Positive growth sentiment returns

Posted 26 January 2024

After the bumpy ‘hangover’ start and the volatile two weeks that followed, it looks like investors are finding their feet again, slowly turning January into a far more positive month than many had expected following the very strong rally into the year-end. As the month draws to a close, financial markets are turning out to be rather quiet, at least in terms of price volatility. Reasonable sums of savings are flowing into financial assets. Companies and governments are able to find willing investors to fund their requests for capital. Therefore, almost entirely across the board, regional equity markets are up another healthy amount. Even China has managed another positive week, with Hong Kong finally bouncing (we look at how sustainable that bounce may be in a separate article). Surplus liquidity searching for attractive returns is the one market variable that has repeatedly surprised during this highly unusual post-pandemic cycle, and 2024 does not seem to be any different.

As suspected, bond markets are extremely busy this January. They are different to equity markets in that borrowers have to issue new bonds frequently because older issuance reaches maturity and has to be repaid. We talk about a 10-year bond being ‘long’, but large borrowers end up having to issue new bonds every few months, because of the nature of their rolling book of debt finance.

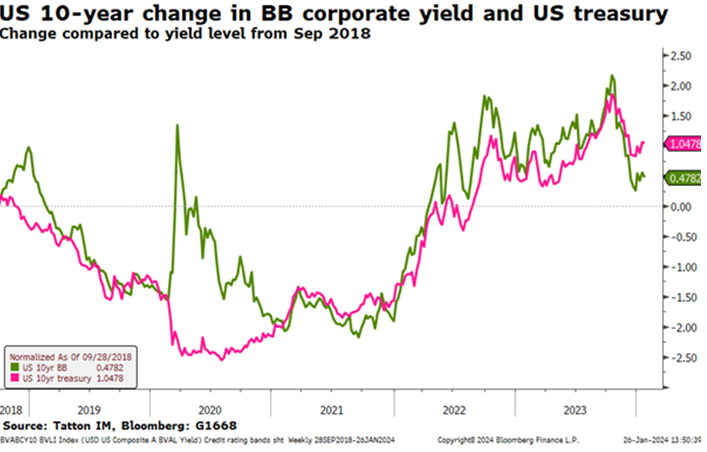

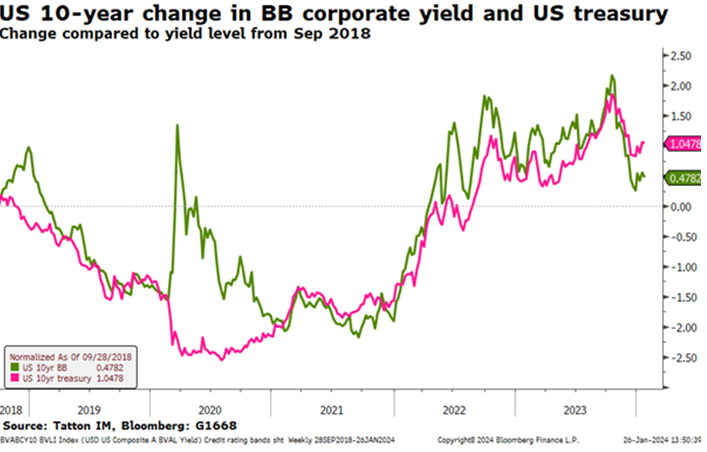

And, because yields rose sharply from the beginning of 2022, many companies across the world delayed refinancing, hoping that yields would surely fall back as the economy contracted, forcing central bank to cut rates. As we know, this did not happen, and so yields have not fallen back to the historic lows we saw in 2021. Nevertheless, with inflation falling, they have declined from the relative highs of 2023. For government borrowers, yields have declined by around 1%, but for riskier corporate borrowers, the turn in sentiment in both markets and economies has resulted in reduced fears of defaults – which has additionally driven down the risk premium (spread), they have to pay above the government. In the US dollar bond market, in September 2018, the US Government was paying 10-year interest of just less than 3%. Now the yield is about 4.1%. A borrower with a credit rating just below investment grade (BB-rated) was paying just over 6% in September 2018, and now will pay interest of around 6.5% according to Bloomberg.

Only 3 months ago, that BB rated borrower was looking at paying over 8%. Perhaps it is no wonder that corporate borrowers are feeling the current yield levels are reasonably attractive enough to replenish their loan capital side.

While we cannot go into the details here, the story is similar in the Eurobond market, which have already seen record issuance for a January. Bloomberg reports that US dollar markets will achieve a similar high point next week.

It is a good sign for markets and economies that more companies are thinking this is a good time to borrow money. This rise in spirits is getting some backing from moves in the commodities markets (which we write about below) and from business sentiment surveys like the ‘flash’ purchasing managers’ index (PMI) surveys from across the world, released this week.

Perhaps sentiment is not racing ahead, but the broad composite measures – which include both manufacturing and service sector companies – are now generally heading above the 50-level which signals the difference between companies thinking they are in growth and decline. Indeed, the US, UK and even China are at or above the 52 level (which aligns with activity at a normal level, and optimum capacity usage).

But, it is also notable that core Europe is still having a tough time. The composite has edged up from the October low of 46.5 but languishes at 47.9. Services surprised on the downside and fell back rather than rose. Both France and Germany appear to be at the centre of the despondency, while the periphery is feeling better (Greece is doing very well!). There is a positive underlying story in that the manufacturing PMI on its own is rising sharply, in line with other areas, albeit from a lower level. Manufacturing tends to lead services, so we should expect some improvement in the coming months.

As mentioned before, a step-up in Euro-denominated bond issuance could be a positive signal for Europe’s economy, with companies hopefully borrowing to invest and spend. The fall in natural gas and electricity prices has also continued despite the slight rebound in oil prices (the rebound being a probable consequence of the Red Sea problems and not affecting liquefied natural gas so much).

The European Central Bank (ECB) also did its bit to keep confidence stable with its announcement this week. Nobody expected a rate cut (and none was forthcoming) but ECB President Christine Lagarde said there was “stabilisation” in some wage indicators and that companies were currently absorbing wage hikes, reducing the risk of second-round effects on prices. She also gave little pushback when asked about a spring rather than summer start to cutting rates.

Next week is the turn of the US Federal Reserve and then the Bank of England. Again, nobody is expecting rate cuts, it will be all about the comments.

So, markets have returned to that beneficial frame of mind, where optimism is slight and risks have been high but are falling. That even applies to the dreadful geopolitical situation. Even if it never feels that way when observing geopolitical events and risks, in economic terms the current situation is not getting worse – for example, there has been no notable aftermath from the Taiwan election.

However, the Republican elephant is in the room (as this week’s cartoon notes), and Trump is becoming impossible to ignore. After finishing as the undisputed winner of the primary in New Hampshire (thought to be the one state where he was least likely to win) Donald Trump will probably become the de facto nominee after Super Tuesday of primaries on 5 March. Meanwhile, nobody but Biden is standing in Biden’s way. The 2024 election ends on 5 November, and while a change of candidate would only happen if the chosen nominee could not continue, it is still possible that one or both of the leading candidates could face election-ending legal or health issues. In that case, Convention delegates would be asked to select a ‘unity ticket’.

The geopolitical risks will start to be about whether the next phase of ‘Making America Great Again’ will be at the expense of the rest of the world. Trump has had a habit of making policies on the fly, but seems to have been somewhat more controlled so far. We will write more on some implications over the coming weeks.