Transcontinental growth divergence

Posted 25 August 2023

We don’t seem to be able to get away from writing about how bond yields have been driving equity markets due to their influence on underlying valuation dynamics. We wrote about it last week, on many occasions over the past two years, and we have to say that this week is no different.

However, whereas we have previously generally commented on yields rising, yields will probably end lower this week. Compared to last Friday, currently the US 10-year yield is lower by -0.05%, German 10-year -0.10% and UK 10-year -0.25%.

Last week, the upswing in yields came on an improving US growth outlook. This week, the catalyst for the yield drop was unexpectedly weak ‘flash’ Purchasing Manager Indices (PMI) survey results (collected by S&P Global). The worst of these forward-looking measures of business confidence were focused on services in Europe and the UK, and we look at these in more detail in the first of our articles. European data has been poor for well over a year now, but there had been hope that thus-far resilient services would underpin weak manufacturing, but now it may be travelling the other way.

In the US, services at 51.0, were also weaker than expected but still managed to remain above the neutral 50 level. Indeed, recent US data may have felt mixed but the combination indicators suggest growth is solid to strong.

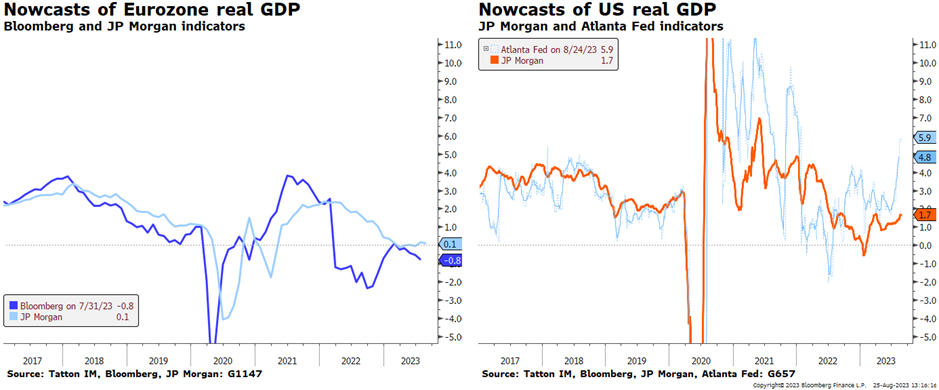

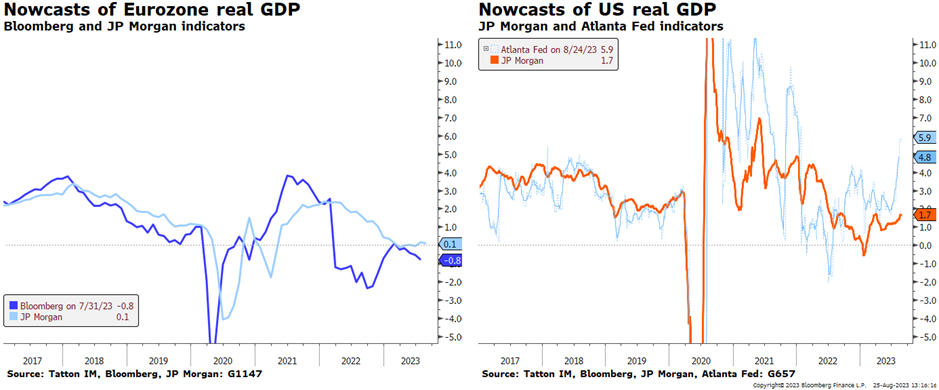

The charts above show current estimates of Eurozone (left) and US growth (right), with the Atlanta Federal Reserve’s US indicator (light blue) pointing sharply upwards. We suspect this may come down quite sharply again soon, given its increased post-pandemic volatility record, but visually the indicators suggest there is little doubt about the different trajectories of the two transatlantic powerhouse regions.

Some of those differences can be traced back to energy prices still remaining more of a burden for Europe’s manufacturers, especially for natural gas and electricity. Sentiment improved through the first half of this year as gas prices declined but the recent uptick in both oil and gas prices is a blow. Meanwhile, the auto sector (much more important in Europe than the US) is also feeling a sharp pinch, with Chinese electric vehicle manufacturers gaining substantial market share at home and getting an easier ride in Europe than in the US.

Unusually, Germany is the focal point of European weakness. This is all too logical after the double whammy of losing both their access to cheap Russian energy and increased reliance on exports of cars and machines to China. Olaf Schulz’s rating as Chancellor has taken a sharp swing down in recent weeks, while talk is growing of increasing the fiscal deficit. However, expand deficits will be a difficult and long-winded process after the combined hits of the pandemic and Ukraine-Russia war.

Given that the European Central Bank (ECB) has moved rates up from below 0% to 3.75%, it is much more likely that pressure will grow on the Governing Council to cut rates at the first sign of an alleviation in inflation pressure. The problem for them is that real bond yields (after subtracting inflation) may finally be positive (the 10-year German government inflation-linked bond has a real yield of 0.18%) but nowhere near as positive as in the US or even the UK, where they are nearing 2%. We know from the past that the ECB will not flinch from acting if a crisis ensues, but it is less likely to act without a clear crisis and given its balance sheet remains inflated due to quantitative easing (QE) its only policy alternative may be to cut rates this time around.

It may also be hamstrung by inflation pressure re-emerging which could happen if the euro were to come under more pressure and given the widening gap in real yields to the US, euro weakness is a distinct possibility.

On the flipside, Europe’s economic weakness has had surprisingly little impact on either equity or credit markets. Commentators have pointed to the relatively more benign government bond market which helps forward valuations of profits. With few new high-yield bonds available to buy in either Europe or the US markets, demand has to necessarily focus on what is already being traded – and demand keeps yields down. As a result, given that there aren’t any new issuances and none is likely for another month, Bloomberg has decided to cease its daily report on new high yield bonds.

However, a thin market can be deceptive and potentially volatile. A lack of supply can keep prices high, but it can also make the impact of bad news greater and, of course, a weak economy is generally not great for prospective revenues and profits.

It is quite possible that investors believe the current pessimism over pan-European growth will pass much like it did last year in the US. Turning to Europe’s biggest swing in demand factor, China, the equity market there remained weak this week despite rumoured “support” buying from government-influenced investors. However, expectations are still strong that Beijing is piecing together a wider fiscal package. That would certainly improve sentiment for European exporters.

As we write, the central bankers have begun their weekend in Wyoming’s Jackson Hole. The strap-line for this get-together is “Structural Shifts in the Global Economy” so there will be a concerted effort not to talk about near-term policy. Nevertheless, we hope we will get more clarity on how central banks view the impact of their still-huge balance sheets. Clearly, with the ECB facing another slowdown, it would be interesting to know how this affects their viewpoint on current policy alternatives.

Economic divergence between regions is not unusual, and Europe is prone to having bouts such as the euro crisis. We don’t think something as serious as that is about to happen, but there is little doubting that Europe has less resilience than the US currently, due to the conspicuous lack of growth momentum. This probably means pressure on the US dollar to strengthen at least for a time and, historically, that has coincided with increased global risks. In particular, it has a tendency to put pressure on credit spreads as a stronger dollar leads to shortages of dollar liquidity away from US shores. That, in turn, can create a less positive outlook for global risk assets – corporate bonds and equities.

However, if no actual credit event arrives, a less positive environment may just mean increasing market volatility but little direction on average. August has already provided plenty of that and as we head towards its close, is going nowhere more rapidly.