Expect the unexpected

Posted 4 August 2023

July turned out to be another good month for portfolio investors as markets rose across the board, leaving only commodities and property investors in the red for the year. For more details on the month’s returns picture, please refer to our July review in this week’s edition.

That positivity feels somewhat remarkable, given that not much changed in the underlying economic fundamentals and that companies (in aggregate) reported lower profits compared both to last quarter and also a year ago. Nevertheless, general investor sentiment improved as inflation – the biggest headwind of the last year – continued to decline. Meanwhile, market analysts cheered on the widespread ‘earnings beats’ from quarterly corporate earnings reports.

These two points capture what is going on in the markets at the moment, and also in our view, why stock and bond markets started August with a wobble. At the moment, it is not actual improvements in fundamentals that are pushing markets higher, but an expectation or hope that they will do so in the near future.

Falling rates of inflation across the board and worldwide has investors increasingly convinced that central banks will no longer feel obliged to push rates and yields higher still, and thereby limit the threat to stock market valuations that drove them down last year, when the rate hiking started. The noise from the ongoing quarterly reporting season of company results left them with the impression that earnings downgrades are equally a thing of the past and while not going up significantly at the moment, at least they are not going down either. When bond yields suddenly ticked up over the week, for reasons that were not immediately obvious, equity valuations reacted with a mild correction. The end of the week’s US jobs data signalled perhaps a cooling of underlying inflation from the tight labour markets, and equity markets began to relax again.

So far so good, but as regular readers will know, we like to look a little deeper, to understand whether the prevailing trends have the potential to be sustained going forward.

Therefore, first a bit of an insight into how the quarterly phenomenon of ‘earnings surprises/beats’ comes about and what the specific developments of the current round of quarterly beats actually tells us, and then some more on the current interaction between bond and equity markets.

Over recent weeks, the market commentariat featured regular statements like these:

“A lot of these beats were priced in and as a result there’s not a lot of excitement,” said Michael Casper, an equity strategist with Bloomberg Intelligence.

Unsurprisingly, given such comments, many of us find the earnings season news flow confusing. Equity strategists, analysts and journalists talk about company results in terms of ‘beats’ and ‘misses’ which generally refer to profits but can also apply to sales revenues.

In the US, the quarter’s reports fill the financial news headlines and the general tone is rarely anything other than positive. Thursday night’s release of Apple’s results was a case in point. Apple told us that its profit was nearly 5% higher than analyst forecasts for the April-June quarter, and yet the share price fell by 2%. The bad news was that sales in the past quarter may have beaten (lowish) expectations but in absolute terms were still down on the January-March quarter and are expected to continue to decline in this July-September quarter.

So, what they give with the one hand, they take with the other. When we look back at the record of how this reporting season has gone, Apple will add to the aggregate ‘earnings beat’, but the offset is that there is a hit to next quarter’s expectations.

This pattern gets repeated quite often. Companies work hard to show profit in their past performance, but it is generally in managements’ interests to push down expectations for the near future, to shine with better than thus expected results at the end of the next quarter – especially if the past quarter’s performance can be explained by ‘one-off’ factors.

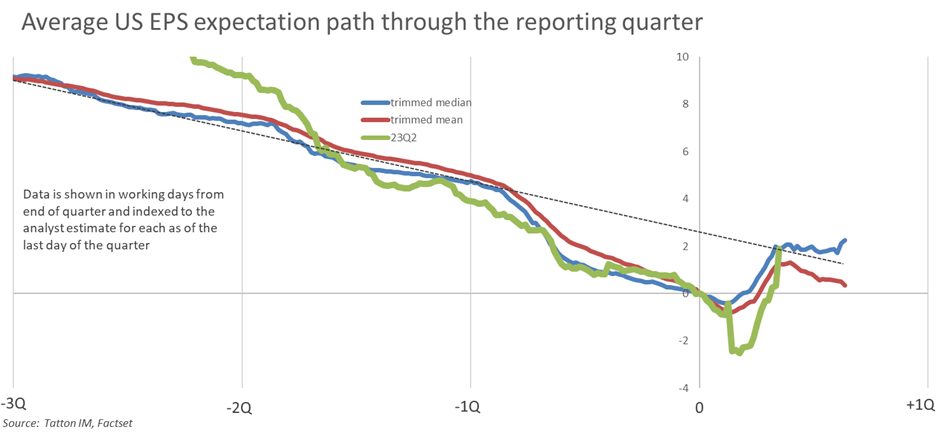

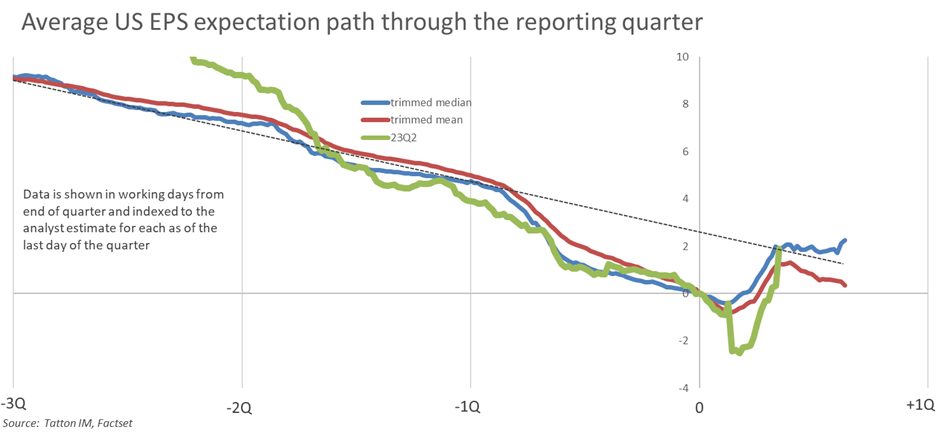

To evidence this behaviour, we have looked at the path of analysts’ aggregate earnings forecasts leading up to and then beyond the end of each quarter (over the past 20 years, with the global financial crisis and pandemic periods removed). The chart below shows the average track of aggregate estimates for the US Factset Index (around 3,000 US listed stocks, market-cap-weighted, and similar to the Russell 3000). The horizontal x-axis provides the timeline with ‘0’ marking the beginning of the actual reporting period start for the previous quarter. ‘-1Q’ therefore describes expectations as they stood at the beginning of a given quarter. The vertical y-axis shows how the aggregate earnings moves compared to the level as of the last calendar day of the quarter being forecasted. (So we can see that, compared to their predictions on June 30th 2023, when reporting was imminent, the analysts were predicting Q2 2023 earnings to be 9.2% higher on 31st December 2022, which declined to 3.9% when they looked at them again on 31st March 2023).

When analysts start their forecast (looking a year and a bit forward) they are too optimistic, so the forecasts fall at about 2% per quarter. Equally, in the final phase after the quarter has happened and the companies start reporting their results, analysts end up being too pessimistic. Companies generally manage to surprise them by about 2% in total. But here’s the rub; as companies give us the good news about the quarter just gone, they give us some ‘bad’ outlook news about the upcoming quarter. This, on average and perhaps unsurprisingly, knocks the analysts estimates down by an additional 2%. The quarter just before the results has an average decline of 4% in total, 2% of which is regained in the results period.

This current reporting quarter has had some differences (a sharper deterioration during the early months of the year) but has followed the median path pretty well. So, as usual, results are beating the analyst final expectations, but are not beating compared to what we might expect at the beginning of the quarter.

One might think analysts would learn and adjust, but perhaps there is an incentive to be slightly pessimistic, especially as most analysts have more buy recommendations than holds and sells.

The fact that neither this quarter’s earnings – nor the guidance for the next – is special is a problem for the market’s price given the expensive valuations. Expensive valuations usually occur when the next few quarters can be expected to show strong growth – markets price in what’s already on the horizon. We have had strong growth in the post-pandemic period partly because nominal revenues have been supported by both real economic growth and by high inflation. Now, a sharp decline in the pace of inflation isn’t being offset by any substantial rise in real growth.

In summary then, all the reported ‘beats’ are not telling us that the outlook is improving, but at best that it is not getting worse, or in other words, ordinary earnings growth which would struggle to justify July’s valuation dynamics.

When growth and inflation are slow, help has often come from falling bond yields. Equity valuations are supported as dividends can look attractive in comparison. But that is not what happened this week. As already noted, US bond yields have risen (which means prices have fallen).

The catalyst for bond price falls may have been the Fitch rating agency’s downgrade of the US long-term foreign currency credit rating to AA+ but, since US Treasuries are NOT issued in a foreign currency, this shouldn’t matter greatly. In addition, the much more influential Standard & Poors has had its US rating at AA+ since 2011.

It is more likely that the price falls are due to a non-market sentiment specific situation of ‘more sellers than buyers’. The US Treasury surprised markets by selling substantially more new long-term bonds than expected, just as corporate borrowers have been shifting from high-cost short-term borrowing to longer-term financing (as we noted last week) and therefore – like the US government – also looked for more buyers of long-term bonds.

The struggles of the US bond market can have quite a big impact on the equity market, and this might occur even if the US Federal Reserve (Fed) was perceived to be close to finishing its tightening cycle. The yield curve inversion (the difference between short rates and long-term rates) has been extreme for some time, possibly because investors appear convinced that a recession might be imminent, or that elevated inflation is only temporary. Well, no recession has occurred and many of the other market metrics (such as corporate credit spreads) have been indicating quite the opposite – that recession risks have been receding.

The bond sell-off may not have an enormously long way to go but investors are still wary after the huge capital losses of 2022. It may be that recent bond positivity is evaporating which could see the US ten-year bond yield head above the 4.3% highs of the last year, an outcome that oddly might raise recession risks substantially.

Here in the UK, we are no stranger to bond price falls since last autumn’s mini-budget disaster. On Thursday, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority to raise rates by another 0.25%. Two independent members wanted 0.5%, the other two independents wanted no rate rise. The MPC said the current stance was “restrictive” but reiterated that “further tightening in monetary policy would be required”.

Although the forecasts tended to indicate that the MPC saw inflation as difficult to shift, investors seem to perceive that the risks no longer as heavily skewed. Growth here and in Europe (extremely important for the UK) seem to be on a slower path than the US, especially recently. Although the UK government bond yield curve is inverted, UK (and Euro) bonds look cheaper than those in the US. All areas have seen some price falls but, when comparing bonds of similar maturity, UK Gilts and Euro government bonds have been relatively stable.

The previously-mentioned US non-farm payroll data of new jobs created over the month (being slightly weaker and below 200,000 new employees) has helped alleviate some of the pressure on US yields this Friday afternoon. Nevertheless, we suspect the technical expensiveness of US ten-year bonds could still have some further follow-through. It’s not the end of the world, but equities could lose a bit of momentum. So, while we very much welcome the positive returns that July’s upbeat sentiment brought for investors, this first week of August has once again demonstrated the fragility of optimism-driven valuations. As such, we expect markets and investors’ fortunes to remain in fine balance and therefore volatile and sensitive to anything that has the potential to sway the current optimism one way or the other.