Tatton Teaser

Posted 23 February 2024

An interesting report from the Resolution Foundation examining intergenerational wealth and income trends reveals interesting trends about the UK labour market and intergenerational equality.

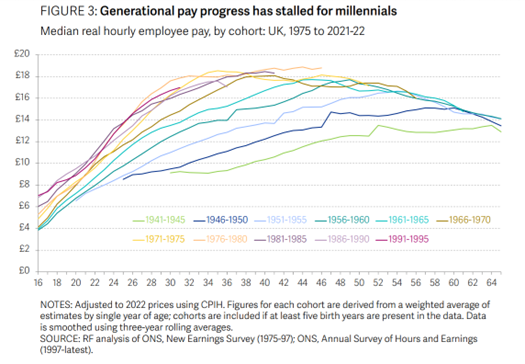

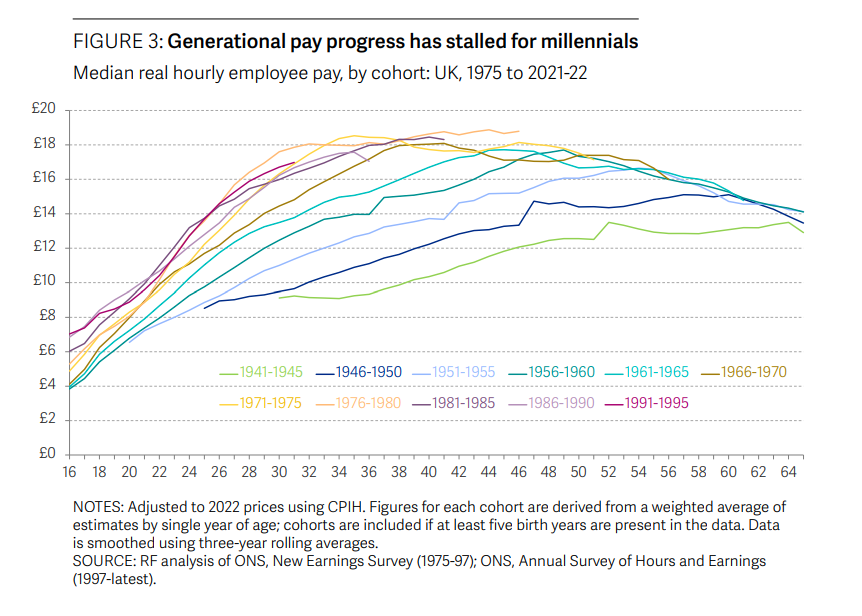

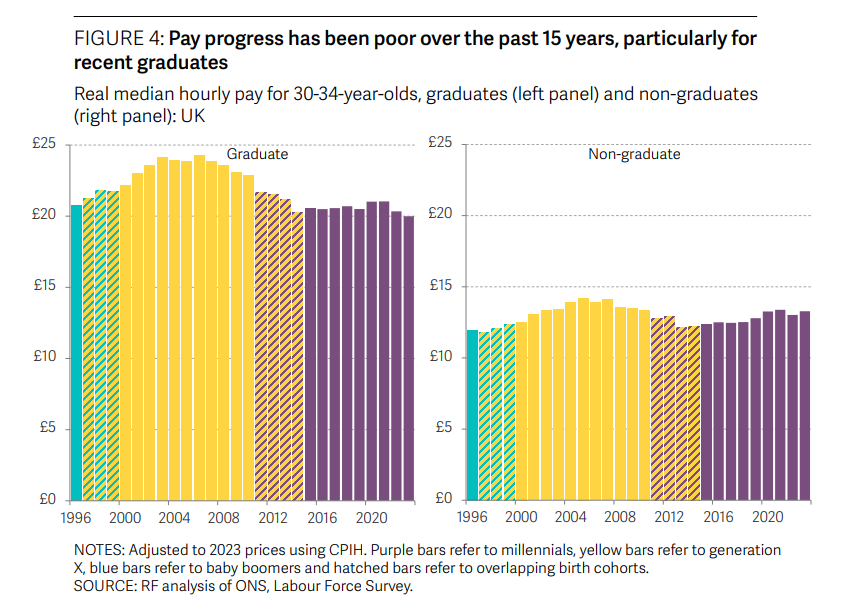

In inflation adjusted terms, UK workforce pay has stopped improving. A trend from 1941 to almost 1980 has halted, if not reversed at some points in the life cycle of a working adult. This is perhaps not a surprise to all, but something I found interesting was the distribution of this – the declines seemingly mostly attributable to graduate employment outcomes.

The study goes on to point out two things – the UK has very high numbers of graduates (about 60% of 25-34 year olds), and very limited markets to deploy them in. with only London achieving over 75% in “graduate occupations” for graduates living in the city.

The report describes far more than just this – however the implied mismatch in the UK labour market seems to be leading to worse outcomes for many. Perhaps a Northern Powerhouse, prioritising non-university based tertiary education, or a combination of strategies could be deployed, however for now, it seems progress has stalled for the UKs best educated workers.

Thank you James Saunders for the analysis.