Tatton Teaser: Petrodollars to Petrocoins

Posted 21 June 2023

Pricing oil contracts solely in US$ is undergoing a transformative shift as the global economy becomes increasingly multipolar. India has been using the United Arab Emirates dirham and more recently the Russian Ruble to buy Russian oil, French oil giant Total Energies bought liquefied natural gas (LNG) from Chinese oil company CNOOC using the Chinese Yuan .

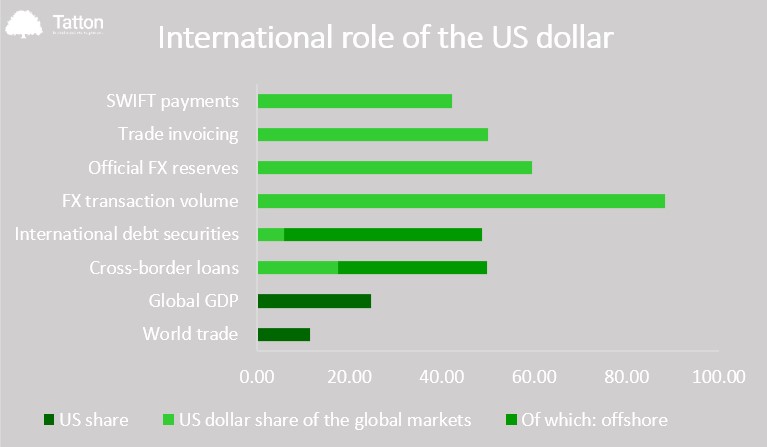

Pricing oil contracts in non US$ currencies offers several advantages. Firstly, it can mitigates risks from fluctuations in exchange rates. Secondly, it reducing the dependency on the US$ dollar empowers countries and market participants to pursue a more balanced and diversified approach.

Several currencies have emerged as potential alternatives to the US$. The euro, has gained traction among European nations and the ride of the yuan reflects China’s growing influence in the global economy. Additionally, cryptocurrencies like Bitcoin are being explored for oil pricing due to their decentralised nature, operating outside the control of central banks.

If developing multi-currency oil contracts presents opportunities, challenges remain. Robust infrastructure, regulatory concerns, and ensuring liquidity are crucial for successful implementation. Moreover, market participants need to balance the risks and benefits associated with each currency – its stability, market depth, and, of course geopolitical considerations.

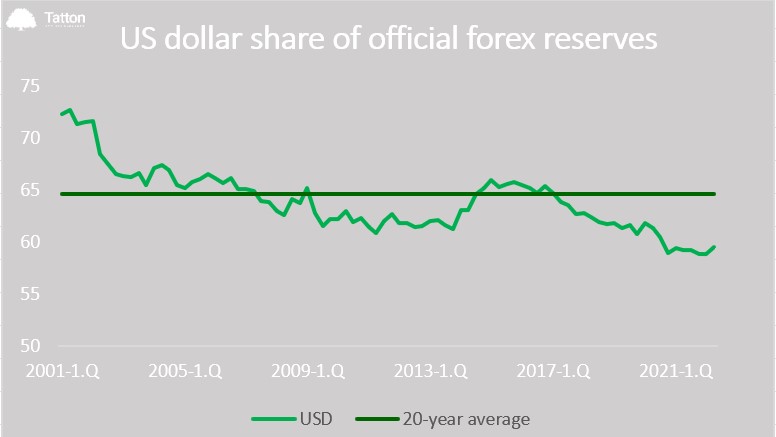

Diversifying oil contracts by pricing them in multiple currencies is a significant step towards a more equitable and resilient global economic system. Embracing alternative currencies in oil transactions can foster greater stability, reduce risks, and provide opportunities for economic growth and cooperation. However, it will also curtail the weaponisation of the US$ since it circumvents its use in sanctions and diminishes the power of the West. Should this be the case, is there likely to be a longer-term impact on the dollar. A long term one to watch.

[1] Source: https://www.forbes.com/sites/davidblackmon/2023/04/02/a-spate-of-recent-deals-raises-chatter-of-a-fading-petrodollar/Thank you Anthony Graham for this note.