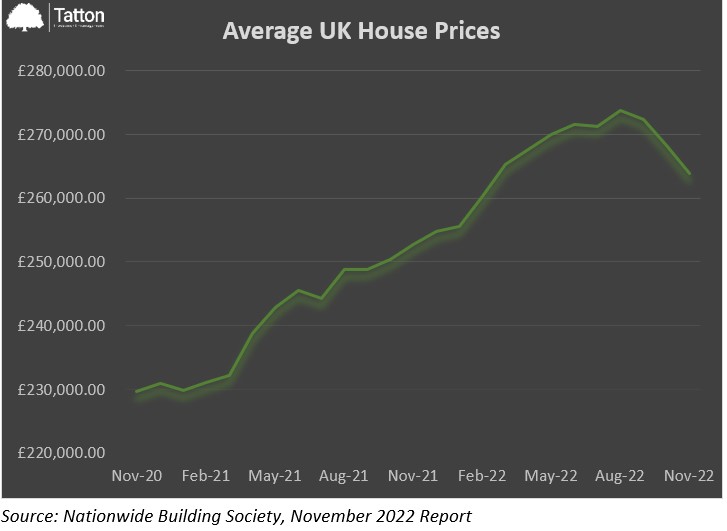

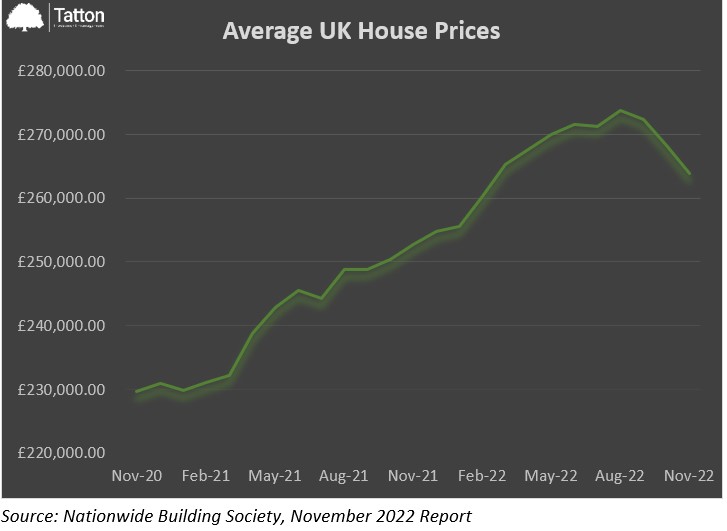

Tatton teaser: Slowdown in the UK house market?

Posted 7 December 2022

UK house prices fell by 1.4% on a month on month basis in November (annual house price growth to 4.4%, from 7.2% in October), the second consecutive month to see a slowdown in rising prices and biggest fall since June 2020, according to the Nationwide Building Society House Price Index. Elevated mortgage rates and rising costs of living have impacted buyers and their ability to purchase property and has seen demand in the housing market fall to lower levels. Over the year, mortgage rates have gone up as the Bank of England started tightening monetary policy to tame inflation. They further spiked following the mini-budget announcement in September. However, the announcement of the government’s Autumn Statement which included a new fiscal package of tax increases and spending cuts, has helped mortgage rates fall to lower levels, but has also put disposable income for households and thus the purchasing power of consumers under pressure.

That is not to say that the UK market is the only one to see a cooldown in house prices in the last couple of months. The US and many European countries have also shown signs of a slowdown amidst higher borrowing costs. One way to interpret this is in combination with other indicators, like last month’s fall in energy prices (mainly oil) and ease in inflation pressures for some regions. We could potentially see activity in the housing market and overall inflation moderating from here onwards.

Thank you Dimitra Liga for this note.