Market conundrum amid volatile growth

Posted 16 June 2023

This week saw equity markets move higher yet, despite central bank hawkishness. We had another 0.25% rate rise from the European Central Bank (ECB) and, although the US Federal Open markets Committee (FOMC) left rates unchanged, they gave us strong hints of at least another 0.25% hike in July. They also indicated their expectation for rates to stay higher for longer than many think.

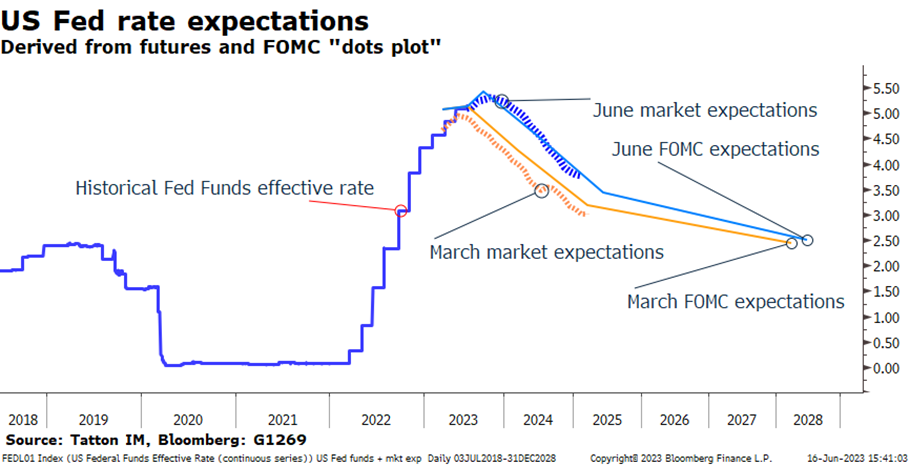

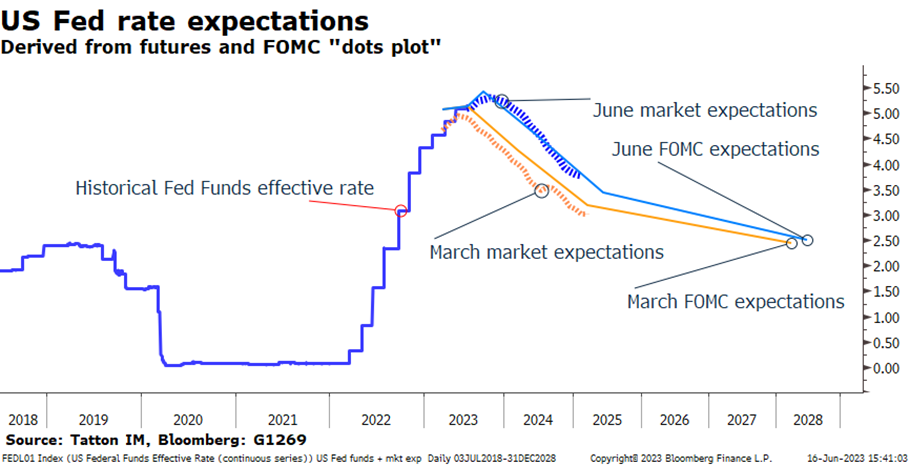

The FOMC’s ‘dots plot’ is published every quarter and shows how the US rate setters see the path of rates unfolding over the coming months and quarters. June’s plot is markedly higher than the committee’s estimates back in March, as per the chart below:

The backdrop to this change is that the 23 March meeting came in the days immediately following the Silicon Valley Bank demise, when many thought the financial system was close to a dangerous precipice, and that a rash of corporate bankruptcies were just moments away.

As a consequence, many among the FOMC thought that in order to regain stability in the financial system, rates might have to be lowered before the end of the year. In anticipation of worsening financial conditions, the Federal Reserve (Fed) had additionally already acted by pushing liquidity into the system and even considered giving all depositors a blanket guarantee on their checking accounts.

We can now see that those actions were effective. They reduced risks in the system, and helped to stabilise confidence in banks and other finance houses. Indeed, now, if one were to look only at the US equity indices, you would think that confidence is brimming.

On 23 March, the S&P 500 stood at 4,000. It is now above 4,400, 10% higher. The S&P 500’s expected earnings-per-share (on a next-12-month basis) have also risen, by a reasonably substantial 2%, although less than equity prices (Bloomberg calculated that analysts’ estimated earnings-per-share was at $224.60 on 23 March; as of today, Bloomberg calculates it at $228.90).

There have been rises in US Treasury yields and falls in credit spreads, both of which suggest a rise in confidence about the US economy. However, the economic data suggest a much more mixed picture. On the one hand, consumers remain pretty confident as inflation declines, wage gains start to outpace price rises and there is very little fear of losing their job. On the other hand, companies are not so sure and are no longer hiring as much and nor increasing wages as quickly. Indeed, the pace of hiring seems to have slowed significantly in the past three months, and paid overtime has slumped, according to both government-sourced data and employment agencies such as Indeed. Also, almost all sectors are now affected, not just the IT sector.

Interestingly, business confidence survey data is swinging quite sharply. For example, the New York State purchasing manager index swung from May’s -31.8 to June’s +6.6, a change of over 38 points. Over the last six months the index has swung more than 30 points month-on-month on average. The average pre-pandemic change was less than 10 points.

Outside the US, the economic picture is also mixed. The UK may be skirting recession rather than plunging and for similar reasons to the US – consumers feel confident that earned income is rising enough to allow them to continue to spend. Germany is in recession but it is mild and the decreasing demand is centred on businesses rather than consumers.

But the west’s continued growth is not assured, precisely because our central banks still have more work to do to quell second-round inflation pressures from the self-enforcing dynamics of wage rises. The Fed and the ECB told us that this week, and unlike the Fed, the Bank of England (BoE) will most certainly raise UK rates next week. Yet, as we said earlier, markets appear to be behaving as if growth is set to rise sharply, despite institutional investor sentiment surveys showing only a little improvement in confidence.

It may be that a combination of circumstances has increased the pool of money available to be invested. While institutional investors are cautious on growth drivers, the increase in cash rates has stabilised savings ratios. People are spending but they also appear to be saving out of their rising incomes.

One interesting thought comes from Andrew Hunt Economics. Perhaps the March turbulence in the US financial system has created a boost to financial market liquidity. He thinks that the shift of deposits away from regional banks has left the larger banks with a conundrum about what to do with their increased deposits. The lending surveys tell us that banks wish to be cautious lenders, and that real economy borrowers are few and far between. However, the money may have found its way out to financial borrowers – such as hedge funds – that have decided to ride the up wave and fuel the markets with their buy orders.

It is very difficult to verify such a theory. However, we noted how expensive equity markets had become in May and, since then, it has become more extreme. The S&P 500 is now 28% more expensive than our historical model of earnings and yields would suggest, a level that has not occurred in over 20 years. Such an optimistic level is only justifiable if we are moving into a significantly higher real growth and inflation environment, as was the case during the second half of the 20th century. One would have to think that central banks will give up on constraining inflation to their targets through higher rates in the medium term, a judgement which we think is way too early to make now.

While of course, we welcome the rise in global markets, we think this ‘pricing for perfection’ will leave markets highly vulnerable to any adverse data points. In our view, investors would be well advised to search for quality in what they buy and exercise a little caution rather than chasing the broad equity markets higher.

Against this optimistic outlook, and few signs of meaningful economic slowing, western central banks are raising rates – however, that’s not the case in Asia. Today, Bank of Japan Governor Kazuo Ueda maintained the easy policy regime. The yen weakened to the year’s weakest point of Y141.5 against the USD. This comes after the People’s Bank of China (PBoC) cut policy rates midweek. China’s easing of policy is both monetary and fiscal, with the authorities promising to bring in as yet undefined measures to help the ailing property market. The PBoC also hinted at measures to push funds into the domestic equity markets. Chinese shares got a bit of a boost and ended the week as one of the better markets after a period of underperformance. We will discuss China in more detail next week.

Back home, European gas prices rose quite sharply after the Netherlands announced the closure of the North Sea’s largest gas field. Still gas prices have been falling through this year and the rise is minor so far. European equities remained positive but this turn bears watching. We cover oil demand in a separate article below.

Last, we returning to our own central bank, the BoE. After wage rises were shown earlier this week to be rising much more sharply than elsewhere, a rise in base rates is again imminent. Long bond yields fell back a bit from midweek highs, but are still now among the highest in developed countries. Against this, sterling is rising, which perhaps signals non-UK investors see those yields as attractive and staying high for longer than elsewhere.

For UK households with mortgage debts to service, it certainly is bad news and, while unlikely to lead to a UK property market crash, it will start to curtail disposable incomes, which will inevitably slow the still-buoyant demand for services, which is precisely what the BoE is aiming for to bring inflation under control. A self-regulating dynamic then, allowing the BoE to step off the brakes as soon as demand dwindles. Alas, all this happens with considerable time lags which are fiendishly hard to project and therefore very easy to get wrong. We do not envy the task in hand for central bankers at the moment.