Tatton teaser: ‘The Bond Dilemma’

Posted 6 September 2022

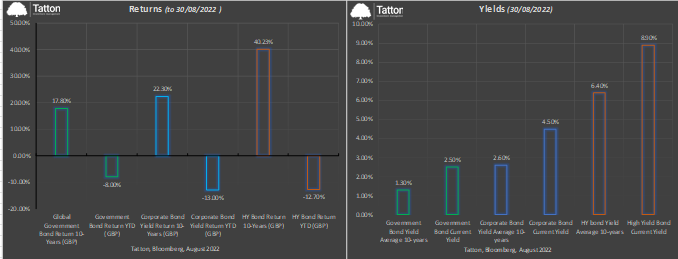

Fixed Income has been unloved this year, providing some of the worst returns for 40 years! Yet investors continue to hold it for two key reasons, diversification from equities and regular income. Short term performance (Chart 1) does not reflect the long run diversification benefits that are provided by fixed income investments – bonds tend to have a low correlation with equities. That this has not happened in the last six months can be offset to some degree since investments should always be judged with a longer time horizon. More importantly however is the regular income stream known as yield.

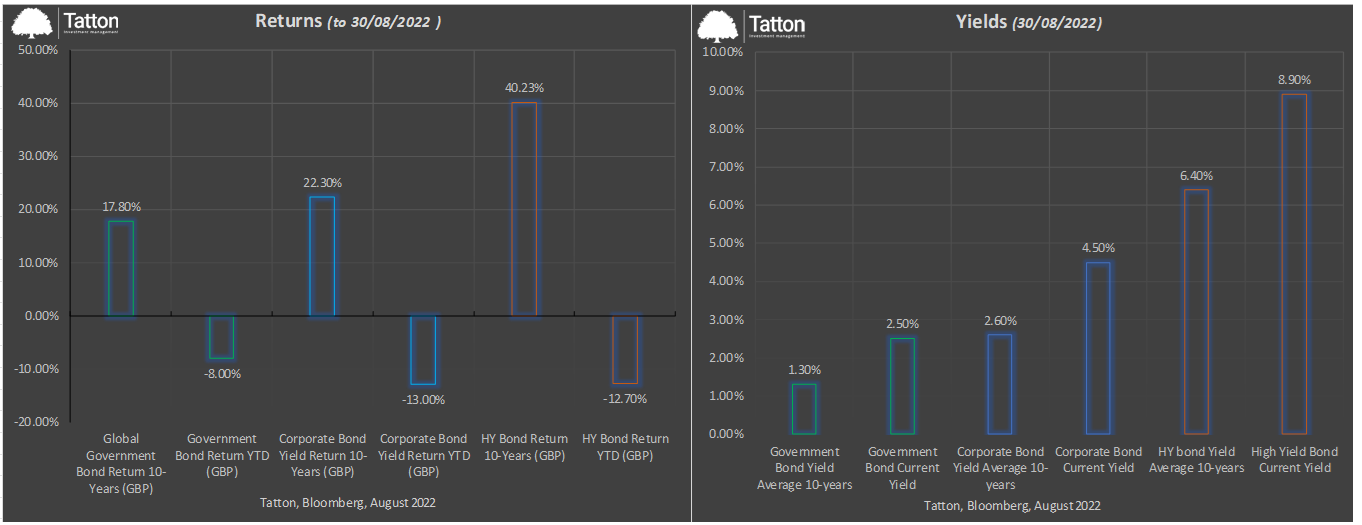

As the second chart shows, Sterling hedged government debt yields nearly double its average of the last decade, higher quality corporate debt averages a coupon of nearly 5%, and some of the riskiest debt known as high yield, provides an average cash flow of 9%. When looking at the current recessionary environment, income security is extremely important for investors. When it comes to equities, dividends tend to be cut by company management to preserve capital when revenue uncertainty is high. For bonds, coupons provide a secure form of income as management cannot alter the coupon stream.

If the short term diversification benefit of bonds can be questioned at the moment, the regular income stream means fixed income is more attractive than it has been for a long time.

Thank you Chris Robinson for this note.