Investors anxious for storms to blow over

Posted 18 February 2022

Another turbulent week in global stock markets on the back of little in terms of new news, but plenty of speculation of what may lie ahead. At the end of this week, real storms have disrupted our lives while markets continue to brace for what may or may not come to pass.

For most of the time, weekends and holidays are non-events for investors. The Sunday papers may have stories about individual companies that mean their individual share prices can dump or jump when markets re-open on Mondays, but rarely do weekends pave the way for big moves in the main stock markets indexes. The couple of days of calm and reflection is one of the reasons we write this weekly on a Friday.

At the moment though, a lot can happen in a weekend when geopolitics are as fluid as they are right now. Markets are likely to get highly sensitised to any news flow on a Friday because market liquidity gets very thin as the brigade of speculative investors close their positions for the week, and consequently investors’ near-term risk appetites are tiny.

As we write, the Associated Press is warning that Russia intends to carry out its nuclear drills on the Ukraine North-border (it does such drills every year but usually later in the year). With western intelligence agencies constantly briefing us in detail, markets could move sharply after we publish.

Readers might well conclude that the distribution of likely outcomes is one-sided, or in other words that the downside is greater than the upside. However, when we look back across the last 70 years at some of the better-known conflicts, markets have tended to perform well immediately after the point of maximum stress. It may seem unlikely now and in this stormy weather, but if the weekend sees any sort of movement towards believable peaceful resolution, markets could well be a lot higher on Monday morning (Earlier in the week we published a special update on this specific topic – here’s the link: https://tattoninvestments.com/special-investment-update/). From our vantage point as professional investors, we need to be very wary of taking short-term ‘bets’ with our investors’ long-term investment strategies. When risks are greater, expected returns are higher. That means, it is not a good investment strategy to sell assets after they have become cheaper.

The tense situation between the Ukraine and Russia is not affecting consumers that much, either here or in the US, except for the extension to elevated energy prices. This comes despite an easing on the supply side which has manifested itself in even further declines in the forward prices of oil in the futures markets. Compared to that, the end to 2021 was a disappointment, with the rise in virus cases clearly putting a dampener on activity. January sales rebounded strongly as fears subsided and February is likely to be good as well.

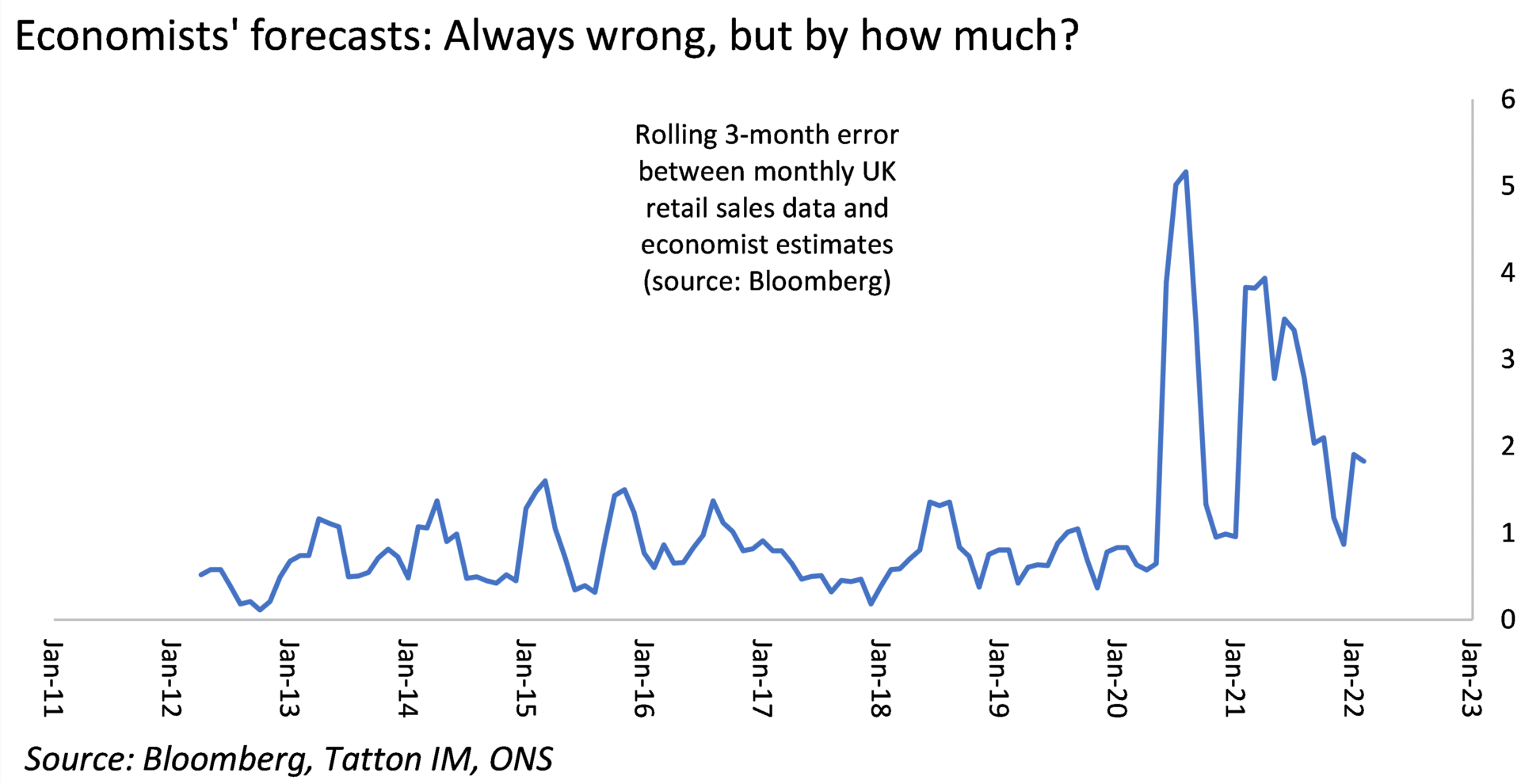

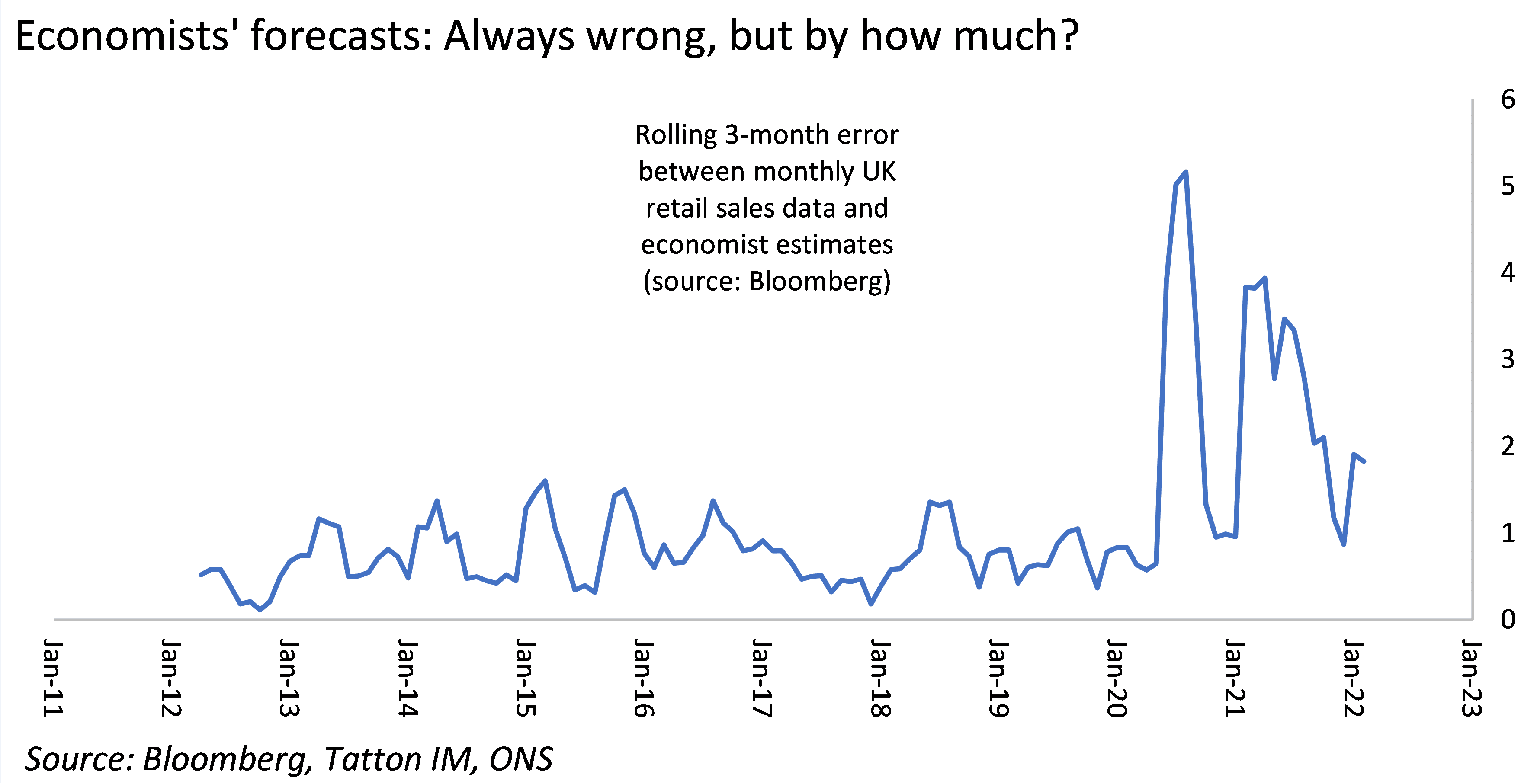

This element of post-virus ‘bounce back’ means gauging underlying trends is still difficult. As the chart below illustrates, economists are currently getting their spring forecasts much more wrong than before (we do forgive them for 2020!). The extent of the ‘noise’ means it is dangerous to assume we have much conviction around what the medium-term situation really is going to be like. However, we have some reason to believe there will once again be a spring recovery phase in the economy that is underestimated.

What we do know as is that the monetary and fiscal policy support environment has tightened, even though the water is still choppy from the pandemic shock. In the article below (‘Build Back Better’ bites the dust), we discuss how the mood is changing in US politics regarding fiscal policy, and that inflation dynamics have made fiscal austerity an attractive proposition again to many voters. In this context, the US rate setter’s Federal Reserve’s Open Markets Committee (FOMC) meeting minutes from January were published this week, and provided more insight into current policy thinking. The minutes underlined how the central bank has become much more hawkish in the past three months, however, the details revealed signs of flexibility. The FOMC restated that it felt the longer-term situation for interest rates was still biased towards low rates rather than high. It also indicated it remains flexible in the face of data, an important restatement given that the noise level remains high. It remains very important for the global economy, and for markets, that the US Federal Reserve (Fed) is not entrenched in a hawkish view, or even gone on ‘autopilot’ in terms of rate rises.

Talking of inflation, Dario Perkins (of TS Lombard, one of our independent research providers) published a piece this week about inflation, wages and corporate margins, which also provides the link to this week’s cartoon. Professional investors like to invest in companies that have good margins and strong revenue growth. Perkins points out that occasionally, for the sake of an economy’s systemic stability, you cannot have the corporate sector as a whole having both. Here’s an excerpt that captures his thinking:

“Simple accounting identities (e.g. the ‘Levy-Kalecki equation’) show that government stimulus will always end up in higher corporate revenues, as long as households do not save all the proceeds or use it to buy more imports. This is why US earnings have outpaced those of most other nations – US fiscal stimulus was much larger. But now the authorities have a problem: a greater proportion of this rise in corporate profits has come from higher prices, not stronger output. Even as Wall Street analysts celebrate this ‘margins expansion’ (‘the return of pricing power’), it has triggered widespread complaints about ‘price gouging’ and the abuse of ‘monopoly power’… Over the past 30 years, faster wage growth has always undermined corporate margins. While Wall Street bulls are confident this time will be different because companies have rediscovered their ‘pricing power’, central banks will have rather different ideas. In fact, if wage growth remains strong and the business sector is successful in protecting its margins, central banks will need to squeeze corporate earnings in other ways – namely by raising interest rates more aggressively [to curb the demand side].”

The 1970s discussion about the ‘wage-price spiral’ is now morphing into a debate about ‘wage-margin-price spiral’. This is especially pertinent in the US, as Perkins points out. US company profit margins tend to be higher than other regions and that is before one takes into account lower corporate tax rates in the US.

Despite current strong retail sales, it may be that the effects of inflation, rising interest rates and much-reduced government handouts are reducing consumers’ spending ability – in other words demand – already. Should this feed through into slowing revenue growth, companies will be much more circumspect in their hiring, which will feed back into a slowdown in wage growth.

Consumers across the developed world have spent a huge amount on imports and have drawn down on the savings made through the past two years. In the aftermath of the pandemic, a return to purchasing services will slow the import drag, but a likely key determinant in how much they spend will be how certain they feel about being able to replenish their savings down the line.

There is still probably more room for consumers to draw down savings, but confidence levels will have to be stable in the coming months for that to happen. In the US, the University of Michigan consumer sentiment survey was very downbeat. On the other hand, similar surveys in Europe have shown a much rosier picture. Next week will see the release of the IHS Markit Purchasing Manager Index Surveys around the world, and they will be examined closely for indications of consumer behaviour and for any possible divergence across regions. At the moment, it looks as though those economies where gushing consumer demand has caused the most inflation pressures are increasingly seeing a lowering of the temperature on the demand side (US), while those with less pressure on wages (Europe), may see consumers more happily looking forward to a spring with fewer restrictions of movement. Whether this means central banks will find less reason to rush their tightening in the face of improving data and the cyclical rotation remains to be seen, but you can rest assured we shall keep our readers posted.