Goldilocks in the air

Posted 30 January 2023

Recent macroeconomic data releases across the western world report declining rates of inflation and no longer overheating (but nevertheless still positive) economic growth. In the US, the important milestone of the rate of personal consumption expenditure inflation falling below the interest rate has been reached. Perhaps unsurprisingly then, the term ‘Goldilocks’ (not too hot, not too cold) has returned to the market narrative.

Still, following the last ten weeks of uptrend, capital markets had already priced in the good news and trended quite calmly but more or less sideways. Reassuringly, this comes despite further impending rate rises from central banks next week. But on the back of the ‘Goldilocks’ data picture, markets now price in for the US Federal Reserve (Fed), to further reduce the size of this rate rise from 0.5% to just 0.25% – and only for a further one or two more hikes to follow before then reversing quite quickly to rate cuts again later in the year.

Meanwhile, employment remains strong everywhere and even those laid off by the US mega-tech companies are finding new jobs quickly. Other early warning signals for recessions, such as elevated junk bond yields, are likewise not flashing red either. On the back of all this, the soft-landing narrative of central banks’ – for the first time in history – being able to reverse inflation without causing a recession, continues to gain momentum among the market commentariat.

The sidewards trending markets tell us, however, that the current balance between the market bulls and bears remains fragile, because there are still major contradictions to the Goldilocks narrative beyond the next two calendar quarters. This is because pessimists can point at almost as many indicators for the likelihood of a distinct downturn as the optimists have in petto for a soft landing. This particularly relates to soft factors such as continued negative business expectations and negative revenue and profit guidance coming from companies currently reporting their Q4 2022 earnings. Most damning perhaps are the bond market signals themselves, which – as mentioned above – are expecting central bank rate cuts towards the end of the year, which together with an inverted yield curve have historically been quite reliable early warning signs for recessions ahead.

Instead of a sustained Goldilocks period, at Tatton we see the current environment more as a temporary market truce, or period of ‘wait-and-see’ as the economic reality unfolds. This should provide evidence to tilt the balance of arguments in one direction or the other. In this respect, central bank actions and (just as important) their accompanying comments will be very closely observed next week, as will be further inflation figures and the full picture of Q4 2022 company earnings trends. As always, we monitor these signals very closely to decide when the time has come to steer portfolio compositions in one direction or the other.

Turning to a brief update of notable changes we observed over the past week, positive signals outweighed negative ones, but we would not yet speak of a clear trend in that direction: JP Morgan noted on Thursday night “data is consistent with the view that the global economy lost some momentum late last year, but that the risks of a near-term recession have diminished”. US fourth quarter real GDP (adjusted for inflation and seasonally adjusted) grew +0.7%qq (+2.9% annualised, the basis which US analysts always use), slightly above the consensus forecast of 2.6% annualised.

An inventory build-up pushed growth higher but may mean slower growth now. The US sold more goods abroad, which may signal global growth resilience, which is useful for the US as its domestic demand will continue to decline as higher rates start to bite. Domestic private sector purchases rose a tiny 0.2% annualised (0.05% qq) in Q4, the weakest in the post-pandemic period.

However, disposable income has started to rise again, strongly on a nominal basis at 6.5% annualised. The GDP measure of inflation (the Personal Consumption Expenditure Deflator) has fallen back to +3.2% annualised. With domestic spending growth as weak as stated above, but disposable income rising strongly, this indicates consumers have returned to building up financial savings – as we suspected from the flow of money into both bond and equity markets. Good income growth and slower price rises helps consumer confidence, which started to pick up into December.

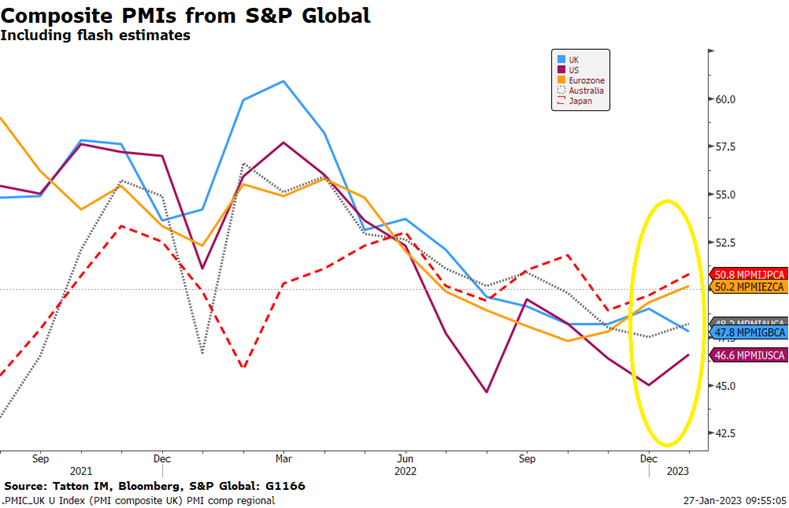

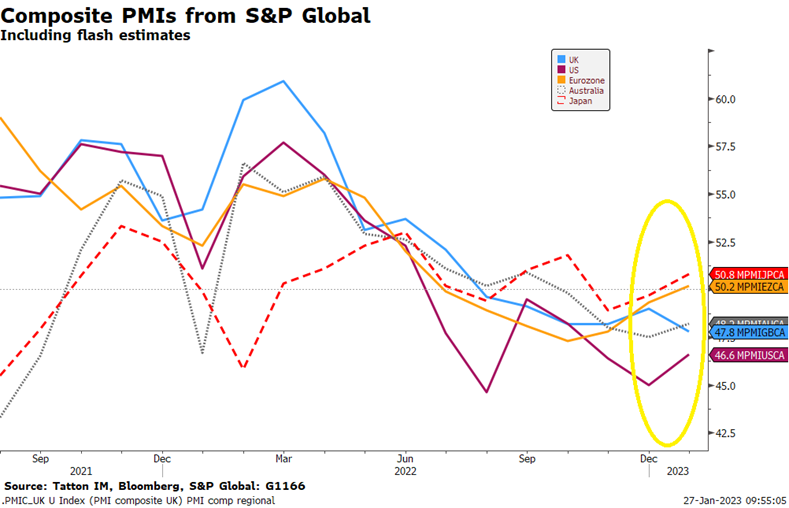

As we reported before and above, business confidence slid globally throughout the fourth quarter, especially in the US. However, this week’s ‘flash’ PMI data showed at least a levelling off, albeit still at weak levels below the neutral 50: