Everyone is an optimist now

Posted 28 March 2024

Asset price volatility continues to decrease, much like it has done across the quarter, so we can be reasonably sure that Q1 2024 will finish strongly positive for equity markets across the world. This week (so far) has been another reasonable one, with the UK markets playing a bit of catch-up.

The MSCI All Country World Index (one of the most widely used global equity indices) had a small pull back right at the start of the year – somewhat unsurprisingly, given the exceptionally strong Santa Rally into year-end – but that has been the only down week since the end of October. In US dollar price terms, it has since risen almost 25% from that point. Overall, the strong start to 2024 is a pleasant surprise for global investors, considering how well markets performed in the final quarter of 2023. The UK market has been positive as well, but not to the same extent. The FTSE 100 is within touching distance of 8,000 points at the time of writing, but our market lacks the same vibrancy as elsewhere.

Flutter Entertainment’s previously announced shift of its primary listing to the US encapsulates the perceptions that our domestic stock market has become a backwater of global markets. At Tatton, we are sad about the perception, but feel this misses the point that the UK remains a very vibrant part of the global capital markets. Our country’s expertise in global investments is immensely strong, and we continue to act as the hub for global capital flows, regardless whether they are transacted through our domestic exchanges, or only advised and arranged here but executed elsewhere.

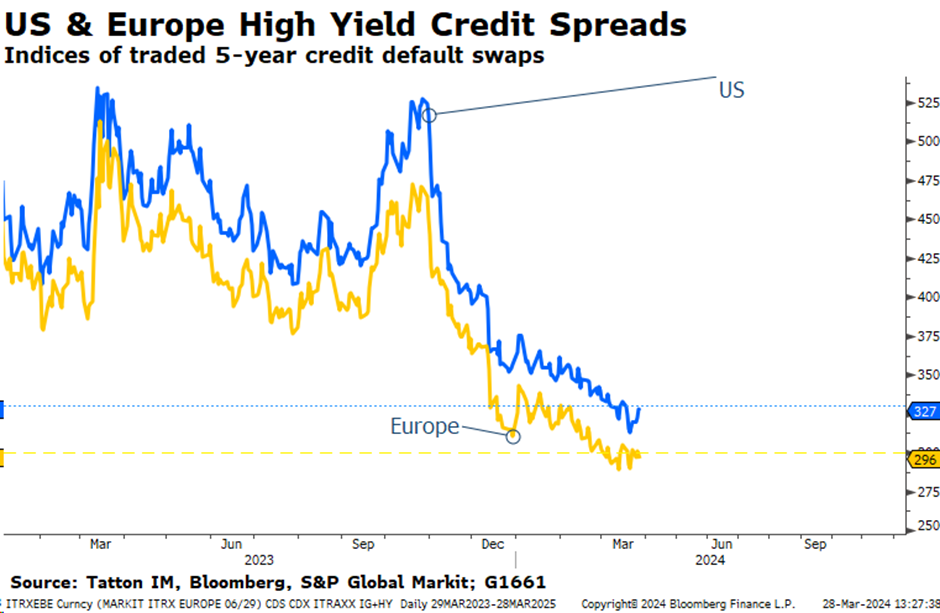

Returning to the market rally, it’s not just equities that have done well. Even though government bond prices have not moved much during this quarter, corporate bonds have done pretty well, meaning a lower cost of finance for companies. Recession fears are fading, so the general environment for borrowers has improved. Credit spreads – the risk premium corporates have to pay above government bonds – have moved from the wide levels seen at the start of November to today’s “normal” levels. The chart below shows how interest costs have come down even for less creditworthy borrowers. The credit spread is shown in “basis points” and one basis point is equivalent to 0.01%.

The five-year government bond yields in the US and in Europe fell sharply from October to the end of 2023, which bought down borrowing costs for all. However, from the start of this year, those five-year government rates have risen a little even though corporate credit spreads have continued to decline. Essentially, this means that many firms’ borrowing costs, on a net basis, have only risen by 0.5-1% since the inflation-induced rise in interest rates started three years ago.

We have mentioned before that we see these moves as signalling a relatively benign equilibrium. Borrowing costs are higher than they have been, but at the same time, growth is stronger than it was pre-pandemic. More importantly, investors and companies increasingly believe that growth will remain reasonably strong. That makes increased borrowing costs affordable for businesses, and arguably justified.

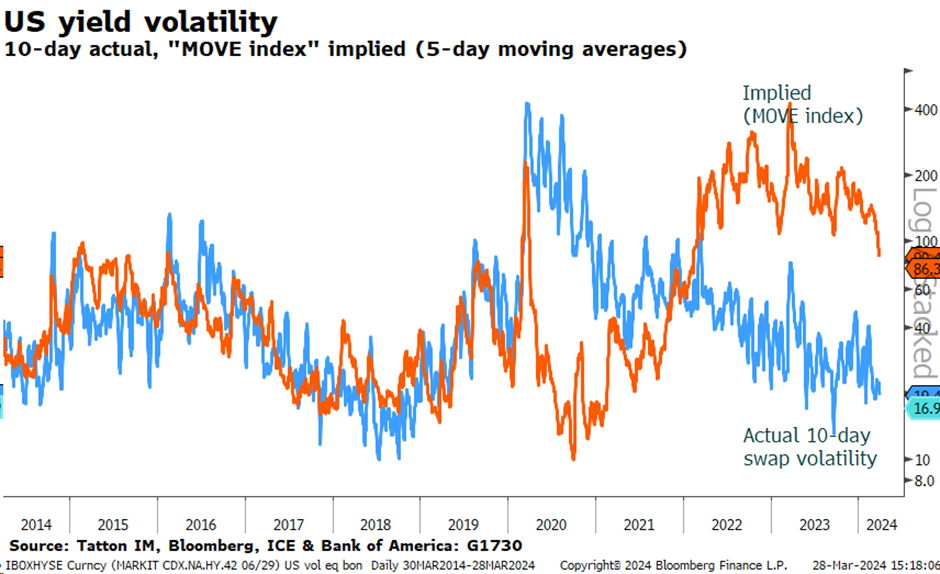

Another market signal of equilibrium is the decline in stock and bond market volatility. Commentators tend to focus on stock market volatility and often use the “VIX” Index. This is a measure of expected volatility of the US S&P 500 over the next 30 days. Through this quarter, expected volatility has declined to levels last seen in the calm times of 2018-2019, although it’s not quite back to the extraordinarily quiescent period in 2017.

Lower expected and actual volatility leads to greater investor appetite for riskier assets. So, is there any room for risk appetite to increase further?

The chart above shows actual and ‘option-implied’ yield volatilities. The MOVE Index (orange) is a bit like the VIX Index – an amalgam of traded option volatilities.

It sounds complicated, but as can be seen from the blue line, actual volatility has moved back to pre-pandemic lows. This could be bad news if one was banking on further bond yield declines for an enhancement of the economic outlook. However, the positive story is again around growth, where prospects are already high, meaning that company earnings should be strong enough to pay the interest cost. As a result, the risk of a spike in corporate defaults has diminished and, despite the higher (but much like the old ‘normal’) overall yield levels, the global economy is settling at a higher activity level.

Yet, the other dynamic the chart presents is that actual (blue) and expected volatility (orange) have diverged – having previously moved in tandem. This tells us that investors are still worried yields might move sharply higher, leading them to buying highly priced options to protect themselves (which is what the orange MOVE index represents). Recently, the implied volatility has declined as well, but, as we can see, it still has quite a way to come down. That’s good news for underlying assets, since there’s room for concerns about bond volatility to diminish. So, does that provide fuel for yet another bullish quarter?

Well, given the strong market performance of this quarter, the next has quite a lot of expected positivity built into it already. Investors are hoping that the world is on a stronger growth path than before the pandemic and there are good reasons to believe that. Consumers have higher savings, relatively less borrowing and employment is plentiful. Companies also have relatively less borrowing, margins have stabilised and profits are growing reasonably well.

The fly in the ointment is that improvements in overall private sector balance sheets have come at the expense of public sector balance sheets. If interest rates are stable, government borrowing will probably not get worse relative to the overall economy, but things are fragile.

Liz Truss, in October 2022, gave us a lesson in how ill-prepared fiscal plans can destabilise government bond markets and create significant pain for many people. This week, Larry Fink, the CEO of Blackrock Investors, warned that the US might face a similar situation because of its high levels of ongoing borrowing. The Congressional Budgetary Office indicated a similar concern. So, although there is room for expected bond yield volatilities to decline, the upcoming Presidential election could still throw a few bombshells into the market.

Another risk is that the decline in inflation could be challenged. Our cartoon hints at the recent sharp rise in cocoa prices which threatens a sugar rush in chocolate prices. Perhaps more worryingly, Brent Crude Oil prices have been heading back towards $90 per barrel. This seems to be due to low inventories following the past production cuts, which suggests room for production increases and a stabilisation of the price level. Nevertheless, markets could get spooked.

In the coming weeks, perhaps the biggest focus will be the company Q1 2024 results, to provide evidence for everyone’s extended growth expectations. However, because that gets underway only in mid-April, we have time to wait.