Tatton Teaser

Posted 27 March 2024

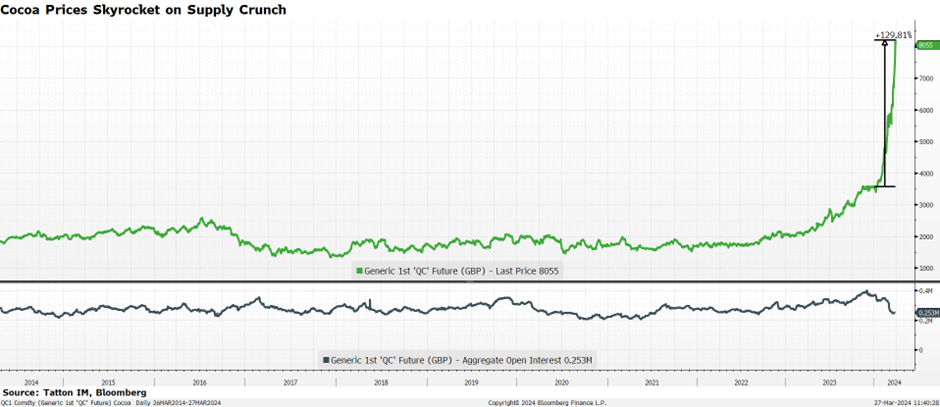

Cocoa Prices Skyrocket on Supply Crunch

The cocoa market is experiencing a historic surge, with prices surpassing £8,000 per metric ton for the first time ever. Cocoa futures have more than doubled in price this year, driven by a severe supply crunch emanating from West Africa, the dominant cocoa-growing region. Poor harvests due to adverse weather and crop disease have tightened supply.

This rally translates directly into higher chocolate costs. Consumers have already felt the pinch, with prices of Easter egg products rising in response to last year’s price increases. Manufacturers are adapting by shrinking bar sizes or promoting alternative ingredient varieties.

Despite technical indicators signalling overbought conditions, prices continue their ascent. Interestingly, speculative activity in the cocoa market has waned despite the price surge. Open interest, reflecting outstanding contracts, has fallen from its early February peak. Additionally, money managers have significantly reduced their net-long positions, reaching a one-year low. These trends suggest physical buyers, undeterred by rising prices, may be driving the rally, highlighting robust demand for cocoa beans. However, concerns linger regarding a potential worsening of the supply shortage, particularly with the impending introduction of EU regulations targeting deforestation-linked commodities.

The focus now shifts to West Africa’s upcoming mid-crop season, the Ivory Coast anticipates a decline in production this year. Bloomberg Intelligence analysts warn of further price hikes for Easter 2025 if cocoa diseases and unfavourable weather persist, compounded by high sugar prices. The industry grapples with the challenge of increasingly expensive cocoa, prompting major chocolate companies like Lindt & Sprüngli, Mondelez, Hershey, and Nestle to consider or implement price hikes to offset rising raw material costs. While some cost absorption through efficiencies is possible, the prospect of sustained high cocoa prices suggests further adjustments may be inevitable – perhaps keep some Easter eggs in reserve for 2025?

Thank you Eli Stubley for the analysis.