Tatton Teaser

Posted 15 February 2024

Where next for lending standards?

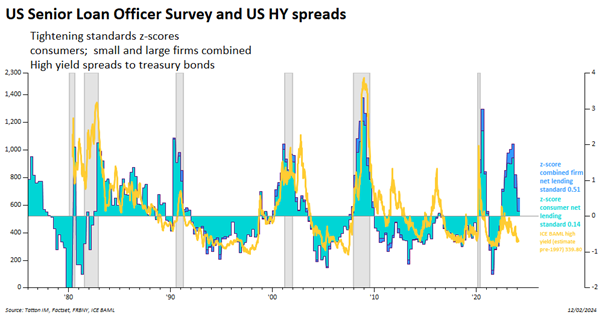

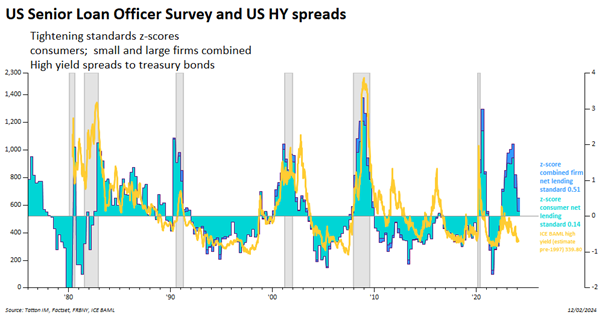

The US Senior Loan Officer Opinion Survey (SLOOS) is a quarterly survey conducted by the Federal Reserve Board on bank credit availability and loan demand. It shows that lending remains tight, but fewer banks were tightening their standards (the blue area in the chart shows firm lending standards; the turquoise is consumer lending standards). Although loan demand remained subdued, standards improved.

Not back to the long-term average levels for lending standards, but the trend is positive. Interestingly, whilst banks were getting worried last year, high yield spreads were low relative to credit and wider economic conditions, so bond markets gave a good steer on the direction of the economy.

There remain plenty of risks to US credit lending standards. Auto loan balances and credit card balances amount to $1.61tn and $1.13tn, respectively. Commercial real estate is precarious – as shown by recent events concerning US regional banks, in particular, New York Community Bancorp. But. there are positives, Banks have money they are willing to lend, money supply is improving and inflation is reducing at a faster rate than wages – real disposable incomes are rising.

Is the key US story for 2024 a return to credit demand? Not good news for longer-term rates, but if the tighter lending conditions ease, this may be good news for the US economy.

Thank you Dane Harrison for the analysis.