Inflation genie back in the bottle?

Posted 17 November 2023

Inflation genie back in the bottle?

This week was another good one for most investors. In sterling terms, the strongest equity markets were in Europe with the DAX up 4.5% since last Friday afternoon. The biggest winners have been small and mid-sized firms; the FTSE 250 has stormed up by 4.3% compared to a 1.4% increase for the FTSE 100. Likewise, the Russell 2000 (America’s most-watched market index for small and mid-sized companies) is up 5.1% in US dollar terms.

As we reasoned last week, risk asset markets are benefitting from the perception that central banks have reached their tightest levels in terms of interest rates and the most likely next moves now are lower. That perception grew stronger this week. Yields on 10-year government bonds are down another 0.2%-0.3% in the UK, Europe and the US. The move is even stronger for shorter-dated maturities.

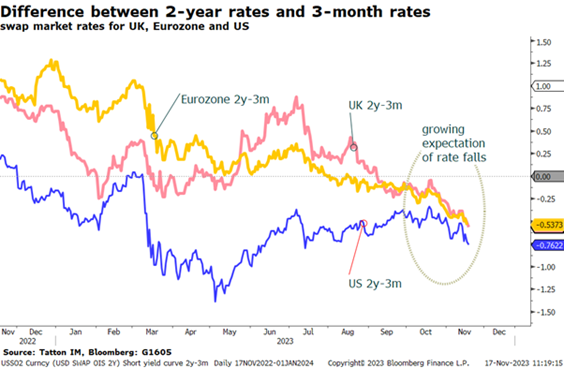

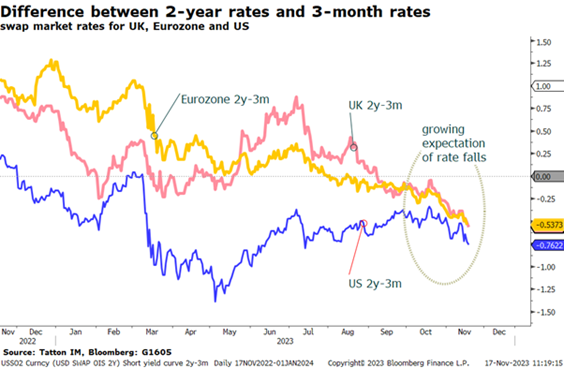

Monetary policy tightness has had a greater impact on smaller firms as they have less ability to directly issue fixed-coupon debt funding in the major bond markets, but rely on banks and other lending institutions. The inverted yield curves in longer bonds (yields on longer maturities are lower than those where funds are locked up for less long) may signal that investors expect rates to fall at some point, but smaller firms gain no benefit from that view because their financing tends to be on shorter terms than what big companies can achieve through bond issuance of their own. Investor cash and lower funding rates in this phase thus gets channelled to larger firms. However, in the phase where the curve inverts at the short end, this can send a different signal.

The chart above shows how 2-year rates have fallen in the period since the last round of central bank meetings. The pace of those falls has picked up this week. As a result, investors are starting to feel smaller companies may get a break in the foreseeable future, and start winning rather than losing, relative to larger sized firms.

Thinking we are through the worst is tempting but is also dangerous. Indeed, central banks moving from tight to easy is also a sign that economic growth is not going so well. And if growth is not going so well, profits may be under pressure.

That seems to be the case for the Russell 2000 companies. Analysts have been digesting the latest earnings reports together with managements’ future guidance and revising their projections for the tail-end of this year and for 2024. It is not unusual for them to revise down the last bit of the current year’s numbers, but they usually remain reasonably upbeat for the next. This year though, there has been a more noticeable wave of pessimism for 2024 than one could reasonably expect due to seasonality.

One of the interesting aspects of the global fall-back in inflation is the disparity between goods and service prices. For producers of things, pricing power seems to be hard to come by of late. Businesses have been trying to reduce overstocked inventory levels but final demand has been slowing faster than they can manage inventory levels down. This week, the data showed that US producer final-demand price growth slipped to a 0.5% month-on-month fall in October. They had been stronger in the summer but this reversal is significant. US industrial production fell quite sharply, by 0.6%, and factory utilisation rates declined to 78.9%, the weakest level since September 2021, while US inventory levels were reported earlier this month as still rising.

A similar dynamic occurred in the UK, although October’s output prices managed a small 0.1% rise rather than a fall.

Thursday’s sluggish stock market price action suggested investors are struggling with this dilemma as they digested these latest data updates. Perhaps growth is in a short-term soft patch and will bounce back given that employment levels remain resolutely strong. But it is also currently soft enough to be creating cashflow problems for some firms, judging by the recent increase in default rates.

We have one more set of 2023 central bank meetings in December. Investors have been positive about prospects of dovish announcements, but we will need to hear that it’s more than okay to talk about rate cuts – which last week was certainly opposite to what central bankers stressed.

On the political side, China’s President Xi sounded distinctly dovish in his meeting with US President Biden. Biden appeared to make an error, describing Xi as a dictator (although one might think this ‘slip’ was more about playing to a particular subset of the US audience) but nothing was made of it by the Chinese.

We write about China’s policies and economy in the second article below. A significant factor in global goods price falls is China’s past overproduction and current soft private sector demand. The increased urgency to revive economic growth that China’s leadership is currently displaying – on both monetary and fiscal fronts – suggests that their weakness is substantial and probably spreading across the world.

The good news is that policy action is unmistakeable. We may be wary about its efficacy but it is happening. China’s equity markets appear especially wary but they may be ripe for a bounce similar to that seen in small and mid-cap stocks in the West.

Lastly, the US dollar has weakened as the US growth exceptionalism appears to be running out. We think that this has the makings of an important shift, one which could be important for longer-term economic and investment outcomes. We will cover this in our 2024 outlook which should reach you on 15 December.