The Fed at work and China snubs Putin

Posted 16 September 2022

The period of mourning for Queen Elizabeth II continues amid truly touching scenes. Our Chief Economist’s walk from Rotherhithe to the Tatton office follows the path of the waiting line for the Queen’s “Lying-in-State”. Usually, the early morning walk is a fairly lonely experience but, over the past two days, he has been accompanied on the entire route by people making their gentle way to pay their respects.

Moving to investment concerns, the consequences of a European war continue to dominate our economy and markets, as it does throughout Western Europe and, to some degree Asia. Meanwhile, seemingly unaffected by the rest of the world, the US is blazing its own trail.

This is predominantly because US energy security means they do not face the same input cost pressures. Nevertheless, inflation still remains a problem for the US Central Bank, the Fed. The August consumer price data reflected a fall back in oil-related pressures but tightness in the labour market continues to feed through. Therefore, and perhaps surprisingly, the US is faced with a more structural inflation issue through looming wage-price-spiral dynamics than Europe.

Labour clearly does wield some pricing power. A US rail strike, the first for 30 years was called off on Thursday after a deal neared agreement. According to the BBC, it includes a 24% wage increase and $5,000 bonuses, as well as changes to existing policies on time off, which had been a crucial sticking point for workers.

The ability to pay the increases suggests that US companies have more cash-flow leeway. It also suggests that next Wednesday’s meeting (21st) of the Federal Reserve Open Markets Committee will decide to raise rates to at least 0.75%. Some analysts, like investment bank Nomura, think they will raise the Fed Fund target rate by 1%pt to a 3.25-3.5% band. More importantly few think US interest rates are close to the peak. That is now seen to be around 4.5%.

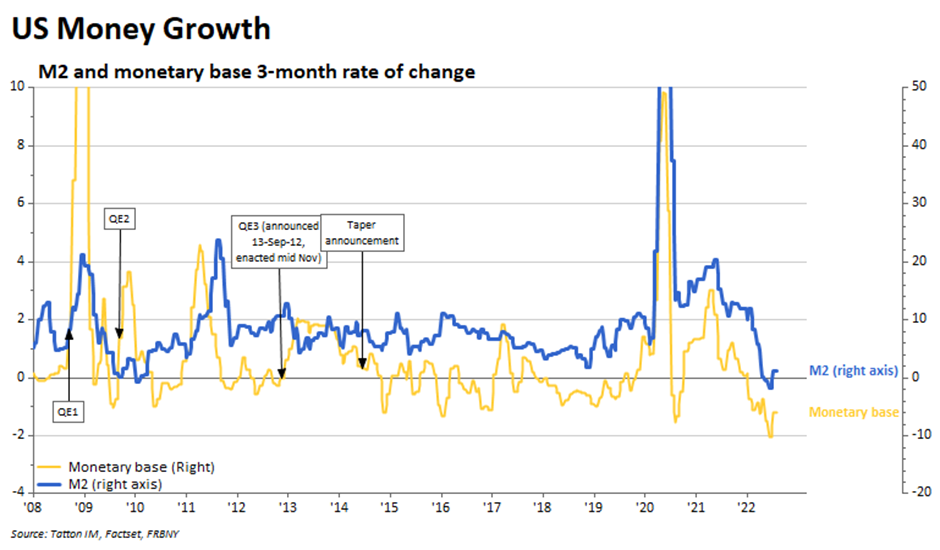

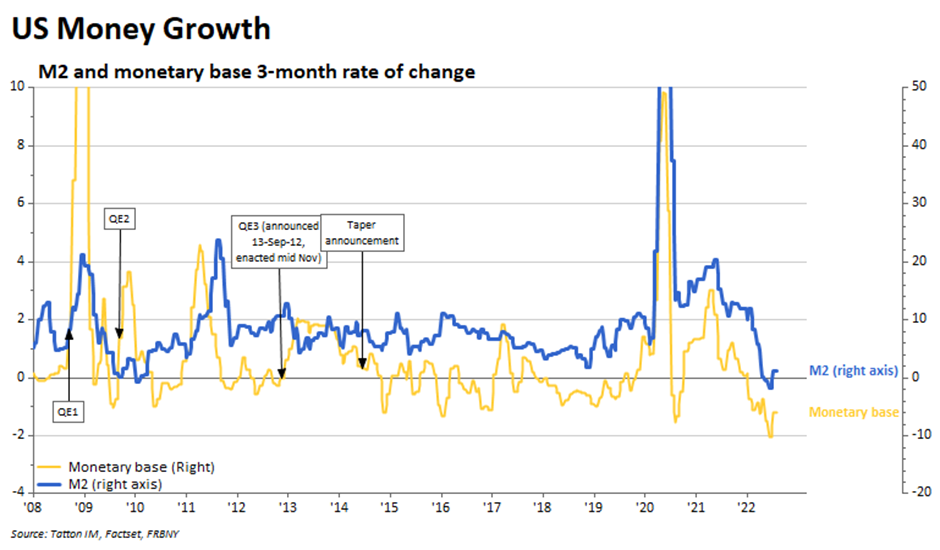

It does look like the Fed seemingly loosened its grip on the US economy during the summer and will now have to tighten harder, after the fallback in inflation expectations data perhaps allowed a bit of complacency. The money supply (M2) data showed some reacceleration over the past quarter as seen in the graph below:

It has been noticeable that private sector credit growth has been the driver, both on the corporate and the consumer side, while the government has reined in spending.

Equity markets fell back, as government bond yields rose. The 10-year treasury is within touching distance of yielding 3.5% while the 10-year “real” yield (after 10-year inflation expectations) has moved above 1%. Credit spreads, which had moved to quite low levels at the end of last week, rose although not to the highs seen in August. We write about the current relative resilience of US corporate credits in an article below.

Ray Dalio, co-CIO of renowned US investment managers, Bridgewater Associates, ventured the opinion that the leading US market Index, the S&P 500, would fall some 20% over time if long rates were to go to his expected level of 4.5% – 1% higher than in the UK amid continued inflation pressure. Our assessment is that, if he is right about a rise in long rates to 4.5%, it would definitely put more downward pressure on US stock valuations as bonds’ attractiveness increases. However, the flip side of such a rise in yields would be produced by strong nominal earnings growth, while real yields would rise less overall, which would limit valuation pressures on equities. There would also be an offset from probable further strength in the US Dollar. Overall, even if Ray Dalio is proved right, in Sterling terms, the S&P500 fall should be limited to within the region of 5-10%.

All that assumes that long rates do move up to that level. Clearly there is a trend to move higher but we should also factor in the relative weakness of the rest of the world’s economy. The US can be less affected for some time but not forever. While the US economy is stronger than expected one should not overstate it. The summer bounce has been relatively muted amid a clear slowing centred mostly on the west coast and its tech companies. Meanwhile construction, the major economic driver for 2021, has slowed and is not rebounding given that mortgage rates remain at 6%. Meanwhile August retail sales disappointed.

Seasonally, consumer spending picks up through the last quarter so the Fed will be anxious, waiting to see if consumers have just delayed their purchases. The Fed showed determination in the first part of the year and will probably reassert itself next week. We would be unsurprised by a 1% rate rise (rather than 0.75%) and think that after this week’s moves the market is already prepared for the bigger move.

Elsewhere, international pressure on Vladimir Putin is growing from what might seem to be an unlikely source. He met China’s Xi Jinping this week to cement their relationship, but it did not quite go to plan. Putin stridently supported China’s position on Taiwan but there was no such reciprocation from Xi. Indeed, Xi reportedly expressed his concerns about Russia’s war in Ukraine.

Before the meeting, some market analysts reported that relations between Russia and China were cooling rather than improving. Signum Global Advisors noted Chinese companies “have scaled down their exports, suspended deliveries or started winding down their operations on the Russian market altogether”. This may seem at odds with the Chinese official rhetoric, but the private sector behaviour is being tacitly accepted.

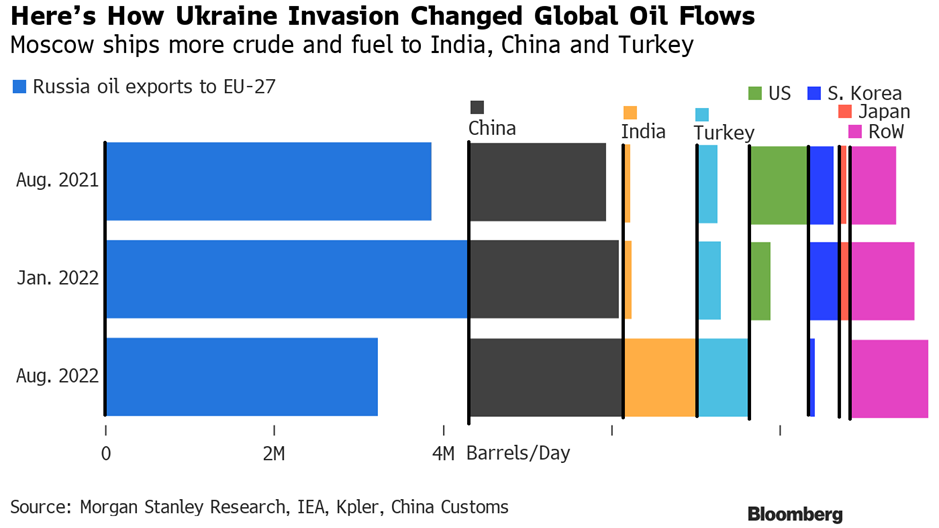

China’s recent domestic weakness may be on a path to some improvement, but it is slower than we expected. The policy crackdowns, that partly led to the compression, are being eased but China is deeply reliant on foreign demand for its goods. The US is pulling a huge amount of Chinese goods in, but Europe’s slowdown is really hurting. China would really like Russia to cease its energy war. Reluctance to validate Russia’s actions is probably most evident in the data on energy imports. Bloomberg and Morgan Stanley published a chart earlier this week which shows the changes in Russia’s oil exports to various regions (we have adjusted it to show the country changes more clearly):

After the bad-tempered episode involving Taiwan and Nancy Pelosi, there appear to be efforts from both the US and China to calm relations. While it will not dissuade Putin from continuing the conflict, it may weaken his hand further.

In summary, while there are formidable headwinds to the global economy, which from time to time create particularly strong market reactions, there are likewise positives that balance the negatives in-between. We are still going through a post pandemic period that is characterised by increasing economic activity. However, because of the formidable disruptions of the past two years, this is neither happening in a straight line, nor does it happen without impacting yield levels as we had become used to over the past decade.