Tatton Teaser

Posted 24 January 2024

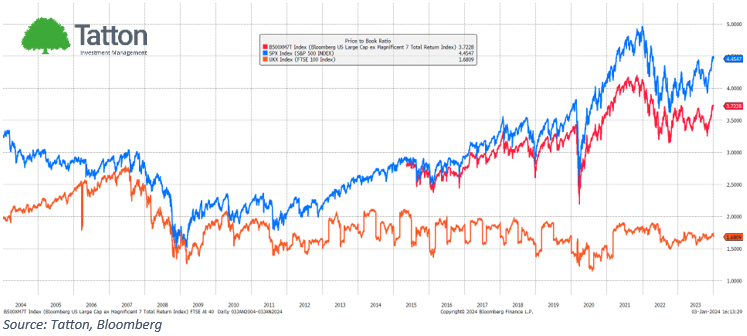

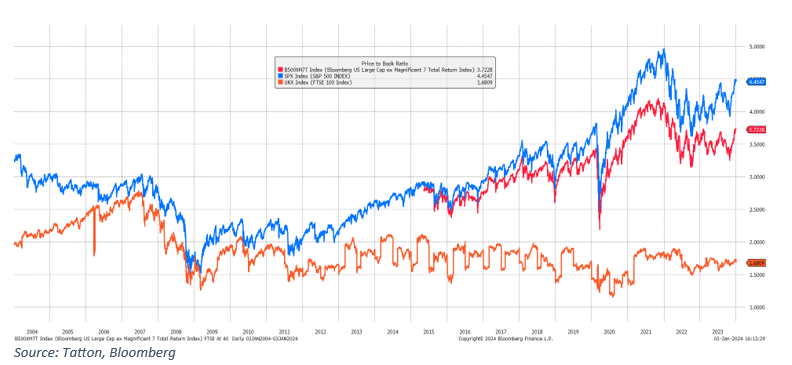

Now the fanfare of the FTSE 100s 40th anniversary has died down its worth examining just how underwhelming its performance is compared with global peers – as highlighted by Bloomberg’s John Authers at the time. The spectre of Brexit undoubtedly casts a shadow but the roots of this underperformance run deeper.

Two factors are immediately apparent – tech and mining (and that’s not for BitCoins)

The FTSE 100 has a significant lack of tech giants and a heavy reliance on those in mining. The likes of Apple and Nvidia turbocharge the S&P 500, yet the FTSE is bereft of similar firepower. RELX, a rare success story, stands as a testament to the potential that lies untapped. Further, the fortunes of the mining firms are tied to the volatile whims of commodity prices.

Diversification into more stable sectors could provide much-needed ballast as could making UK companies have to list in the UK if we want to prevent (and promote) British-HQ ‘titans’ movement to the lowest cost of capital (read ARM Holdings PLC on the NASDAQ).

Adding to the puzzle is the dramatic shift in British pension fund strategies. Once champions of equities, they’ve increasingly embraced bonds, driven by liability-matching and regulatory pressures and pressures from regulators. This bond pressure has created a vicious cycle, dragging down the market and further fuelling their flight to safety.

Fixing this conundrum requires a delicate dance. While some, like economist Will Hutton, advocate for directing pension funds back towards UK equities, concerns about forced investment and market interference lurk. Finding the right balance between supporting domestic growth and respecting market dynamics is crucial.

Beyond domestic issues, the FTSE 100’s struggles offer valuable lessons for the global financial landscape. Pension protects in Chile serve as a stark reminder of the potential pitfalls of aggressive liability-matching, while the debate surrounding protectionism highlights the delicate balance of fostering domestic markets and embracing the interconnectedness of a globalized world.

Ultimately, by acknowledging its shortcomings the FTSE 100’s 40th birthday should be a call to action. By, embracing innovation, and navigating the pension challenge with a steady hand, the UK can pave the way for a future where the index is not just a relic of the past, but a vibrant engine of growth for the British economy.

Full details of John Authers article can be found here with some further interesting charts: https://www.bloomberg.com/opinion/articles/2024-01-03/ftse-100-s-40th-birthday-is-a-very-british-disappointment“

Thanks to Anthony Graham for the note.