Tatton Teaser

Posted 28 February 2024

Just when you thought you’d seen it all, reality often proves you wrong. By now, most will have seen the headlines and digested Nvidia’s stunning results, with profits in its data centre unit [which includes its AI chips to you and me] up a whopping 217% for the year. Investors rewarded the shares with a 16% gain the day after it reported.

Despite this jump, and relative to peers, Nvidia still unbelievably trades at slight discount to its peers. According to Bloomberg data, as of 22/2/2024, Nvidia trades on 28x its estimated next twelve month or NTM earnings, while chip rival AMD is on 34x NTM earnings and Microsoft at 31x. Meanwhile the Nasdaq 100 Index trades at 27x and the S&P 500 at a 19x multiple.

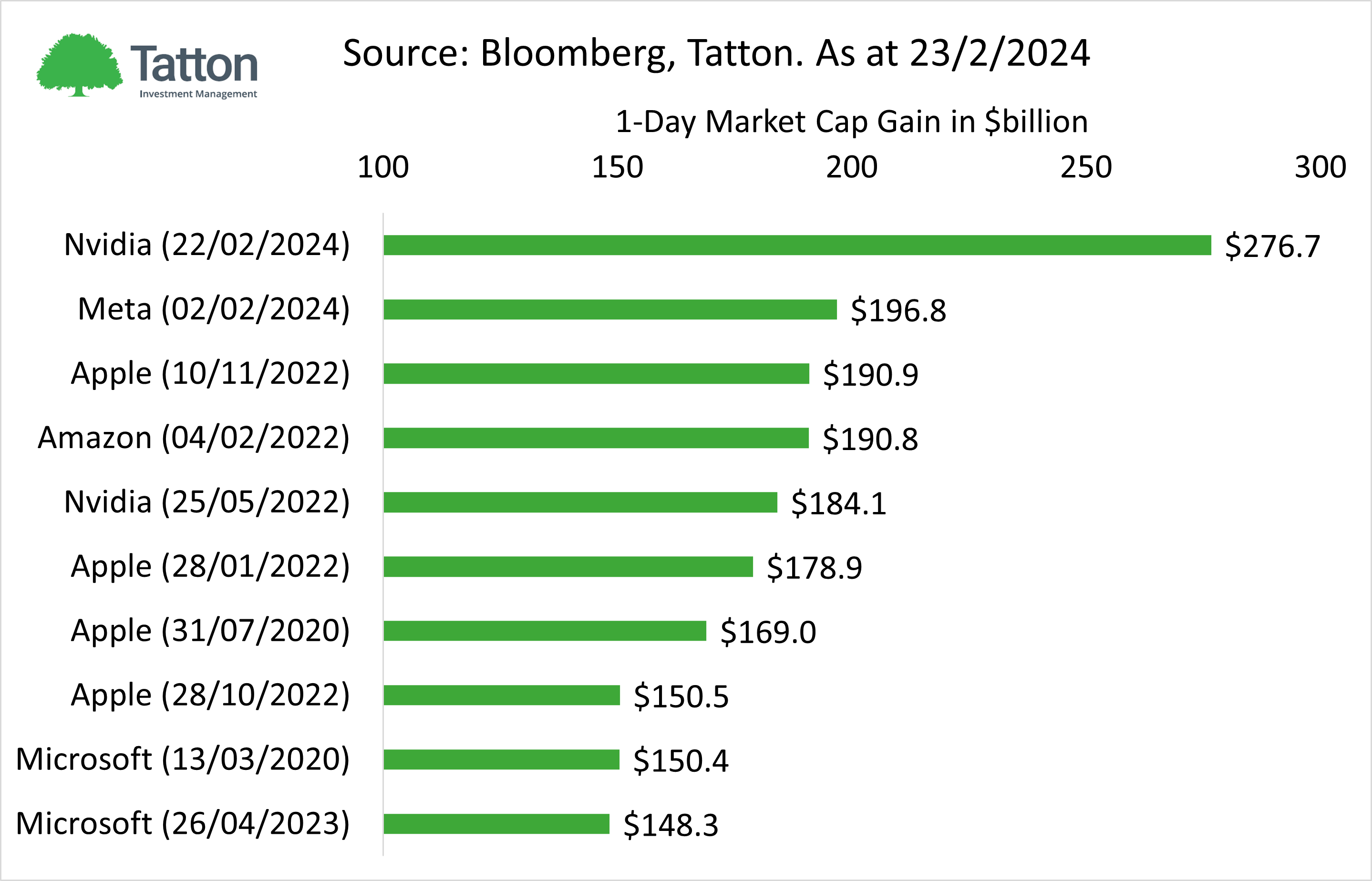

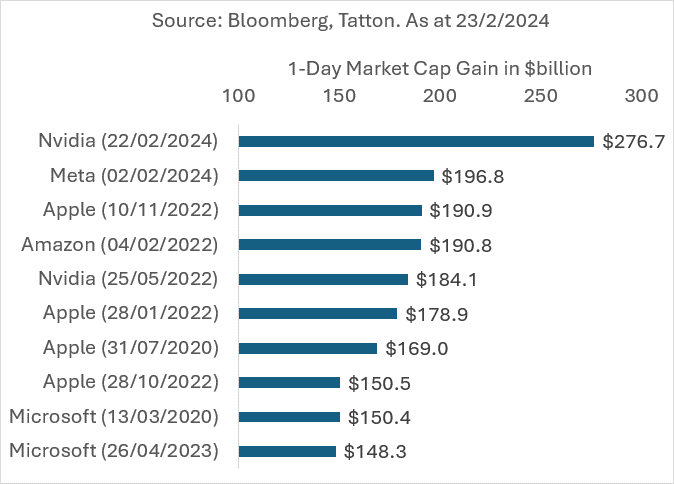

Also remarkable, was the magnitude of its jump in its market value in absolute terms as the attached chart shows. Curious that all these jumps occurred either in or post-covid times. Nvidia’s market cap added over $270 billion from its close price on 21/2/2024, catapulting the firm straight to the top of the 1-day biggest gains in history. To put this gain in context, it’s as big as the bottom thirty one largest stocks in the S&P 500 Index, including familiar names like toymaker Hasbro, film studio Paramount and appliance maker Whirlpool – all combined. A $270 billion plus gain is a bit more than an entire Netflix, a bit less than a Coca-Cola, or about two of Goldman Sachs or nearly half of a JP Morgan. In a UK context, Nvidia’s market cap gain is equal to just over three entire FTSE AIM Indices when measured in USD-terms.

Going by the investor reaction to Nvidia’s results one could be forgiven for thinking that maybe, just maybe, this AI thing might have some legs after all.

Thank you Samuel Leary for the analysis.