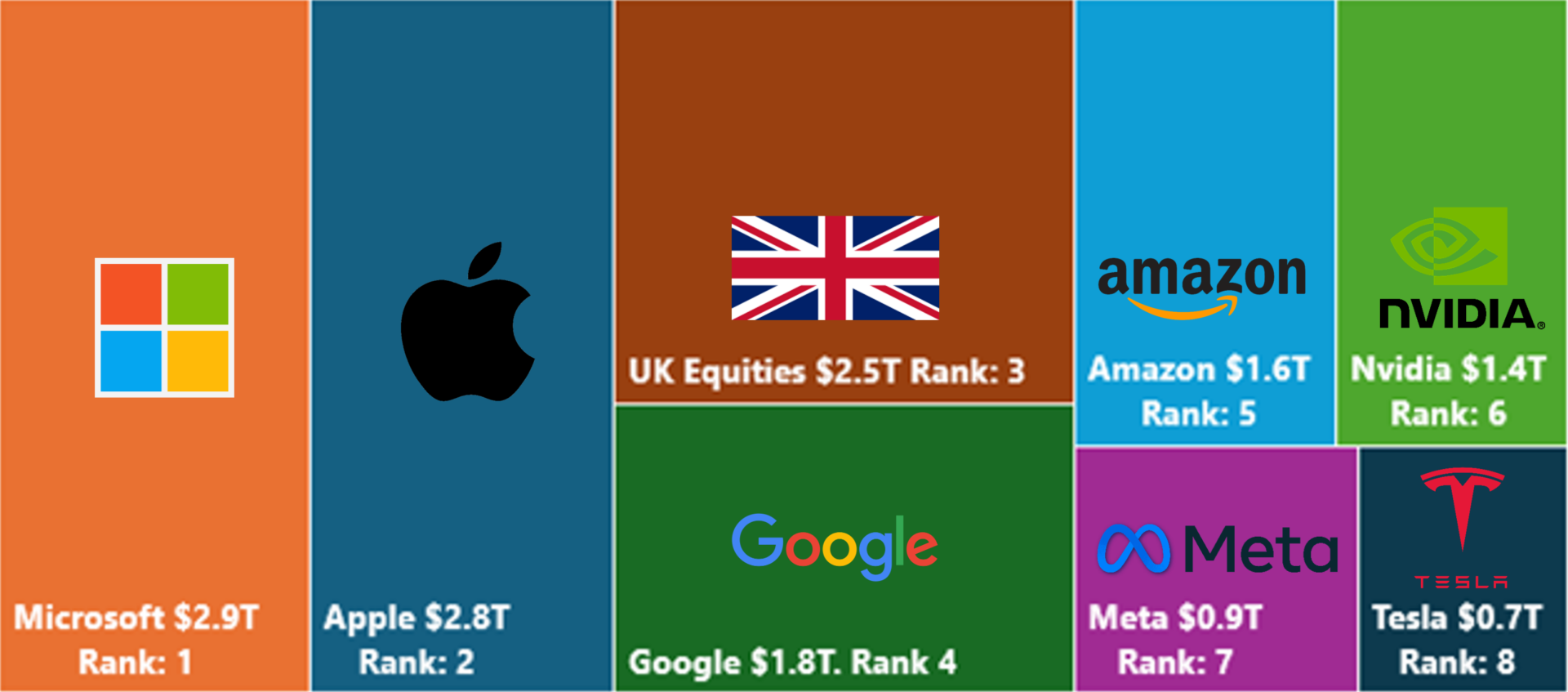

Chip maker Nvidia powered to an almost 240% gain last year, leading to large jumps in each businesses market capitalisation or value. It starts to become easier to see why UK equities would only represent around three to four percent of global indices given the sheer size of the Mag-7 valued at $12.5 trillion as of 22/1/2024. Ranked first, Microsoft currently stands as the largest of the M7, at $2.9 trillion which is just head of Apple at $2.8 trillion. In comparison, the UK is in bronze medal position, comfortably ahead of fourth placed Google. The total size of large cap equities in the UK is $2.5 trillion or about 86% of Microsoft and 88% of Apple. The UK has had much to deal with in recent years from Brexit to multiple prime ministers, oh and a mini bond-market crisis. Global investor interest appears to have waned over the years, but could a potential new UK government later this year change the country’s fortunes?

Thank you Sam Leary for the note.