As recession talk subsides, inflation pressures increase

Posted 27 May 2022

As we head towards the final days of May, markets appear to be calming down. Stock markets are heading for a positive week and credit spreads – the proverbial canary in the coalmine ahead of recessions – have come down sharply. So, are the concerns that have overshadowed capital markets in recent months starting to look less worrisome?

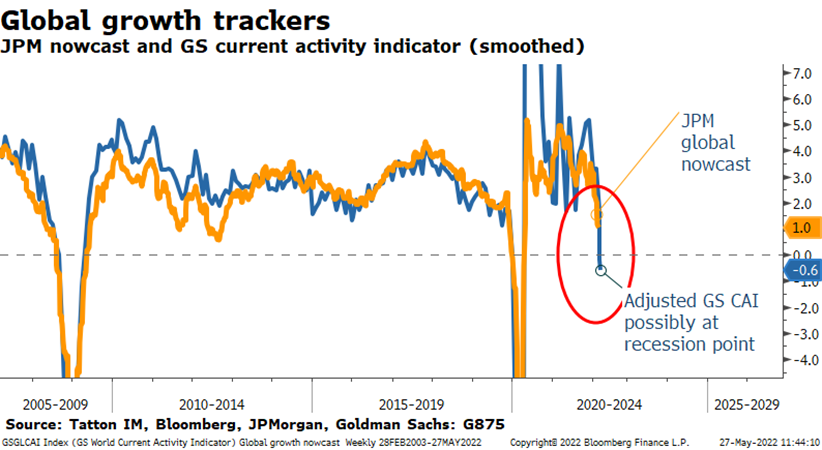

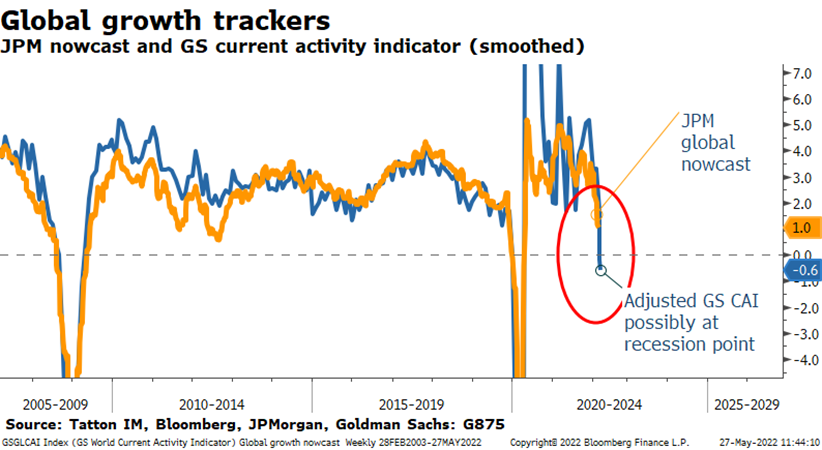

For most of May and April, declining global growth prospects have been worrying investors. There are various trackers of growth that we follow, and the graph below shows the GDP real growth ‘Nowcast’ from JP Morgan, and our adjusted version of Goldman Sachs’ current activity indicator. The Goldman Sachs indicator tends to lead the JP Morgan Nowcast by a month or two.

Worryingly, both have been declining sharply and the unsmoothed Goldman Sachs indicator suggests that growth may have dipped below zero in May.

As we have outlined here before, investors have been mindful of three specific headwinds this year: (1) tightening central bank policy driving up yields (and thereby challenging valuation levels); (2) a prolonged cost-of-living crisis and persistently higher energy costs eating into consumer spending (thereby driving down corporate profitability); and (3) China’s economy slowing as it attempts to deflate its property bubble while still grappling with COVID and widespread lockdowns.

So, what changed sentiment this week? On the central bank tightening side, investors may have been relieved by inferences from the most recent meeting of the Fed’s (US Federal Reserve) Open Market Committee. Due to the US dollar’s status as the predominant global currency, the Fed is de facto the world’s central bank, even if it doesn’t accept this title and doesn’t factor this into its policy objectives.

However, financial stability in the US is in the Fed’s remit, and that is inevitably affected by global markets. While the Fed remains resolute in stating the current primacy of fighting inflation, the meeting minutes raise concerns about financial stability. For those searching for signs of when and how policy could become neutral, this is good news, as “Concerns about financial stability” are seen as equivalent to bringing back the fabled “Fed Put” (i.e. supporting capital markets through looser monetary policy). This inference may be jumping the gun, though.

Despite turbulence in the credit and equity markets, bank lending remains strong. And, as we note in a separate article on labour markets this week, the total of US vacancies and existing jobs almost certainly still exceeds the current workforce. However, there are good signs that things are cooling while the real economy is far from chilly.

Jumping ahead to the third headwind, China has made a significant contribution to the sharp slowdown in global growth. Indeed, according to JP Morgan’s Nowcasts, China is currently contracting at around 10%, almost as fast as it did in the early COVID lockdown stage.

China’s apparent COVID policy success in 2020 seems to have led to complacency and perhaps even a sense of invincibility. In fact, the return of the virus has shocked the Chinese economy when it was at its most fragile. In recent weeks, we have noted sharply slowing production levels and how central authorities have been almost constantly announcing new stimulus measures. These measures appear to have been effective only in a limited sense. They’ve kept production up to some degree, but consumption has collapsed, especially in services.

China’s prime minister Li Keqiang has been much more visible recently, while president Xi has stepped out of the limelight. At an emergency meeting held on Wednesday, Li was extraordinarily frank in front of thousands of local officials, and much more direct than the official readout published by state media suggested. Li made it clear the situation was dire, and that the politburo viewed this as a failure by his audience to enact the policies which had been issued in recent weeks. According to Bloomberg, Li listed objectives for local officials to focus on this year, and stated that growth is the key to solving all problems in the country, such as creating jobs, ensuring people’s livelihood, and containing COVID.

In order to make sure the local officials comply, the central leadership State Council will send ‘inspection teams’ to 12 provinces to supervise the implementation of policies, the official Xinhua news agency posted on the government’s website. The report didn’t name the regions. Li was also clear that money was being made directly available to local governments and that employment needed to happen quickly. Perhaps most importantly, LI said that local governments should balance COVID controls and economic growth.

It’s been notable that China’s financial conditions have been easing sharply over the past two weeks. With the quite extreme governmental policy push, it is not surprising investors are sensing that China’s near-term outlook may finally be improving, and therefore the growth drag on the global economy may be diminishing.

Turning to the cost-of-living headwind from inflation, even after the reduction of wage pressures from cooling labour markets, developed world inflation expectations are still hugely influenced by energy costs. For policymakers, this is a massive policy conundrum, as well as a challenge from their voter base, and this is probably most apparent here in the UK. Here’s a précis of the challenge:

- Energy companies are reluctant to build rigs which may have a short production life because of the need to constrain carbon emissions.

- There is too much demand for energy relative to constrained supply, and energy prices rise.

- Global conflict constrains supply further.

- Oil and gas prices rise further.

- Oil rigs start to be profitable enough to warrant developing them for a short production run.

- The rise in energy price rises is unbearable for the wider public, so instead of constraining demand, we take the energy company profits and subsidise demand.

- Oil rigs are no longer profitable enough to be built for the short-term.

- Demand is not reduced as subsidies help consumers to pat.

- Energy prices go up again.

This is simplistic, of course, and the UK is not the only country feeling this pressure. Still, there is little doubt that if Europe cannot reduce its fossil fuel demand and wants to displace Russian energy from its supply, we need new sources of production. Otherwise, all we will do is create a new supply chain which channels Russian fuel through a more costly and opaque route, paying shady intermediaries to get rich.

China’s recent weakness has probably helped in lessening global inflation pressures. Industrial metals have fallen back somewhat, and it seemed energy prices might be moving the same way. However, oil prices have been heading back towards recent highs this week.

For the central banks, they need signals that overall demand has moved into line with supply before they can think their inflation fighting is done. Energy demand is a big part of that signal.

Markets have taken comfort that economies have been cooling. Should China succeed in engineering a rebound, it may mean more production capacity for finished goods, thereby reducing price pressures from last year’s supply chain issues. It may, however, mean rising energy demand and the inadvertent return of energy and resource inflation pressures on the rest of the world.

This week, markets may have glimpsed the “Goldilocks” scenario – not too hot and not too cold – but nobody will be sure until the oil smoke drifts away.